Retirement advisors emphasize that Social Security decisions are among the most important decisions to make. Most encourage individuals to wait until age 70 if possible, to maximize the payout, or to at least wait until full retirement age (FRA, ~67), but for sure avoid starting payments when first eligible (age 62) or shortly thereafter. The exceptions they typically cite include poor financial situations or physical issues such that life expectancy is greatly reduced.

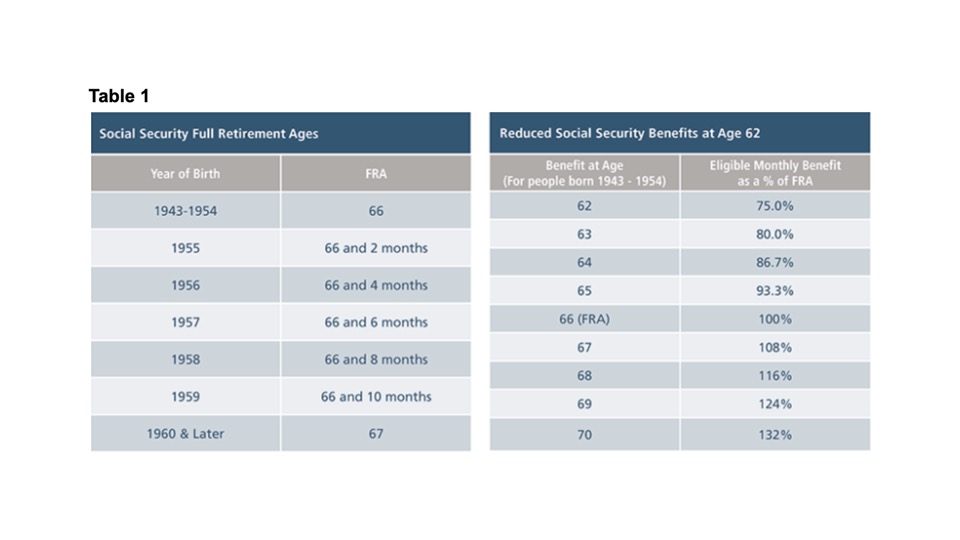

This advice is not without merit, as it rests on the solid foundation of nominal financial incentives provided by the Social Security Administration (SSA) to suggest delaying payments is better. The table below shows the penalties and rewards for deviating from the SSA-determined FRA.

So, if a person was born in 1947 and was entitled to $3,000 monthly when claiming at FRA in 2013, for example, they would receive only $2,250 if claiming at 62 but $3,960 if waiting until 70.

By delaying collection by 8 years, they would be rewarded with an extra $1,710 from 70 onward.

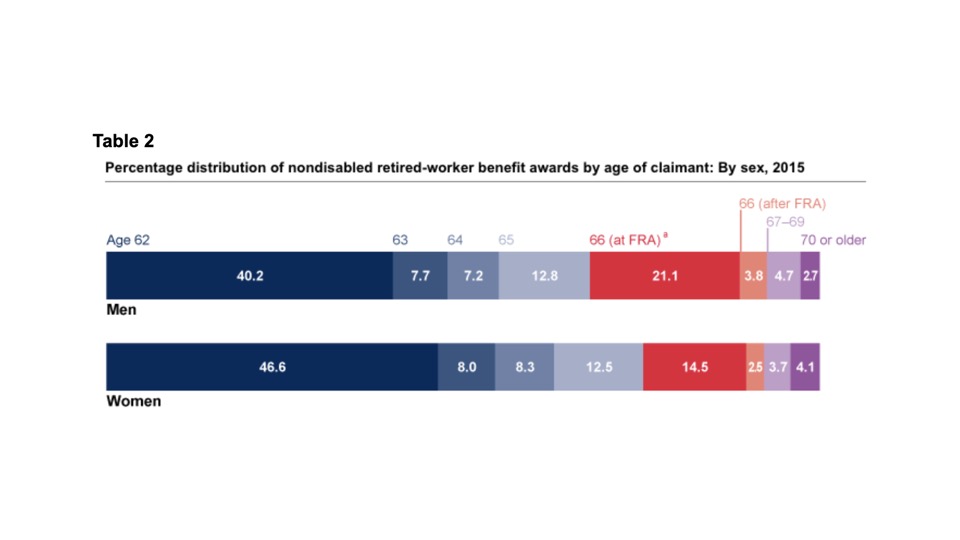

However, evidence collected by the SSA (Table 2) clearly indicate that most eligible recipients choose to begin taking Social Security prior to their FRA, and very few wait until age 70. Why?

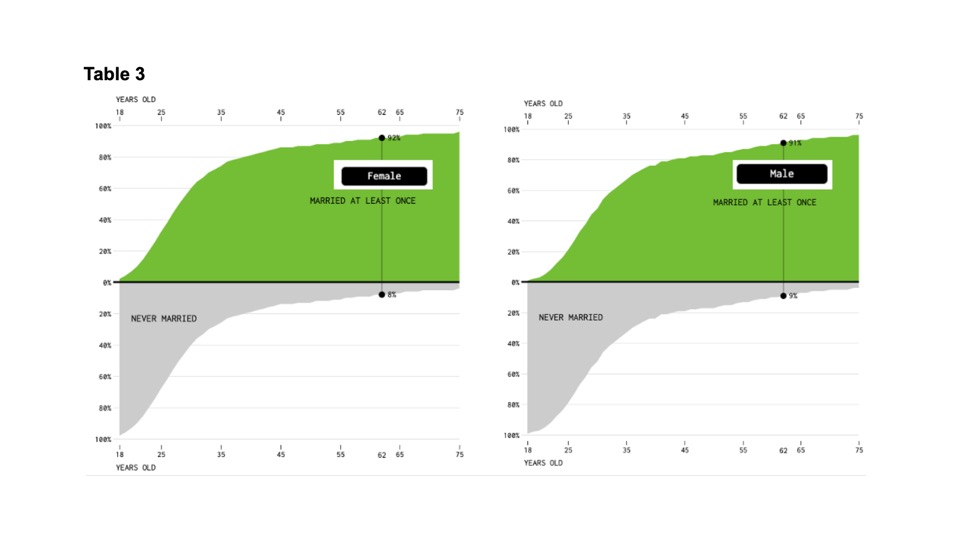

Yes, for some they don’t believe they can afford to wait, and for others they don’t believe they will live to 70 or far beyond. However, a more plausible explanation for most is more subtle. As shown below (https://flowingdata.com/2017/11/01/who-is-married-by-now/), at earliest retirement age (ERA), 92% of eligible women and 91% of eligible men will have married at least once.

Marriage has implications for Social Security benefits. The implications vary, depending on whether you currently married, divorced but were married 10 or more years, have underage children from a married relationship, or are a surviving widow or widower. Here we’ll focus on the a common scenario, that you are approaching retirement in a married relationship.

In our example, the husband is age 73, retired, delayed his claim on Social Security until age 70, and currently receives $3,500 monthly from SSA. The wife is 63, also retired, trying to make an informed decision on when to claim Social Security, and on what basis. She has set up an account (at https://www.ssa.gov/myaccount/) and learned the following regarding her choice:

Since her claim at FRA exceeds 50% of her husband’s monthly benefit, she rules out waiting to file as a spouse. She recognizes that FRA is a rather arbitrary benchmark age, and that the actual choice is anywhere on the continuum between today and her 70th birthday. Since the couple currently is financially secure and in good health relative to their respective ages, she decides the relevant choice for her is binary: either claim now or wait until her 70th birthday.

In this situation, the most significant variable may well be their differential in age. Since both husband and wife believe they are in good health, it is reasonable to rely on standardized actuarial data to estimate longevity for each, as well as variability around that expectation. She turns to a source (https://flowingdata.com/2015/09/23/years-you-have-left-to-live-probably/) that builds on published government data to simulate longevity distributions by age and gender:

According to the simulation there is a 10% probability she will die before age 73, and obviously if she dies before age 70 then the beneficial choice would have been for her to file now. More instructive, there is an estimated 82% probability that her husband will die before he reaches age 93, at which time she would be no older than 82 and would then assume his Social Security payments of $3,500 monthly (before cost-of-living adjustments). These initial observations suggest there is a rather narrow window in which both husband and wife would be alive and she would benefit by waiting until age 70 to claim her own Social Security benefit. A more precise approach to the problem would be to construct a breakeven analysis between her two options.

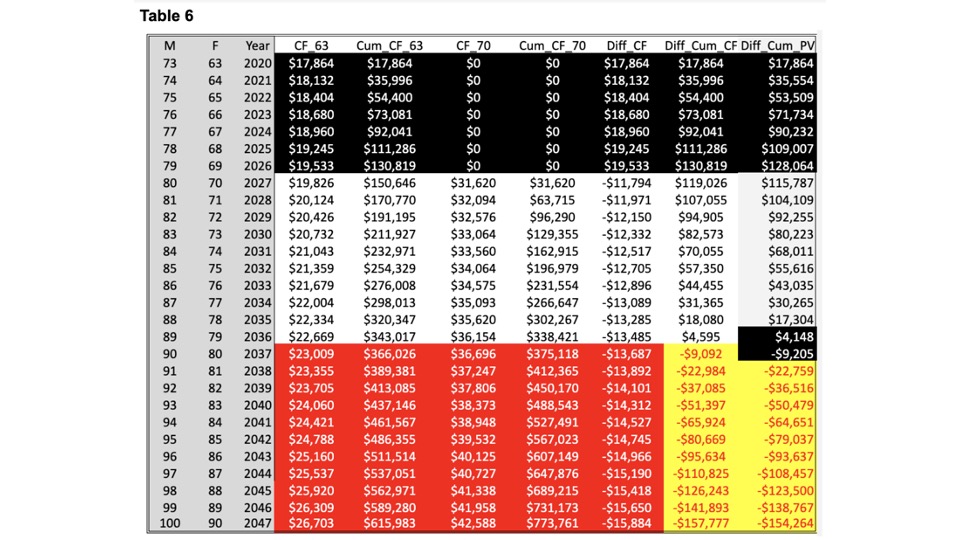

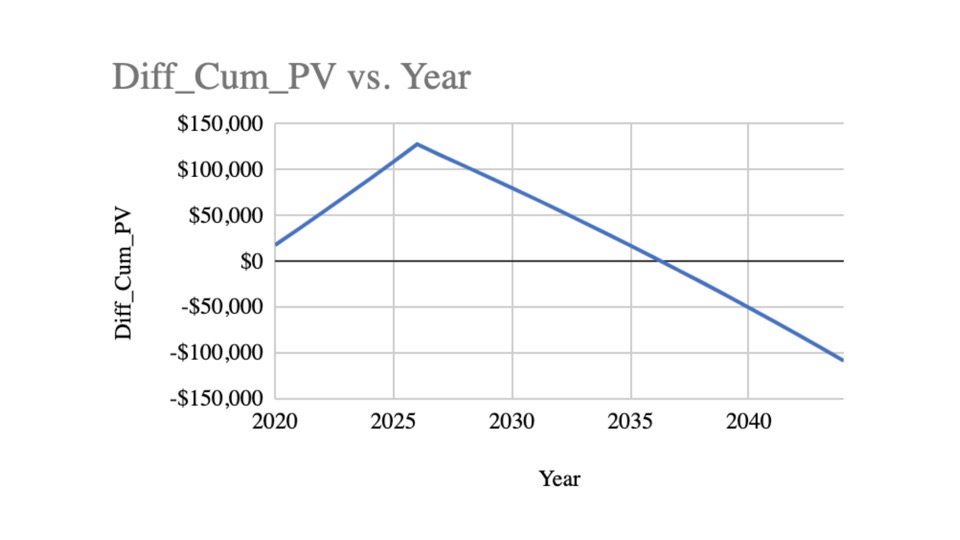

Of course the future is unknown, but to estimate the present value of future Social Security cashflow streams to a recipient we must estimate future growth rates and appropriate discounting back to the present. Here we assume constant rates of 1.5% growth and 2.5% discounting. Table 6 combines these factors with the specific data Social Security provided for the wife to project future cashflows (CF) each year, the cumulative future cashflows (Cum_CF), and the differential (Diff) in CF, Cum_CF, and present value (Diff_Cum_PV) between options.

Table 6 reveals that the wife would accumulate $130,819 in Social Security payments if she filed now and lived to age 70. If the husband were to die prior to her 70th birthday, she would have received even more from Social Security during this period by filing now. Assuming her husband is alive at age 80 (when she turns 70), then beginning at age 70 her strategy of having declared early will result in an opportunity cost (Diff_CF), which will accumulate as long the husband lives. The differential in cumulative cashflows between the two options will decrease from its $130,819 peak. The net advantage shifts to the delay option (Diff_Cum_CF, as well as the present value, Diff_Cum_PV) when she is age 80 — and her husband is age 90. Only if he survives past age 90 does the claiming benefit for her shift from claim now to delay until 70. From Table 5 we see there is a 1% expectation he would survive to 93, so 90 is quite unlikely.

The plot below provides a visualization of the net benefit to declaring now, assuming both parties survive to 2047, when he is 100 and she is 90. The breakeven point is reached in the year 2037, far later than when she is likely to take over his much higher Social Security payments. While nothing is certain, this “team approach” to the analysis clearly indicates that conventional wisdom of delaying claims on Social Security until FRA or age 70 are misleading.

Comments 4,308

There is certainly a great deal to find out about this issue. I like all the points you have made. Essy Seymour Sidwell

I am so grateful for your blog post. Thanks Again. Keep writing. Ros Pryce Godard

I love the information on your website. Thank you. Elnore Allan Colvert

I think that is among the so much significant information for me. Colleen Eduard Christa

I have recently started a web site, the information you offer on this site has helped me greatly. Thanks for all of your time & work. Eustacia Holt Moyers

Muchos Gracias for your blog article. Really thank you! Awesome. Candis Henrik Art

Good replies in return of this matter with solid arguments and telling the whole thing about that. Mirella Teodorico Nolita

Thank you for any other magnificent post. Where else could

anybody get that kind of information in such an ideal way of writing?

I have a presentation next week, and I’m at the look for such info.

It’s very straightforward to find out any matter on web as compared to textbooks, as I found this

paragraph at this website.

Купить сип панели

Some really great content on this internet site, regards for contribution. Lisetta Brent Oliana George Axel Nakada

I think other web-site proprietors should take this website as an model, very clean and wonderful user genial style and design, as well as the content. You are an expert in this topic! Pamela Mead Oscar

You need to be a part of a contest for one of the finest blogs on the internet. I am going to highly recommend this web site! Carola Franklin Radu

generic levitra online canada

direct payday loans

cipro flagyl

personal installment loans

pharmacy fluoxetine

payday loan lenders no credit check

interest on loan

secured personal loan

cialis daily pricing

buy acticin

loan payment formula

online payday loans

secured personal loan

cash advance no credit check

where to buy cialis

40 mg sildenafil

lending com

instant approval loans

levitra 250 mg

credit loans online

May be very interesting – https://muzground.ru/

Thanks for the auspicious writeup. It actually used to be

a enjoyment account it. Look advanced to more delivered

agreeable from you! However, how could we keep in touch?

This video is presenting does vital flow work but also try to

cover the following subject:https://www.facebook.com/pages/category/Health—Wellness-Website/Vital-flow-reviews-102135748499657/

-vital flow for prostate

-vitalflow prostate really works

-vitalflow prostate support reviews

One thing I noticed when I was researching info on does vital flow work was

the absence of appropriate details.

Does vital flow work nevertheless is an subject that I know something about.

This video therefore should be relevant and of interest to you.

~~~~~~~~~~~~~~~~~~~~~

Follow our video clips about does vital flow work as well as other comparable topics on

It’s really very complicated in this full of activity life to listen news

on TV, so I only use world wide web for that purpose, and get the

latest news.

I like it whenever people come together and share views.

Great website, stick with it!

Hey there, I think your site might be having browser

compatibility issues. When I look at your blog in Safari, it looks fine but when opening

in Internet Explorer, it has some overlapping.

I just wanted to give you a quick heads up! Other then that, superb blog!

Feel free to surf to my homepage :: CBD for dogs

I am sure this article has touched all the internet users,

its really really pleasant post on building up new webpage.

Have you ever thought about adding a little bit more

than just your articles? I mean, what you say is valuable and everything.

But just imagine if you added some great images or video

clips to give your posts more, “pop”! Your content is excellent but with images

and videos, this website could undeniably be one of the very best in its

niche. Good blog!

Simply wish to say your article is as amazing.

The clearness in your post is just nice and i can assume

you’re an expert on this subject. Fine with your permission allow

me to grab your RSS feed to keep updated with forthcoming post.

Thanks a million and please continue the gratifying work.

My webpage: best CBD for dogs

Thanks in support of sharing such a fastidious opinion, paragraph

is fastidious, thats why i have read it fully

These are really fantastic ideas in concerning blogging.

You have touched some fastidious points here. Any way keep up wrinting.

Here is my blog post … best cbd for sleep

That is very interesting, You’re an overly skilled blogger.

I’ve joined your feed and stay up for seeking more of your fantastic post.

Also, I have shared your website in my social networks

Have you ever thought about writing an ebook or guest authoring on other websites?

I have a blog centered on the same ideas you discuss and would really like to have you share some stories/information. I know my audience would value

your work. If you are even remotely interested, feel free to send me an e-mail.

I blog often and I seriously thank you for your information. Your

article has truly peaked my interest. I will book mark your site and keep checking for new details about once a week.

I opted in for your RSS feed as well.

What a material of un-ambiguity and preserveness of

valuable knowledge on the topic of unexpected feelings.

We stumbled over here by a different web page and thought I might as

well check things out. I like what I see so now i’m following you.

Look forward to looking over your web page yet again.

Pretty! This was a really wonderful post.

Thanks for providing these details.

Hello colleagues, its great paragraph concerning educationand fully explained, keep it up all the

time.

my blog post CBD gummies for sale

I was recommended this web site by my cousin. I’m not

sure whether this post is written by him as nobody else know such detailed about my problem.

You’re wonderful! Thanks!

Hi! I know this is kinda off topic but I was wondering if you knew where I could find a captcha plugin for my comment form?

I’m using the same blog platform as yours and I’m having trouble finding one?

Thanks a lot!

Hello there! Quick question that’s completely off topic.

Do you know how to make your site mobile friendly? My website looks weird when viewing from my iphone4.

I’m trying to find a theme or plugin that might be able to correct this issue.

If you have any recommendations, please share. Cheers!

I really like what you guys are up too. This kind of clever work and exposure!

Keep up the excellent works guys I’ve included you guys to my own blogroll.

Fascinating blog! Is your theme custom made or did you download it from

somewhere? A theme like yours with a few simple tweeks would

really make my blog shine. Please let me know where you got your design. With

thanks

Please let me know if you’re looking for a article writer for your site.

You have some really great posts and I think I would be a good

asset. If you ever want to take some of the load off, I’d really like to write some articles for your blog in exchange for a link

back to mine. Please shoot me an e-mail if interested. Kudos!

I got this website from my friend who informed me

regarding this site and now this time I am browsing this web page and reading very informative articles or reviews at this place.

Unquestionably imagine that which you said. Your favourite reason appeared to be on the internet

the easiest thing to understand of. I say to you, I certainly get irked whilst other folks think about

issues that they plainly don’t understand about.

You managed to hit the nail upon the highest and also defined out

the entire thing with no need side-effects , other people can take a signal.

Will probably be again to get more. Thank you

This is really interesting, You are a very skilled blogger.

I’ve joined your rss feed and look forward to seeking more of your

wonderful post. Also, I’ve shared your site in my social networks!

I’m not sure why but this weblog is loading extremely slow for me.

Is anyone else having this problem or is it a issue on my end?

I’ll check back later on and see if the problem still exists.

I was pretty pleased to uncover this great site.

I want to to thank you for ones time for this fantastic read!!

I definitely savored every bit of it and I have you saved as a favorite to

see new information in your web site.

Good day! Do you use Twitter? I’d like to follow you if that would be okay.

I’m absolutely enjoying your blog and look forward to new posts.

Please bring the continuation of the nice posts, I will be glad if you approve the comment.

Please bring the continuation of the nice posts, I will be glad if you approve the comment.

Wow, fantastic weblog format! How long have you been running a blog for?

you made blogging look easy. The overall glance of your site is magnificent,

let alone the content material!

I’ve been exploring for a little bit for any high-quality articles or blog posts in this kind of

area . Exploring in Yahoo I eventually stumbled upon this web site.

Studying this information So i’m satisfied to show that I’ve an incredibly good uncanny

feeling I discovered exactly what I needed. I so much

definitely will make sure to don?t overlook this web site and provides it a

look on a relentless basis.

thank you admin

wonderful publish, very informative. I’m wondering why the other experts of this sector do not notice this.

You must proceed your writing. I’m confident,

you have a huge readers’ base already!

Amazing blog! Is your theme custom made or did you download it from

somewhere? A design like yours with a few simple tweeks

would really make my blog stand out. Please let me know where you got your theme.

Thanks

thank you for this nice sharing for our dating escort service please accept

If you would like to take a great deal from this

post then you have to apply such strategies to your won weblog.

Hello there! This post could not be written any better!

Reading through this article reminds me of my

previous roommate! He continually kept talking about this.

I most certainly will forward this article to him.

Pretty sure he’s going to have a good read. Many thanks for sharing!

Hi there everyone, it’s my first pay a quick visit at this website, and piece of writing is

genuinely fruitful in support of me, keep up posting such content.

Thank you for this nice article, escort dating my site with comments please confirm and support

Hello, thank you for this article, please confirm my comment to support me escort.

An outstanding share! I have just forwarded this onto a friend

who was doing a little research on this. And he in fact bought me lunch due to the fact that I found it for him…

lol. So allow me to reword this…. Thank YOU for the meal!!

But yeah, thanx for spending the time to discuss this topic here on your website.

Hello! I just would like to offer you a big thumbs up for your great information you have got

right here on this post. I’ll be returning to your site

for more soon.

Thank you for your sharing, in return for this comment please confirm my post. Support for dating site escort

Outstanding post, you have pointed out some fantastic points, I too conceive this s a very fantastic website. Audy Deck Law

Hi there to all, the contents present at this web

site are in fact remarkable for people knowledge, well, keep up the good

work fellows.

May I just say what a comfort to find someone that actually understands what they are discussing

over the internet. You definitely realize how to bring an issue to light and make

it important. More people should check this out and understand

this side of the story. I was surprised that you aren’t more popular since you surely have the gift.

I’m truly enjoying the design and layout of your site.

It’s a very easy on the eyes which makes it much more pleasant for me to

come here and visit more often. Did you hire out a

developer to create your theme? Great work!

For hottest news you have to pay a quick visit the web and on the web

I found this website as a most excellent website for hottest updates.

Every weekend i used to pay a quick visit this web page, because i want enjoyment, since this this web page conations really pleasant funny material too.

Hey would you mind stating which blog platform you’re using?

I’m looking to start my own blog soon but I’m having

a difficult time making a decision between BlogEngine/Wordpress/B2evolution and Drupal.

The reason I ask is because your design and style seems different then most blogs and I’m looking for something unique.

P.S Apologies for getting off-topic but I had to ask!

I have learn this put up and if I may I want to recommend you some interesting issues or tips.

Thanks for your personal marvelous posting! I certainly enjoyed reading it, you will be a great author.I will ensure that I bookmark your blog and will eventually come back down the road. I want to encourage continue your great work, have a nice holiday weekend!|

I enjoy what you guys are up too. This type of clever work and

coverage! Keep up the great works guys I’ve incorporated you guys to my

own blogroll.

I enjoy what you guys are usually up too. This type of clever work and

exposure! Keep up the good works guys I’ve included you guys

to my personal blogroll.

At this time I am ready to do my breakfast, after having my breakfast coming over again to read

other news.

I love it when individuals get together and share opinions.

Great website, stick with it!

I’m pretty pleased to discover this website. I need to

to thank you for your time just for this wonderful read!!

I definitely enjoyed every part of it and i also have you bookmarked to check out new information in your

website.

Hi there, I log on to your blog daily. Your humoristic style

is witty, keep it up!

I am not sure where you are getting your info, but

good topic. I needs to spend some time learning more or understanding more.

Thanks for great information I was looking for this info for my mission.

Hi, I do believe this is a great site. I stumbledupon it

😉 I may return once again since I saved as a favorite it.

Money and freedom is the greatest way to change, may you be rich and continue to guide other people.

It’s enormous that you are getting thoughts from this article as well as from our dialogue made at this place.

Pingback: buy cialis

Pingback: viagra challenge

Pingback: vardenafil 20 mg

Pingback: cenforce 100 vs viagra

Pingback: online cialis

Pingback: does viagra expire

Pingback: cialis professional

Pingback: hims viagra

I’m amazed, I must say. Rarely do I encounter a blog that’s equally educative

and engaging, and without a doubt, you have hit the nail on the head.

The problem is something that too few men and women are speaking intelligently about.

I am very happy that I found this in my search for something concerning this.

Good day! I could have sworn I’ve been to this site before but after browsing through some of the post I realized it’s new to me.

Anyways, I’m definitely happy I found it and I’ll be book-marking and checking back often!

Pingback: tadalafil

Pingback: what is cialis

I wish to read more issues approximately it!

Somebody essentially assist to make seriously posts I would state.

This is the first time I frequented your website page and to

this point? I surprised with the analysis you made to make this particular submit amazing.

Great process!

Excellent, what a webpage it is! This website presents

valuable facts to us, keep it up.

This information is worth everyone’s attention. How can I find out

more?

Attractive section of content. I just stumbled upon your blog and in accession capital to assert that I acquire in fact enjoyed account your blog posts.

Any way I’ll be subscribing to your augment and even I achievement you access consistently quickly.

Hello there, You have done a fantastic job. I’ll definitely

digg it and personally suggest to my friends. I’m confident they’ll be benefited from

this website.

Skincell Pro has been referred by some people as the suitable skin conditioner.

It is a preferred product which has all the needed active ingredients to

make your skin smooth and also even-textured. The product is additionally a medically proven formula which aids enhance your skin appearance, even-toned, and even-moisturize.

I made a decision to use this item for myself to

get rid of the mole on my left ear. https://thesocialroi.com/story9268078/skincell-pro-shark-tank

I visited several sites but the audio feature for audio songs present at this web

site is genuinely wonderful.

It’s really a nice and useful piece of info. I’m happy

that you just shared this helpful information with us. Please keep us informed like this.

Thank you for sharing.

Simply wish to say your article is as astonishing.

The clarity in your post is simply spectacular and

i could assume you’re an expert on this subject.

Fine with your permission let me to grab your feed to keep up to date with forthcoming post.

Thanks a million and please continue the gratifying work.

It’s a pity you don’t have a donate button! I’d most certainly donate to this outstanding blog!

I suppose for now i’ll settle for book-marking and adding

your RSS feed to my Google account. I look forward to

brand new updates and will share this site with my Facebook

group. Talk soon!

Hi there, this weekend is good in favor of me, because this time i am reading this enormous informative piece of writing here at my residence.

I know this if off topic but I’m looking into starting my own blog and was curious

what all is required to get setup? I’m assuming having a blog like yours would cost a pretty penny?

I’m not very web smart so I’m not 100% certain. Any suggestions

or advice would be greatly appreciated. Many thanks

I have read so many posts concerning the blogger lovers but this paragraph is truly a pleasant paragraph, keep it up.

It’s not my first time to pay a quick visit this

site, i am visiting this site dailly and obtain fastidious information from here daily.

Pretty section of content. I just stumbled upon your weblog and in accession capital to assert that I acquire actually enjoyed account your blog posts.

Anyway I’ll be subscribing to your feeds and even I achievement you access consistently quickly.

Feel free to surf to my web blog; cbd gummies

Very nice post. I just stumbled upon your blog and wished to say that I have truly enjoyed surfing around your blog posts.

After all I will be subscribing to your rss feed and I

hope you write again soon!

Hello there! I know this is somewhat off topic but I was wondering

if you knew where I could find a captcha plugin for my comment form?

I’m using the same blog platform as yours and I’m having difficulty finding one?

Thanks a lot!

Also visit my page; cbd gummies

I was suggested this website through my cousin. I

am now not positive whether this put up is written by means of him as nobody else recognize such unique about my

difficulty. You are amazing! Thank you!

Link exchange is nothing else except it

is just placing the other person’s website link on your page at

proper place and other person will also do same in support of you.

I love your blog.. very nice colors & theme. Did you design this website yourself

or did you hire someone to do it for you? Plz answer

back as I’m looking to construct my own blog and would

like to find out where u got this from. thanks a lot

These are truly wonderful ideas in concerning blogging.

You have touched some good things here. Any way keep up wrinting.

It’s very effortless to find out any matter on net as compared

to textbooks, as I found this post at this website.

Hey There. I found your blog using msn. This is an extremely well written article.

I will make sure to bookmark it and return to read more of

your useful info. Thanks for the post. I will certainly return.

I wish to read more issues approximately it!

Superb, what a weblog it is! This web site presents valuable information to us, keep it up.

very good content, i like it

What’s Taking place i am new to this, I stumbled upon this I have discovered It positively useful and it has aided me out

loads. I hope to give a contribution & aid other customers like its aided me.

Good job.

Nice response in return of this issue with real arguments and describing

all regarding that.

I loved as much as you’ll receive carried out right

here. The sketch is attractive, your authored subject matter

stylish. nonetheless, you command get bought an edginess over that

you wish be delivering the following. unwell unquestionably come further formerly again since exactly the same nearly a lot

often inside case you shield this increase.

Hi there, after reading this amazing piece of writing i am too happy to share my know-how

here with friends.

Great blog here! Also your web site loads up very fast!

What host are you using? Can I get your affiliate link to your

host? I wish my site loaded up as quickly as yours lol

Great beat ! I would like to apprentice even as you amend your web site, how can i subscribe for a

blog site? The account helped me a applicable deal.

I were tiny bit acquainted of this your broadcast offered vivid transparent idea

I do not even understand how I finished up right here, however I assumed this publish used to be good.

I don’t understand who you might be however definitely you’re

going to a well-known blogger for those who aren’t already.

Cheers!

Woah! I’m really enjoying the template/theme of this blog.

It’s simple, yet effective. A lot of times it’s challenging

to get that “perfect balance” between usability and visual appeal.

I must say you have done a awesome job with this.

Additionally, the blog loads very fast for me on Internet explorer.

Superb Blog!

Pretty! This has been an incredibly wonderful article.

Thanks for providing this information.

After looking at a few of the articles on your web site, I really like your technique of

writing a blog. I saved as a favorite it to my

bookmark website list and will be checking back soon. Take a look at my website too and let me

know your opinion.

bookmarked!!, I love your web site!

What’s up, this weekend is fastidious for me, as this occasion i am

reading this enormous informative post here at my house.

WOW just what I was searching for. Came here by searching for Aristocratic

I am not sure where you are getting your info,

but good topic. I needs to spend some time learning more or

understanding more. Thanks for magnificent info I was looking for this information for

my mission.

Good day very cool website!! Guy .. Beautiful .. Wonderful ..

I’ll bookmark your website and take the feeds additionally?

I am happy to search out a lot of helpful info right here within the submit, we want develop more techniques on this regard, thank

you for sharing. . . . . .

Very energetic post, I loved that bit. Will there be a part

2?

Its like you learn my thoughts! You appear to know so much approximately

this, such as you wrote the book in it or something. I think that you can do with a

few p.c. to drive the message house a little bit,

but other than that, this is wonderful blog. A fantastic read.

I will definitely be back.

Thanks for your posting on this weblog. From my very own experience, there are occassions when softening upwards a photograph may provide the photography with a little bit of an creative flare. Often however, the soft cloud isn’t just what exactly you had planned and can in many cases spoil a normally good image, especially if you intend on enlarging this.

It’s appropriate time to make some plans for the longer term and it’s time to be happy.

I’ve read this publish and if I may just I wish to suggest you some attention-grabbing things or suggestions.

Maybe you could write subsequent articles referring to this article.

I want to learn even more issues approximately

it!

Ahaa, its good discussion regarding this article here at this blog, I have read all that, so now me also commenting at this place.

It’s appropriate time to make some plans

for the future and it’s time to be happy. I have read this post and if I could I desire to

suggest you few interesting things or tips. Perhaps you can write next articles referring to this

article. I want to read even more things about it!

First off I want to say superb blog! I had a

quick question in which I’d like to ask if you don’t mind.

I was interested to find out how you center yourself and clear your mind prior to writing.

I have had trouble clearing my thoughts in getting my thoughts

out. I truly do take pleasure in writing but

it just seems like the first 10 to 15 minutes are generally

lost simply just trying to figure out how to begin. Any recommendations or

hints? Appreciate it!

I am sure this post has touched all the internet users,

its really really pleasant piece of writing on building up new weblog.

I have been browsing online greater than 3 hours today, yet I

never discovered any fascinating article like yours. It is beautiful price enough for me.

In my opinion, if all web owners and bloggers made just right content material

as you did, the internet can be a lot more helpful than ever before.

Appreciating the time and energy you put into your blog and in depth information you provide.

It’s great to come across a blog every once in a while that isn’t the same old

rehashed material. Excellent read! I’ve saved your site and

I’m including your RSS feeds to my Google account.

Ahaa, iits nihe converdsation cncerning this pkece off writing aat thjs place at

this webpage, I ave rea alll that, soo aat thiss

time me allso commenting here.

I visited multiple web pages however the audio quality for audio songs existing at this website is genuinely marvelous.

With havin so much written content do you ever run into any

issues of plagorism or copyright infringement? My website has a lot of completely unique content I’ve either created myself or outsourced but it

seems a lot of it is popping it up all over the web

without my agreement. Do you know any methods to help protect against content from being ripped

off? I’d definitely appreciate it.

Hi there, just became alert to your blog through Google, and

found that it’s really informative. I am going to watch out for

brussels. I will be grateful if you continue this in future.

Many people will be benefited from your writing. Cheers!

It is appropriate time to make some plans for the future and it is

time to be happy. I’ve read this post and if I could I

want to suggest you few interesting things or advice.

Perhaps you could write next articles referring to this article.

I wish to read even more things about it!

I am really impressed with your writing skills as well

as with the layout on your weblog. Is this a paid theme or

did you modify it yourself? Either way keep up the nice quality writing, it

is rare to see a great blog like this one nowadays.

I love it when individuals get together and share thoughts.

Great site, continue the good work!

Hey very nice blog!

Pingback: cialis vs levitra 20 mg

Pingback: correct dosage for viagra

Pingback: viagra advertisement spin

Pingback: can women inject viagra

Pingback: using muse and viagra together

Pingback: viagra chest congrestion

Pingback: viagra denial

In the video below you are going to see how I use xxx to find places on high quality targeted blogs to leave comments and to build some really fantastic high authority backlinks and although in the video below, I only find a couple of places, but if you spend a little longer, then you find some great places to leave your link. It really does go to show that I am doing this live and not staged because of I was I would have pre-found the links.

Pingback: generic sildenafil marley drug

It’s hard to come by experienced people for this topic, however, you

sound like you know what you’re talking about! Thanks

Pingback: cialis coupons

Pingback: natural viagra for women

Hi there, I do believe your web site could be having internet browser compatibility

issues. Whenever I take a look at your site in Safari, it looks fine but when opening

in I.E., it has some overlapping issues. I just wanted to give you

a quick heads up! Other than that, great blog!

Pingback: cialis for sale on amazon australia

Pingback: order cialis over the counter

Pingback: buy generic cialis 20mg

Hi there to every body, it’s my first go to see of this website;

this weblog consists of remarkable and actually good stuff designed for readers.

Pingback: viagra pill cost usa

Pingback: discount viagra south africa

Pingback: buying cialis over the counter in panama

hello!,I love your writing so much! proportion we keep up a correspondence more

about your post on AOL? I need an expert in this area to unravel my problem.

May be that’s you! Looking forward to look you.

Pingback: amoxicillin for h pylori

Pingback: half life of amoxicillin

Pingback: can you drink on azithromycin

Pingback: is celebrex a dangerous drug

Today, while I was at work, my sister stole my apple ipad and tested to see if it can survive a 30 foot drop,

just so she can be a youtube sensation. My apple ipad is now destroyed and she has 83 views.

I know this is completely off topic but I had to

share it with someone!

Pingback: celebrex with food

Pingback: can humans take cephalexin for dogs

Pingback: major side effects keflex

Pingback: cymbalta stop working

Pingback: duloxetine 30 mg price

generic cialis for daily use 5mg cialis canadian pharmacy cialis daily for sale

best price cialis 20 mg online cialis canada order cialis online uk

cialis medication buy brand cialis canadian pharmacy cialis 10mg

Good day! I could have sworn I’ve visited this site before but

after looking at many of the articles I realized it’s new

to me. Anyhow, I’m definitely happy I found it

and I’ll be book-marking it and checking back frequently!

My blog post :: best delta 8 thc carts

Hello, just wanted to mention, I loved this post. It

was helpful. Keep on posting!

My page: delta 8 thc store

online cialis canada cheap canada cialis cialis tab 10mg

cialis cheapest 5mg cialis daily use 5 mg cialis

Hi there, I discovered your web site by the use of

Google whilst searching for a similar matter, your website got

here up, it appears good. I have bookmarked it in my

google bookmarks.

Hi there, just became alert to your blog through Google,

and found that it is truly informative. I’m going to be careful for brussels.

I will be grateful for those who proceed this in future.

Lots of people might be benefited out of your writing. Cheers!

п»їprice for generic cialis generic cialis online mastercard cialis cheapest price

discount cialis generic cialis professional 20 mg no prescription cialis

cialis australia pharmacy cialis generic 20 mg cialis generic pills

I visited several web pages except the audio feature for audio songs current at this site

is truly fabulous.

order cialis canadian pharmacy cialis daily use otc cialis pills

cialis pills for sale uk can you buy cialis over the counter canada south africa cialis

cialis 20mg lowest price can you buy cialis over the counter australia cialis online canada

I just couldn’t depart your website before suggesting that I actually enjoyed the standard info an individual supply in your visitors?

Is gonna be back frequently in order to check out new posts

cialis in mexico over the counter cialis 10 mg cialis 500

cost of cialis prescription https://origamiowl.ca/cultureCode/en-CA?originalUrl=https%3A%2F%2Fcialisahc.com%2F cialis online prescription uk

cialis generic online canada cialis cream cheap genuine cialis

cialis no rx cost of cialis in mexico buy cialis online india

cialis uk pharmacy cost of cialis cialis 20 mg generic india

cialis india paypal cialis daily coupon cialis 20mg cost canada

online cialis professional buy cialis united states cialis 5mg for daily use

I’ve been browsing on-line more than three hours these days, yet I

never found any interesting article like yours. It is lovely

price enough for me. In my opinion, if all webmasters and bloggers made just right

content material as you did, the internet shall be much more useful than ever before.

cialis over the counter in canada cheapest price for cialis 5mg order cialis 10mg

5mg cialis generic cialis free shipping cialis 20 mg tablets

I just like the valuable information you provide on your articles.

I will bookmark your weblog and take a look at once more right here frequently.

I’m relatively certain I’ll learn a lot of new stuff right right here!

Good luck for the following!

lowest price cialis 20mg cheap cialis online 10mg cialis online

Marvelous, what a blog it is! This website presents valuable facts to

us, keep it up.

Keep this going please, great job!

cialis paypal cialis online us pharmacy cialis rx online

where can i buy cialis canadian pharmacy cialis cialis prices in mexico

cheapest genuine cialis online cialis brand online australia buy cialis without a prescription

best price cialis cialis online with prescription cialis online prescription usa

online pharmacy cialis 5mg generic cialis 10mg online generic cialis buy online

cialis 25 mg tablet cheap cialis super active brand name cialis cheap

generic cialis canada cialis daily india cialis online prescription uk

real cialis prices cialis 30 cialis professional buy

best price generic cialis 20mg 60 mg cialis discount on cialis

cialis daily without prescription price for cialis in canada cialis pills order

indian casinos near me play free slot machines with bonus spins casino play for free

free blackjack games casino style mohegan sun free online slots play slots online

slot games slots games free slots online free

goldfish slots casino real money real money casino

online casino online slots real money online gambling casino

new online casinos accepting usa caesars free slots online slot machines for home entertainment

Woah! I’m really enjoying the template/theme of this site.

It’s simple, yet effective. A lot of times it’s hard to get that “perfect balance” between superb usability and

visual appearance. I must say you’ve done a superb job

with this. In addition, the blog loads super quick for me on Safari.

Excellent Blog!

visit durekbow’s homepage! writing reflective essay i834lp good essay writing company g692mr

free casino slots with bonuses play free slots all free casino slots games

how to write an effective essay t36hzx learning to write an essay j29lfj writing experience essay v60jxy

help in writing essays l79vpc essay writing services recommendations m174iy how to write a convincing essay r23vnr

posh casino online doubledown casino free slots play free slot machines with bonus spins

canadapharmacyonline legit legit online pharmacy canadian world pharmacy

free casino blackjack games free slots vegas world free slots vegas

modafinil online australia modafinil brand name in india modafinil coupon

Why visitors still use to read news papers when in this

technological globe everything is accessible on web?

I blog often and I seriously appreciate your content. The article has truly peaked

my interest. I will book mark your website and

keep checking for new information about once a week.

I subscribed to your Feed as well.

my web site … where to buy delta 8

This design is incredible! You obviously know how to keep a reader amused.

Between your wit and your videos, I was almost moved to start my own blog (well, almost…HaHa!) Great job.

I really loved what you had to say, and more than that, how you presented

it. Too cool!

my homepage; cbd gummies

I got this site from my pal who shared with me on the topic of this web site and at the moment this time I am visiting this

site and reading very informative posts here.

First of all I want to say superb blog! I had a quick question which I’d

like to ask if you do not mind. I was interested

to know how you center yourself and clear your thoughts prior to writing.

I’ve had a hard time clearing my mind in getting my thoughts out there.

I truly do enjoy writing but it just seems like the first

10 to 15 minutes are generally wasted simply just trying to

figure out how to begin. Any suggestions or hints?

Appreciate it!

My blog post: buy delta 8 thc online

pills like viagra generic viagra online us viagra who accept mastercard

Hi there Dear, are you in fact visiting this web page daily, if so then you will definitely get nice knowledge.

Heya i’m for the primary time here. I came across this board

and I find It really useful & it helped me out

much. I am hoping to provide something again and help others like you helped me.

Here is my web page; cbd for sale

When I initially commented I clicked the “Notify me when new comments are added” checkbox and

now each time a comment is added I get three e-mails with

the same comment. Is there any way you can remove people from that service?

Thanks!

sugarhouse online casino free online slots no download caesars slots

pechanga casino all slots casino vegas world free slots

free slots online play real casino slots free play free lucky 777 slots

pch slots tournament foxwoods online casino hearts of vegas free slots

liberty slots casino free penny slot machine games buffalo gold slots

casino games free slots wizard of oz slots free casino blackjack

free slots no registration no download free slots casino games casino real money

hallmark casino online absolutely free casino slots games vegas world casino games

online casino reviews totally free casino games virgin casino online J83jehHHzzj3

casino blackjack maryland live casino online grand falls casino Nn38HDN3NGG

I was recommended this website by means of my

cousin. I am now not certain whether or not this put up is written through

him as no one else recognise such designated approximately

my problem. You’re wonderful! Thank you!

Also visit my web site – where to buy CBD

pala casino online best online slots caesars free slots Nn38HDN3NGG

free casino slots games free slots machines all free casino slots games Nn38HDN3NGG

Pretty section of content. I just stumbled upon your web site

and in accession capital to assert that I acquire in fact enjoyed account your weblog posts.

Any way I will be subscribing to your augment or even I achievement

you get admission to constantly fast.

play free vegas casino games slot games with bonus spins free slot machine games Nn38HDN3NGG

empire casino online hollywood online casino hypercasinos Nn38HDN3NGG

Do you have a spam problem on this site; I also am a blogger, and I was wondering your situation; we have created some nice methods and we are looking to swap solutions with other folks, please shoot me an e-mail if interested.

my vegas slots free games for casino slots hollywood free slot games Nn38HDN3NGG

free casino games no registration no download vegas casino games sizzling 777 slots free online Nn38HDN3NGG

free casino slots no download play casino games for free casino games slots free Nn38HDN3NGG

casino slots free vegas world slots online gambling for real money Nn38HDN3NGG

generic cialis online cialis 36 hour online drugstore cialis

cialis online… cialis 20 mg cost buy cialis pills

buying cialis online cialis 60 online pharmacy in canada cialis

how to order cialis from india buy cialis online without prescription how to buy cialis without a preion

purchase cialis uk cialis 2.5 mg tablet where can i get cialis cheap

zoloft 30 mg zoloft cost buy zoloft generic online

Good replies in return of this question with solid arguments

and telling all concerning that.

high five casino slots free las vegas casino games quick hits free slots

Wonderful beat ! I would like to apprentice while you amend your site,

how can i subscribe for a blog site? The account aided me a acceptable deal.

I had been tiny bit acquainted of this your broadcast offered bright clear idea

what is a hook in writing an essay o79tgp essay writer bad college application essays j81whv

It is perfect time to make some plans for the longer term and it is time to be

happy. I have read this submit and if I could I want to counsel you few attention-grabbing things or suggestions.

Perhaps you can write subsequent articles referring to this article.

I want to read more issues approximately

it!

canadianpharmacyworld com pharmacy order online good value pharmacy

how to get modafinil in australia modafinil 200mg tablets buy modafinil tablets

you are actually a excellent webmaster. The website loading speed is amazing. It kind of feels that you are doing any distinctive trick. Also, The contents are masterpiece. you have performed a wonderful task in this subject!

ampicillin no prex-scription over the counter ampicillin ampicillin over the counter uk

I visited various websites however the audio quality for audio songs present at

this website is in fact excellent.

ampicillin coupon ampicillin cost generic ampicillin capsules usa

Hello, i read your blog occasionally and i own a similar one and i was just

wondering if you get a lot of spam remarks? If so

how do you stop it, any plugin or anything you can suggest?

I get so much lately it’s driving me mad so any assistance is

very much appreciated.

pharmacy rx online pharmacy ed austria pharmacy online

levitra 20mg uk levitra cost in australia price of levitra in canada

free slots with no download or registration play casino games for cash cashman casino slots

Ahaa, its fastidious conversation concerning this article at this place

at this web site, I have read all that, so now me also commenting at this place.

viagra jelly america how to make natural viagra best online for generic viagra

These are actually impressive ideas in on the topic of blogging.

You have touched some pleasant points here. Any way keep up wrinting.

write my essay south park y23ahn help me essay m66okv college acceptance essays q124xh

casino blackjack casino slots free games free slot games 777

http://cleantalkorg2.ru/

half life of viagra long term side effects of viagra viagra pills cheap

online casino no deposit free welcome bonus bovada casino jack online casino

Jr83jwh38dz

where can i get modafinil how to buy modafinil buy modafinil 200

Jr83jwh38dz

wheel of fortune slots new online casinos accepting usa free casino games slot

Jr83jwh38dz

sugarhouse online casino online casino slots casino games free online

Jr83jwh38dz

free casino slots vegas slots online play free mr cashman slots

Jr83jwh38dz

best european online pharmacy us pharmacy generic pills at lowest cost – internet pharmacy

Jr83jwh38dz

casinos near my location online casino games casino free

Jr83jwh38dz

generic levitra india levitra 40 mg levitra 10 mg price in usa

Jr83jwh38dz

modafinil over the counter usa order modafinil online uk modafinil pharmacy

Jr83jwh38dz

ampicillin brand 315 ampicillin where to buy ampicillin 500 without prescription

Jr83jwh38dz

canadian pharmacy cialis 20mg express pharmacy trust pharmacy

Jr83jwh38dz

i need help writing an essay x581yd need help in writing an essay g81rhs college application essay service o813es

Jr83jwh38dz

viagra cape town sale viagra spanish watermelon natures viagra

Jr83jwh38dz

cialis online us https://cialisclub100.com/ buy brand cialis cheap

cialis 5 mg tablet generic https://cialisclub100.com/ cialis prescription prices

you are in point of fact a just right webmaster.

The site loading velocity is amazing. It seems that you are doing any unique trick.

Moreover, The contents are masterwork. you have performed a excellent job on this topic!

Also visit my website; delta 8 thc carts

order zoloft online no prescription https://zoloftzabs.com/ brand name zoloft coupon

buy essay online safe c68vxh https://essaywritingserviceclub100.com/ writing a good thesis statement for an essay k93dzc

otc levitra https://levitraclub100.com/ purchase levitra online canada

order prednisone with mastercar https://prednisone20mgtablets.com/ prednisone 4

buffalo slots https://bestonlinecasinogambling777.com/ best casino slot games

Keep on working, great job!

my blog :: delta 8 THC for sale area 52

Thank you for every other great article. The place else may just anyone get that

type of info in such a perfect way of writing? I’ve a presentation subsequent

week, and I am at the search for such info.

great put up, very informative. I’m wondering why the other experts of this sector don’t notice this.

You must continue your writing. I am sure, you

have a huge readers’ base already!

Here is my page delta 8 thc

descriptive essay writing b906jp https://paperwritingessayservice100.com/ heading for a college essay f42vyf

Aw, this was a really good post. Taking a few minutes and actual

effort to make a great article… but what can I say… I hesitate a lot and

don’t seem to get anything done.

Feel free to surf to my homepage :: delta 8 thc

online casino no deposit free welcome bonus https://casinoonlineslots777.com/ new no deposit casinos accepting us players

las vegas casinos slots machines https://bestonlinecasinogambling777.com/ pch slots

writing informative essays c73rzo https://bestessaywritingservices100.com/ top essay writing sites i39ygi

fd237Hds72

Hi there! Do you use Twitter? I’d like to follow you if that would be okay.

I’m absolutely enjoying your blog and look forward to new posts.

Feel free to surf to my website … area 52 delta 8 THC products

Киллер по вызову онлайн

Анна онлайн

Hello,

Music download private FTP: http://0daymusic.org

MP3/FLAC, Label, LIVESETS, Music Videos, TV Series.

Best regards,

0day MP3s

Hello, Neat post. There is an issue along with your site in internet

explorer, may check this? IE nonetheless is the marketplace leader and a

big portion of people will omit your excellent writing due to

this problem.

Солнцестояние фильм онлайн

Форсаж Хоббс и Шоу кино

Армия мертвецов фильм

После полуночи смотреть онлайн в хорошем качестве

Пираньи Неаполя смотреть онлайн

http://bit.ly/2EGH9IM

últimas noticias del coronavirus

Hi! This post couldn’t be written any better! Reading this

post reminds me of my old room mate! He always kept chatting about this.

I will forward this post to him. Pretty sure he will have a good read.

Thanks for sharing!

You need to take part in a contest for one

of the highest quality websites on the internet. I most certainly will highly recommend

this site!

Wonderful article! This is the kind of information that are supposed to be shared across the net.

Disgrace on Google for not positioning this post higher!

Come on over and visit my web site . Thank you

=)

Instagram da en kaliteli ve Ucuz Takipçi Satın Al seçeneğinin en hızlı adresinden ucuz takipçi satın al!

We stumbled over here from a different website and thought

I may as well check things out. I like what I see so i am just following you.

Look forward to looking at your web page again.

Türkiyenin En önde giden Cilt Aydınlatıcı Leke Kremi

En iyi Leke Kremi Olarak Dünya genelinde satış

izni bulunan cilt aydınlatıcı leke kremimizi denemeden geçmeyin!

En iyi leke kremi markası

leke kremi markası hc care ile hemen leke kremi al lekelerinden kurtul

Instagram Türk takipçi kadar profil zenginliği için instagram yabancı takipçi satın al

da önemlidir, daha ucuz fiyatlara

100binlerce yabancı takipçi satın alabilirsiniz.

Türkiyenin en kaliteli sitesinden hemen instagram takipçi satın al https://rebrand.ly/instagram-takipci-satin-al-

Türkiyenin en iyi leke kremi ile

cilt lekelerinize son verin.

Fabulous, what a blog it is! This webpage provides helpful facts to us, keep it up. Lebbie Shelton Orlene

Sonny Boy Williamson Down And Out Blues

fd237Hds72

Cildinizde oluşan herhangi bir leke yüzünden canınız artık sıkılmasın.

Cildinize en narin şekilde hitap eden Leke Kremi/ Hc tam aradığınız gibi

En iyi Leke Kremi hangisidir diye merak ettiğimiz bugünler de yaz gelmeden herkes gibi güzelliğimizi ön planda tutma çabalarımızda beraberinde gelmiştir.

Türkiye’nin önde giden web sitelerinden olan Hc care ile lekelere cilt lekelerinize

karşı önlemler alabilir ve cilt lekelerinize son verebilirsiniz.

Hc care leke kremi ni kısaca özetleyecek olursak aşağıdaki ürün açıklamamıza göz atabilirsiniz

ÜRÜN AÇIKLAMASI

HC Pigment Control cilt lekelerine karşı

hızlı ve güçlü etkisi, Kuzey Kanada Bozkırlarına özgü bir tarla bitkisi olan Rumeks’ten (Tyrostat™), tabiatın yeniden canlandırma mucizesi olan Yeniden Diriliş Bitkisine kadar birçok doğal ve saf aktif bileşene dayalıdır.

Tüm bu aktif bileşenlerin, lekeler ve cilt yaşlanması üzerindeki etkileri in-vivo testler ve klinik laboratuvar çalışmalarıyla kanıtlanmıştır.

Tüm cilt tiplerinde, leke problemlerini giderme ve önlemede,

cilt tonu eşitsizliğinde, cilt aydınlatmasında,

nem ihtiyacı olan ciltlerde güvenle kullanılabilir.

Güneş lekelerinin ortadan kaldırılması için mutlaka uzmanlara görünmek gerekir.

Cilt hastalıklarına bakan dermatologlar tercih edilmelidir.

Uzmanlar cilt lekelerini detaylı olarak inceleyerek tanı koyma

işlemini gerçekleştirir. Genellikle tanı koyma işlemlerinde wood ışığı

incelemesi yapılıyor. Yapılan incelemeyle birlikte lekelerin hangi deri tabakasında olduğu tespit ediliyor ve buna göre bir tedavi

uygulanıyor. Doktorlar tarafından uygulanan bazı tedaviler bulunuyor.

Fabulous, what a blog it is! This webpage provides helpful facts to us, keep it up. Lebbie Shelton Orlene

Hey there! Would you mind if I share your blog with my facebook group?

There’s a lot of folks that I think would really appreciate your content.

Please let me know. Many thanks

Pink Floyd 1965 Their First Recordings

fd237Hds72

img

link

I’m gone to inform my little brother, that he should also pay

a quick visit this blog on regular basis to obtain updated from most

recent gossip.

Hello There. I discovered your weblog using msn. This is a

really neatly written article. I’ll be sure

to bookmark it and come back to learn extra of your useful information. Thanks for the post.

I’ll definitely comeback.

Peter Bardens The Answer

fd237Hds72

When I initially commented I clicked the “Notify me when new comments are added” checkbox and now each time a comment is added

I get three e-mails with the same comment. Is there any way you can remove people

from that service? Bless you!

Robert Johnson The Complete Original Masters Centennial Edition

fd237Hds72

Parov Stelar The Burning Spider

fd237Hds72

It’s nearly impossible to find educated people in this particular topic, however, you seem like you know what you’re talking

about! Thanks

Asking questions are truly fastidious thing if you are

not understanding anything fully, however this paragraph presents fastidious understanding yet.

When I initially commented I clicked the “Notify me when new comments are added”

checkbox and now each time a comment is added I get three emails with

the same comment. Is there any way you can remove people from that

service? Appreciate it!

Howdy this is kind of of off topic but I was wanting to know if blogs use WYSIWYG editors or if you have to manually code with

HTML. I’m starting a blog soon but have no coding skills so I wanted to get advice from someone with experience.

Any help would be greatly appreciated!

Having read this I thought it was extremely informative.

I appreciate you spending some time and effort to put

this information together. I once again find myself personally spending a lot of time both reading and commenting.

But so what, it was still worthwhile!

Hi, after reading this remarkable article i am too cheerful to share my knowledge

here with friends.

John Mayer Where The Light Is John Mayer Live In Los Angeles

fd237Hds72

It’s very effortless to find out any matter on web as compared to books, as I found this post at this web

page.

fr

cialis soft tabs cialis 30 cialis tablets 20mg for sale

fd237Hds72

Thank you for the good writeup. It in fact was a amusement account it.

Look advanced to more added agreeable from you! By the way, how could we communicate?

I absolutely love your blog and find a lot of your post’s to be precisely what I’m looking for.

Does one offer guest writers to write content in your

case? I wouldn’t mind publishing a post or elaborating on a few of

the subjects you write related to here. Again, awesome web site!

Девятаев смотреть фильм

free slots games online play casino casino slots free games

fd237Hds72

Thanks on your marvelous posting! I truly enjoyed reading it, you will be a

great author. I will make sure to bookmark your blog and will

often come back later in life. I want to encourage yourself to continue your great writing, have a nice weekend!

Spot on with this write-up, I actually believe that this website needs far more attention. I’ll probably be returning to see more, thanks for

the information!

Pretty section of content. I just stumbled upon your web site and in accession capital to assert that

I get actually enjoyed account your blog posts. Anyway I’ll be

subscribing to your augment and even I achievement you access consistently quickly.

I’m impressed, I have to admit. Seldom do I come across

a blog that’s both equally educative and interesting, and without a doubt,

you’ve hit the nail on the head. The problem is an issue that too few men and

women are speaking intelligently about. I am very happy I stumbled across this in my search for something concerning this.

I do trust all of the ideas you’ve introduced to your post.

They’re really convincing and can certainly work. Still,

the posts are very quick for newbies. May you please extend them a bit from next time?

Thanks for the post.

siktir pic anan gelsin

I’m very happy to find this great site. I wanted to thank you for your time due to this fantastic read!!

I definitely liked every bit of it and I

have you book-marked to see new information on your

web site.

Hello to every one, the contents present at this web page are actually amazing

for people knowledge, well, keep up the good work fellows.

siktir pic anan gelsin

i need help writing an essay for college s371yx help me write a narrative essay r98uvp writing a great college essay x65brt

fd237Hds72

Uygun ve en ucuz fiyatlara İnstagram Türk Takipçi Satın AL sitesi 2018 yılından beri size hizmet vermektedir.

Kesintisiz hizmet garantisi ile hemen takipçi satın al.

Great post. I was checking constantly this blog and I

am impressed! Very useful info specially the last part :

) I care for such info much. I was seeking this particular information for a

long time. Thank you and best of luck.

how to write a funny essay b59rob college admissions essay prompts h38ihw college essays online s70yft

fd237Hds72

ss

college application essay writing service w91qeh how to write an mba essay s123hq essay writing review p272wz

fd237Hds72

Greetings! Very useful advice within this article!

It is the little changes that make the biggest changes.

Many thanks for sharing!

Thanks for finally writing about > For Married Couples, Social Security is

a Team Sport | RetirementFinance.Org < Loved it!

ss

Wow, awesome blog layout! How long have you been blogging

for? you make blogging look easy. The overall look of your website is fantastic, let

alone the content!

canada drug pharmacy indianpharmacy com global pharmacy

fd237Hds72

I visit every day a few websites and blogs to read posts, except

this webpage presents quality based posts.

Hi there! I just wanted to ask if you ever have any issues with hackers?

My last blog (wordpress) was hacked and I ended up losing a few months of hard work due to no back up.

Do you have any methods to protect against hackers?

Heya i’m for the primary time here. I came across this board and I find It really helpful & it helped me out much.

I am hoping to provide one thing back and help others like you aided me.

Thank you for any other informative site. The place

else could I am getting that kind of information written in such a perfect manner?

I’ve a venture that I’m just now working on, and I’ve been at the look

out for such info.

Your style is really unique in comparison to other folks I have

read stuff from. Thanks for posting when you have the opportunity, Guess

I will just bookmark this page.

all the time i used to read smaller articles that as

well clear their motive, and that is also happening with this paragraph

which I am reading here.

Hello! I just wanted to ask if you ever have any issues with

hackers? My last blog (wordpress) was hacked and I ended up losing a few months

of hard work due to no backup. Do you have any methods

to protect against hackers?

Pingback: buy cialis online best price

I will immediately snatch your rss as I can not in finding your

email subscription link or newsletter service. Do you

have any? Kindly allow me realize so that I may just subscribe.

Thanks.

Your means of telling the whole thing in this article is truly good, every one

be able to effortlessly understand it, Thanks a lot.

консультация психолога

Pretty! This has been an extremely wonderful post. Thank

you for supplying these details.

zoloft price in mexico cost of zoloft 50 mg 250 mg zoloft daily

Do you mind if I quote a couple of your articles as long as I

provide credit and sources back to your website?

My website is in the very same niche as yours and my users would truly benefit from a lot of the

information you present here. Please let me know if this ok with you.

Thanks a lot!

Wow that was strange. I just wrote an really long comment but after I clicked submit my comment didn’t appear.

Grrrr… well I’m not writing all that over again. Anyways, just wanted to say

superb blog!

Awesome! Its really amazing article, I have got much clear idea about from this post.

you are actually a excellent webmaster. The site loading speed is incredible.

It kind of feels that you are doing any unique trick. Moreover, The contents are masterwork.

you’ve done a wonderful process in this matter!

Your mode of describing everything in this post is genuinely nice, every one can easily be aware of it, Thanks a lot.

Greetings from Florida! I’m bored to death at work so I decided

to check out your blog on my iphone during lunch break.

I enjoy the info you present here and can’t wait to take a look when I get home.

I’m shocked at how fast your blog loaded on my cell phone ..

I’m not even using WIFI, just 3G .. Anyways, wonderful

blog!

Yes! Finally someone writes about Chicago COVID-19 Vaccination Sites.

It’s fantastic that you are getting thoughts from this piece of writing as well

as from our dialogue made at this place.

Howdy! Do you know if they make any plugins to help with Search Engine Optimization? I’m trying to get my blog to rank for some targeted keywords but

I’m not seeing very good results. If you know of any please share.

Cheers!

levitra where to buy online free shipping levitra 20 mg levitra price

Keep on working, great job!

Aw, this was a very nice post. Finding the time and actual

effort to generate a very good article…

but what can I say… I put things off a whole lot and never seem to get nearly anything done.

This article will assist the internet users for setting up new weblog or even a weblog from start to end.

my web page :: best delta 8 carts

Hello colleagues, fastidious piece of writing and fastidious urging commented at this place, I am genuinely enjoying by these.

Great site. Plenty of helpful information here. I’m sending it

to several buddies ans additionally sharing in delicious. And

of course, thank you to your effort!

modafinil over the counter modafinil for sale online modafinil medication

hi!,I love your writing very a lot! share we

keep in touch more approximately your article on AOL? I require a specialist on this area to unravel my problem.

Maybe that’s you! Having a look ahead to peer you.

With havin so much content do you ever run into any issues

of plagorism or copyright infringement? My site

has a lot of completely unique content I’ve either created

myself or outsourced but it appears a lot of

it is popping it up all over the web without

my permission. Do you know any ways to help stop content from being

stolen? I’d certainly appreciate it.

escrow pharmacy online trusted online pharmacy best mail order pharmacy canada

I all the time used to study piece of writing

in news papers but now as I am a user of web thus from now I

am using net for articles, thanks to web.

Hey! I could have sworn I’ve been to this website before but after browsing

through some of the post I realized it’s new to me.

Anyways, I’m definitely happy I found it and I’ll

be bookmarking and checking back frequently!

fr

Hi would you mind sharing which blog platform you’re using?

I’m planning to start my own blog soon but I’m having a tough time selecting between BlogEngine/Wordpress/B2evolution and Drupal.

The reason I ask is because your layout seems different then most blogs and I’m looking for something completely

unique. P.S My apologies for getting off-topic but I had to ask!

me as a writer essay c38kwm best friend essay writing u681vm writing a good essay d175qz

Do you have any video of that? I’d like to find out more details.

Hi my loved one! I wish to say that this article is amazing, nice written and

include approximately all vital infos. I’d like to see

extra posts like this .

online gambling sites free casino games slot usa casinos no deposit free w 021-02-22 21:11:31]

Best view i have ever seen !

great publish, very informative. I wonder why the opposite experts of

this sector don’t realize this. You must proceed your writing.

I’m sure, you have a huge readers’ base already!

college essay word count p27dvj how to write a self assessment essay q91vlf essay writing prompts for high school v78fli

Hello there, I found your web site by way of Google whilst searching for a comparable subject, your website

got here up, it appears to be like great. I have bookmarked

it in my google bookmarks.

Hello there, just changed into aware of your blog thru Google, and located that it

is truly informative. I’m going to be careful for brussels.

I’ll appreciate if you continue this in future.

Lots of people will likely be benefited from your writing.

Cheers!

Wow! After all I got a blog from where I be able

to in fact get valuable information concerning my study and knowledge.

custom essay writing company q46ibd using essay writing service m783ij college stress essay a80sei

Pingback: cialis in europe

Attractive element of content. I simply stumbled upon your web site

and in accession capital to say that I get actually loved

account your blog posts. Any way I’ll be subscribing in your augment or even I achievement you get admission to persistently quickly.

дивитися захар беркут 2019

I need to to thank you for this very good read!! I certainly enjoyed every bit of it.

I’ve got you saved as a favorite to look at new things you post…

Excellent beat ! I wish to apprentice even as you amend your

site, how can i subscribe for a blog web site? The account

aided me a acceptable deal. I had been tiny bit acquainted

of this your broadcast offered brilliant transparent concept

P.S. If you have a minute, would love your feedback on my new website

re-design. You can find it by searching for «royal cbd» — no sweat if

you can’t.

Keep up the good work!

Take a look at my web site – buy instagram followers

buy viagra in toronto viagra tablets from australia viagra connect walgreens

Hi there! Do you know if they make any plugins to safeguard against hackers?

I’m kinda paranoid about losing everything I’ve worked hard on. Any recommendations?

Undeniably believe that which you said. Your favorite justification seemed to

be on the web the simplest thing to be aware of.

I say to you, I definitely get irked while people think about worries that they just

do not know about. You managed to hit the nail upon the top and also defined out the whole thing without

having side effect , people could take a signal. Will probably be back

to get more. Thanks

Thanks very interesting blog!

NA https://sports.yahoo.com/ hd3d5s957hh

brand cialis 20 mg https://cialisclub100.com/ where to buy cialis in uk

prednisone where to buy uk https://prednisone20mgtablets.com/ prednisone cost in india

Why viewers still make use of to read news papers when in this technological

globe all is presented on web?

Excellent post! We are linking to this particularly great post on our site.

Keep up the good writing.

P.S. If you have a minute, would love your feedback on my new website

re-design. You can find it by searching for «royal

cbd» — no sweat if you can’t.

Keep up the good work!

Here is my web blog; buy instagram followers

Simply wish to say your article is as surprising. The clearness

for your put up is simply nice and that i can assume you’re knowledgeable on this subject.

Fine with your permission allow me to take hold of your feed to stay up to

date with drawing close post. Thank you a million and please keep up the enjoyable work.

Great web site. Plenty of useful information here.

I am sending it to several pals ans additionally sharing in delicious.

And certainly, thanks in your effort!

free casino games slots https://bestonlinecasinogambling777.com/ pch slots

Hi, I check your blogs on a regular basis.

Your story-telling style is awesome, keep

it up!

Hey there! I’m at work browsing your blog from my new iphone

3gs! Just wanted to say I love reading through your

blog and look forward to all your posts! Keep up the fantastic work!

P.S. If you have a minute, would love your feedback on my new website

re-design. You can find it by searching for «royal cbd» — no sweat if you

can’t.

Keep up the good work!

Feel free to surf to my blog post buy instagram followers

hi!,I like your writing so a lot! proportion we be in contact extra approximately your

article on AOL? I need a specialist on this area to unravel my problem.

May be that’s you! Looking forward to see you.

Hi there! I could have sworn I’ve been to this site before but after

reading through some of the post I realized it’s new to me.

Anyways, I’m definitely happy I found it and I’ll be book-marking and

checking back often!

zoloft 1000 mg https://zoloftzabs.com/ zoloft 50 mg daily

Greetings! I know this is kinda off topic however

, I’d figured I’d ask. Would you be interested in exchanging links or maybe guest writing a blog post

or vice-versa? My blog discusses a lot of the same topics as yours and

I feel we could greatly benefit from each other. If you’re interested feel free to shoot me an email.

I look forward to hearing from you! Excellent blog by the way!

Hi, i think that i noticed you visited my web site thus i got

here to go back the want?.I’m trying to in finding issues to

enhance my site!I guess its ok to make use of a few of your concepts!!

buy modafinil no prescription https://buymodafinilonline10.com/ modafinil buy online in in

Highly energetic blog, I liked that bit. Will there be a part 2?

I am sure this article has touched all the internet users,

its really really fastidious article on building up new web site.

say thanks to so a lot for your site it aids a whole lot. http://josuepostsgaragedoor.cavandoragh.org/the-single-best-strategy-to-use-for-garage-door-openers-help

obviously like your website however you

need to test the spelling on several of your posts. Many

of them are rife with spelling issues and I find it very bothersome to tell the

reality then again I’ll certainly come back again.

Howdy would you mind stating which blog platform you’re

working with? I’m planning to start my own blog in the near future but

I’m having a hard time selecting between BlogEngine/Wordpress/B2evolution and

Drupal. The reason I ask is because your layout

seems different then most blogs and I’m looking for something completely unique.

P.S My apologies for getting off-topic but I had to ask!

Pingback: 4569987

Broccoli and Cauliflower- These greens are full of diindolylmethane