In what year do you think the first U.S. Social Security check was issued?

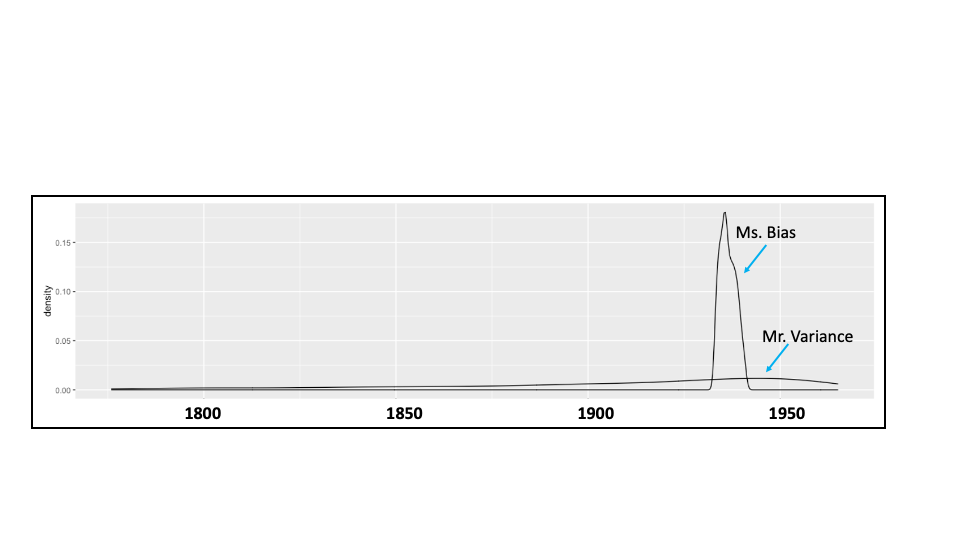

Two people are asked this question, neither knows the answer with certainty, so they separately are guided through a process to represent both their best guess and degree of uncertainty, resulting in the two probability distribution curves below, dating back to 1776. Which person did “better”?

That depends on how we define “better”. Clearly, the flat-liner expressed much less confidence, but perhaps the confidence exhibited by the narrow-bander is misplaced. Let’s look at how each responded and performed.

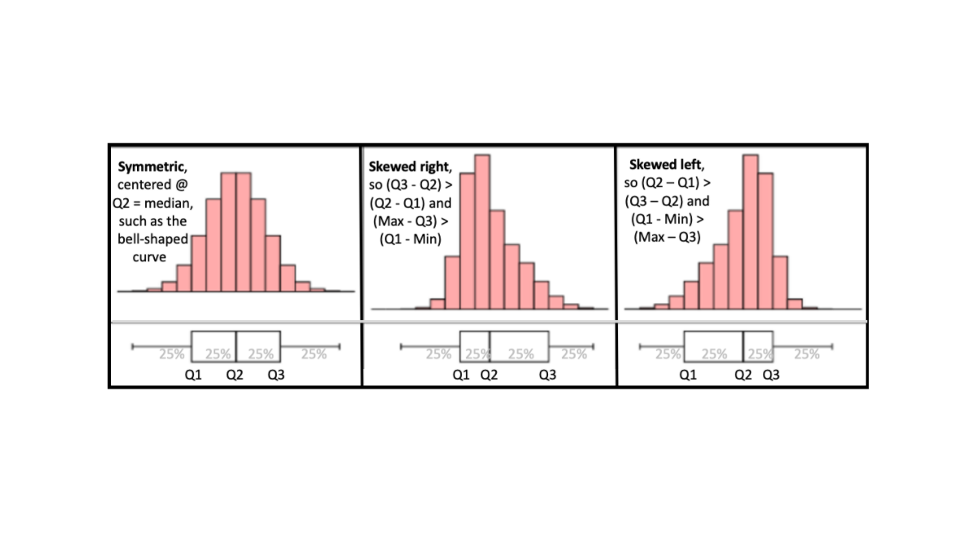

Neither knew the answer off-hand, so they were asked to pick two extreme values, the minimal and maximal plausible values, and their single best guess, the 50th-percentile, such that in each of their respective views the correct answer was equally likely to be above or below that estimate. Next, each was asked to express their degree of uncertainty by specifying a 25th-percentile and 75th-percentile that properly reflects their uncertainty regarding this subjective distribution of possible answers. Surely each would agree that there is 100% likelihood the true answer is greater than 1 A.D., greater than 2 A.D., and so on — eventually reaching amounts believed highly implausible but nonetheless possible. Continuing on until reaching an amount such each believed there is about a 25% chance the true value is less than it and a 75% chance it is larger. That is Q1, a personal first quartile. Continue on until reaching Q2, a number representing an equal 50% chance the true value is lower or higher, and finally to Q3, signifying the personal view there is a 75% chance the number is lower and 25% chance it is higher. Notice that the respondent should be equally confident the true number is inside the range between Q1 and Q3 as that it is outside that range. That middle 50% of data is a subjective interquartile range (IQR). Overconfidence would be exhibited by a general tendency for subjective estimates of the IQR to exclude the true value more frequently than it includes it, so that the true value is lodged somewhere below Q1 or above Q3. For each person, we now have a five-poiont summary, the parameters of a distribution.

Ms. Bias

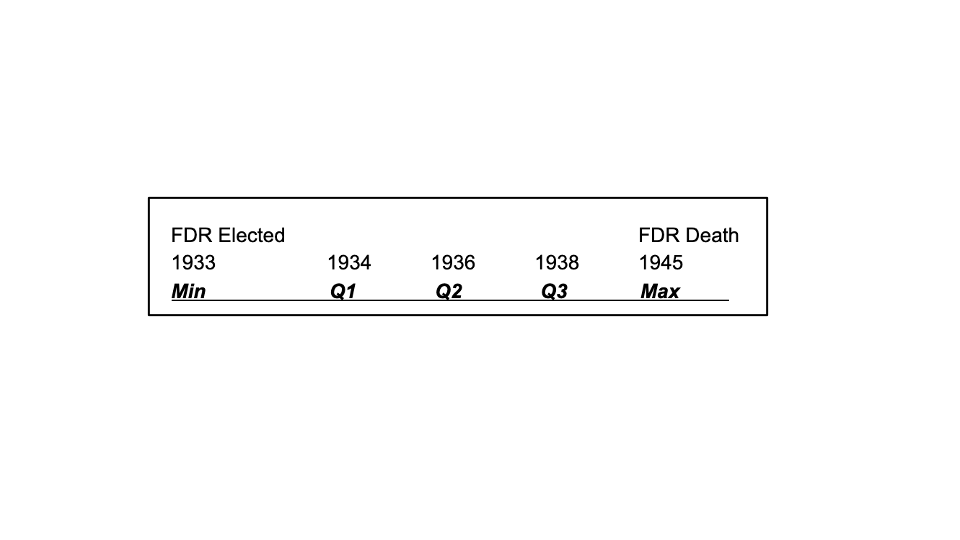

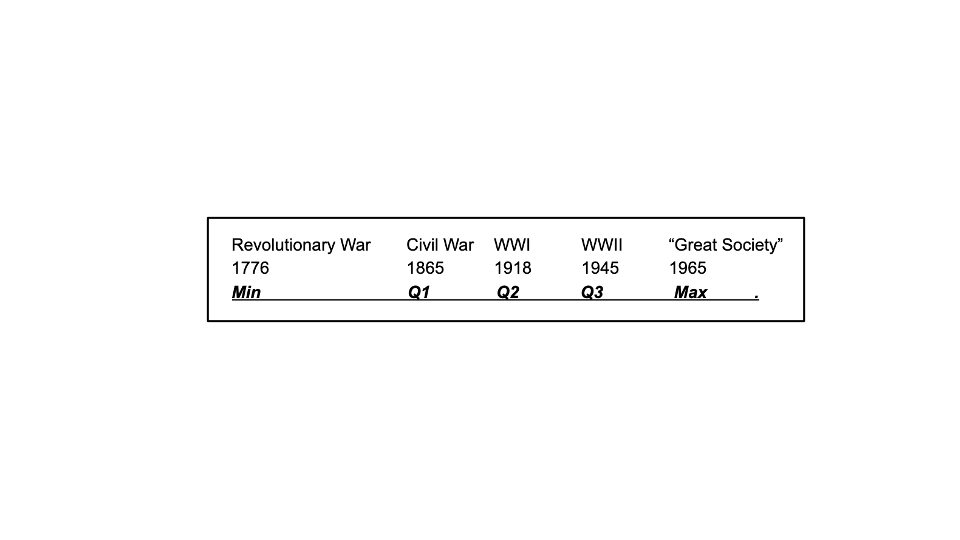

She recalls with assuredness that the Social Security program was a creation of Franklin Delano Roosevelt during his presidency, which she asserts as having run from 1933 to 1945. She believes the program likely started after his first year in office but before the Pearl Harbor bombing, and was equally likely to have occurred inside or outside a two-year window. Her five-number summary is:

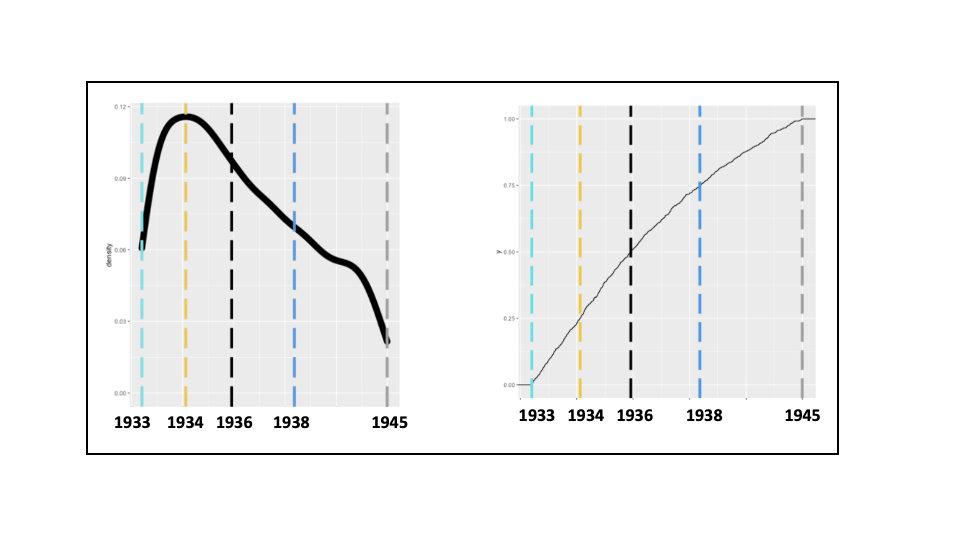

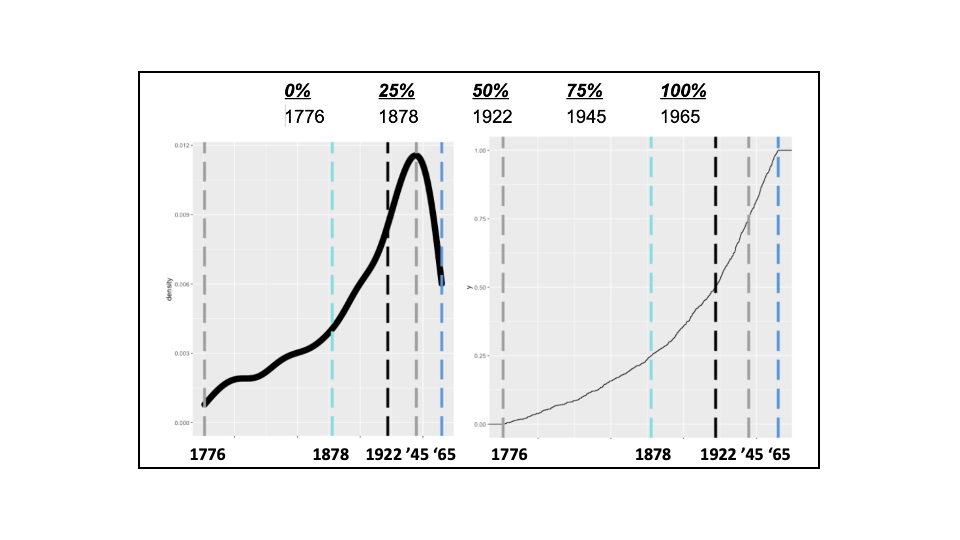

The probability density function (pdf) and its cumulative values (cdf):

Mr. Variance

He confesses to having no idea. Pressed to offer something, he realizes that the answer must fall between 1776 and 2020, since it is a program of the United States government. That’s a start. Pressed further, he suggests the program likely was initiated following a significant historical event, lists five candidate events, and deems each event equally likely to have resulted in the initiation of Social Security. He maps out his thoughts, and decides those five dates correspond to the five-number summary that reflect his subjective beliefs:

So, Mr. Variance believes the actual date is equally likely before or after 1918, with a 50% chance it happened between 1865 and 1945, and 25% probabilities each for the 1776-1865 or 1945-1965 intervals. Applying these parameters to the general lognormal distribution results in the following five-number summary, subjective probability density, and cumulative probability distribution. Note the initial estimates are slightly adjusted. That is because the five-number summary is a set of parameters, which are fed into a program to simulate distributions.

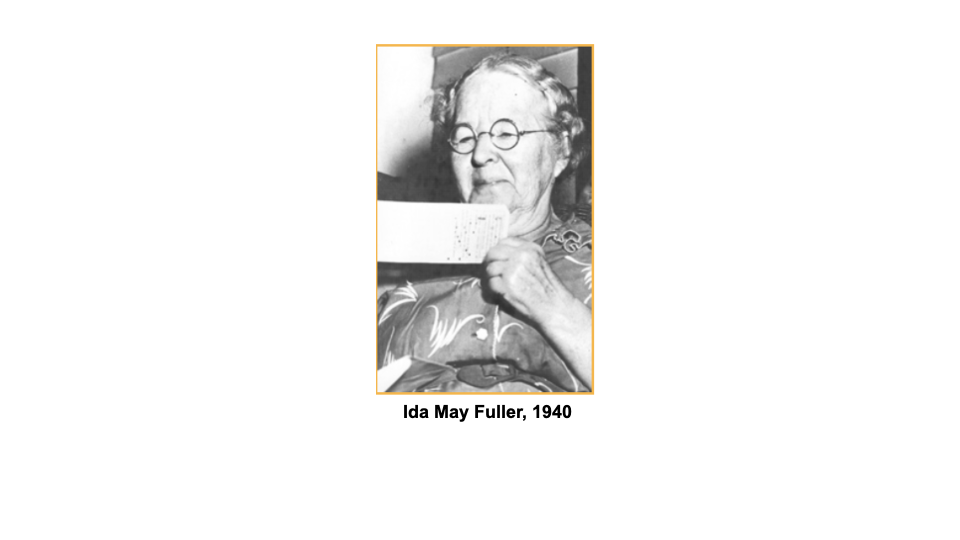

In fact, as part of his “New Deal”, it indeed was FDR who signed the Social Security Act of 1935. Although the first SSA office opened in 1936 and the first Social Security taxes were collected in 1937, the first check was not issued until January 31, 1940. The recipient of that first check was Ida May Fuller, a legal secretary who paid a total of $24.75 in Social Security taxes during 1937-38-39, then received that first check for $22.54 upon turning 65. In an ironic precursor of financial strains on the program, she lived to age 100, collecting $22,888.92 from SSA over 35 years.

Truly unbiased subjective curves would be centered at 1940, with equal belief the actual year would as likely be later than earlier than 1940. Based on their respective belief curves, for Mr. Variance 70.0% of the area under the simulated curve fell earlier than 1940, whereas 95.7% did so for Ms. Bias. Both are biased toward an earlier year, but Ms. Bias far more so.

Overconfidence is characterized by subjective confidence in judgements or beliefs that exceed the demonstrably objective accuracy of those judgements or beliefs. Psychology literature suggests it is far more common than being properly calibrated, and evidence of underconfidence is relatively sparse.

More Complex Example

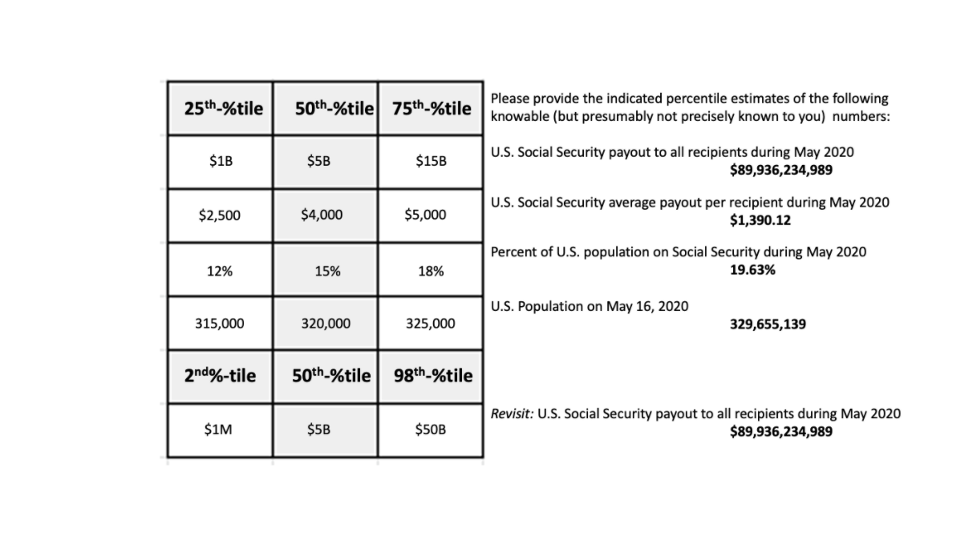

Let’s work through a more complex example. You are asked to estimate the dollar value of all distributions of U.S. Social Security payments to beneficiaries during May, 2020. Assume you had responded Q1 = $1 billion, Q2 = $5 billion, and Q3 = $50 billion. I can conclude from this that your IQR does not include the true answer, but cannot from this conclude you are overconfident. After all, if you are properly calibrated, being inside/outside the IQR is a 50/50 proposition.

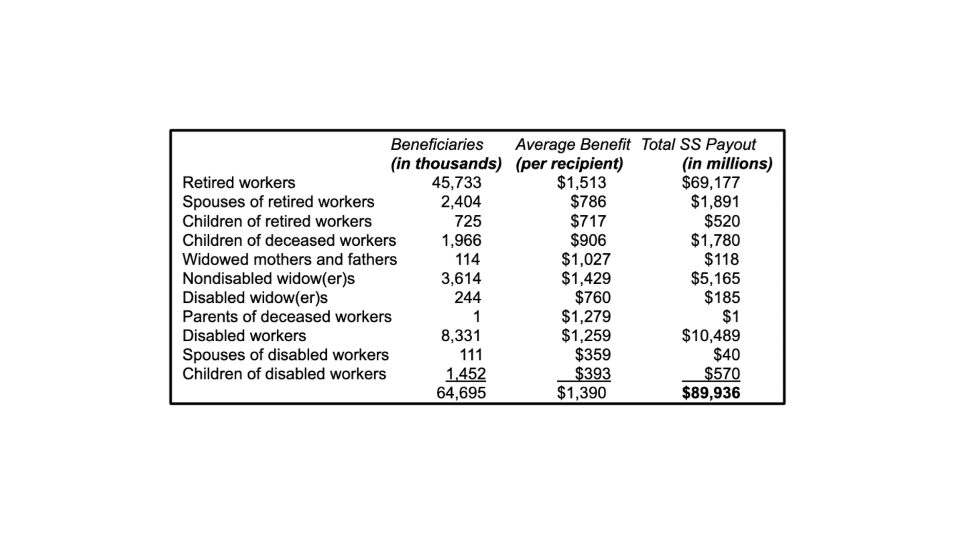

Given sufficient opportunity, time and access to resources, one could construct an informed estimate of the dollar value of all distributions of U.S. Social Security payments to beneficiaries during May, 2020. There are eleven types of recipients, and for each there is a record of the number of beneficiaries and the actual payout to each in May 2020. To multiply the number of beneficiaries times the average payout for each category of recipients requires 22 input values, and the sum of the 11 products equals a total payout by Social Security of about $90 billion ($89,939,234,989.04) during the month of May, 2020.

There is a compromise strategy, more elegant than the loosely-anchored initial estimates of Q1, Q2 and Q3, but far less computationally demanding than the explicit enumeration above. A “fast and frugal” compromise strategy is to provide subjective estimates for a small and manageable number of components that have the potential to reasonably substitute for a complete listing of categories, and that might more reasonably be estimated by an outsider than the required 22 input parameters above.

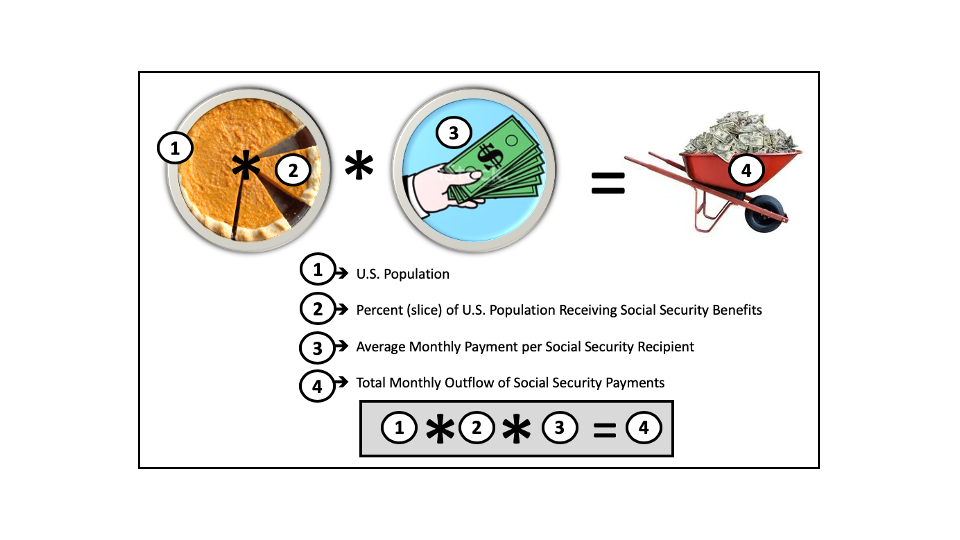

For example, one could device a four-parameter estimation process:

1. World population

2. U.S. population as percent of world

3. U.S. Social Security recipients as percent of population

4. Average monthly payment per Social Security recipient.

* Total Outflow of Social Security Benefits ~ Product of the four parameters.

If preferred, the problem can be simplified further, replacing the first two parameters by directly asking for the U.S. population, thereby reducing to a three-parameter estimation problem (but at a cost: loss of information):

1. U.S. population

2. U.S. Social Security recipients as percent of population

3. Average monthly payment per Social Security recipient.

* Total Outflow of Social Security Benefits ~ Product of three parameters.

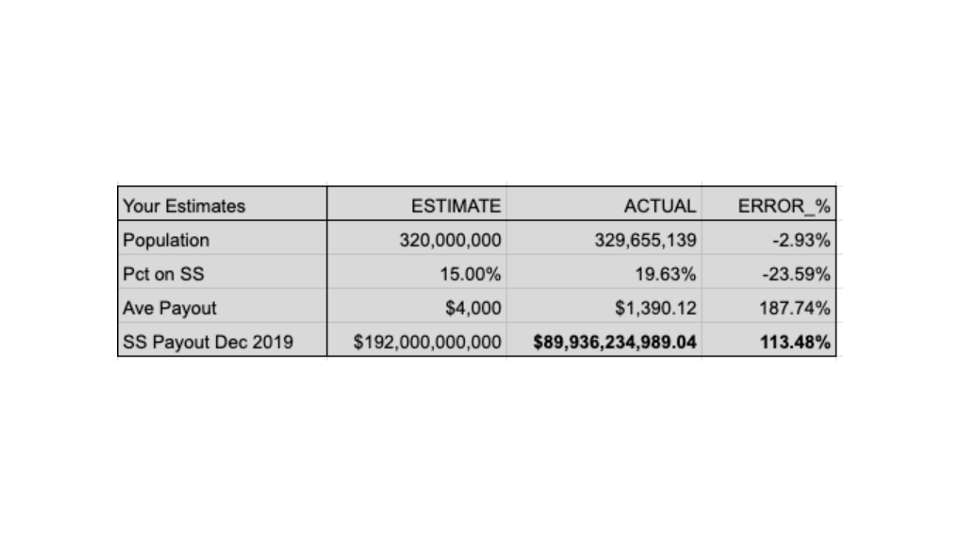

Applying the latter three-parameter estimation process, you now are asked to provide Q1, Q2 and Q3 subjective estimates for each of the three parameters, as shown below. Taking the best guesses (Q2), your new estimate equals 15% of 320,000, times $4,000 per recipient, equalling $192 billion — quite a leap from your original estimate of $5 billion. Error rates for each component are as follow:

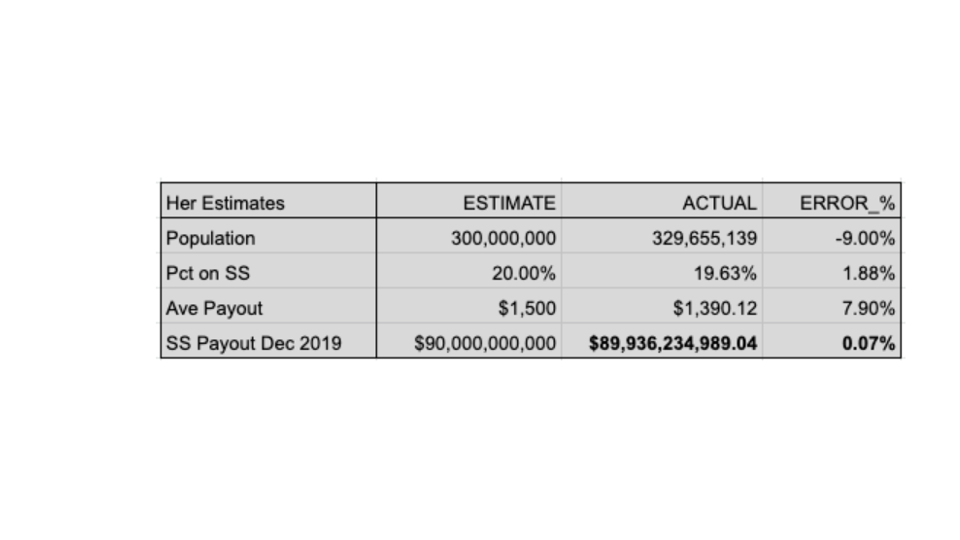

A single poor estimate greatly impaired your analysis, as your average payout per Social Security recipient is almost triple the actual value. With only three parameters to estimate, a single poor choice can greatly distort results. Nobody expects highly accurate estimates, but with more parameters to estimate, the opportunity for errors to offset and provide a decent final estimate increases greatly. For example, another person might complete the same three-parameter estimation process, with these results:

In her case, the two larger errors are in opposite directions, and essentially cancel their distortions. The three component estimates esch have much more error than the remarkably accurate final estimate, due to error cancellation.

Regarding the matter of assessment overconfidence, let’s return to your respective component quartile estimates and their implications. The table below displays your estimates (with actual correct answers in bold and to the far right):

We now also have four independent estimates of Q1 and Q3 for independent questions, and note that the true values are outside the respective IQRs in all four cases, with three above Q3 and one below Q1. This provides preliminary evidence of overconfidence, although it must be noted that two estimates are relatively close to the Q3 bound and the sample size of n=4 can provide no more than tentative support for overconfidence, as opposed to a collection of several such three-parameter estimation processes.

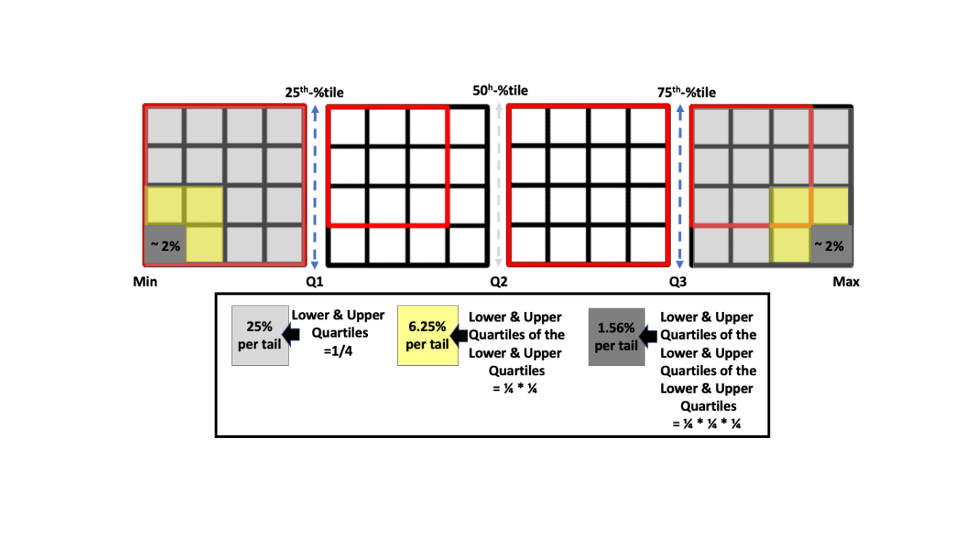

Finally, note from the table above that you also were asked to provide estimates of the far tails to your original estimate of the dollar value of all distributions of U.S. Social Security payments to beneficiaries during May, 2020. In particular, while your best guess of the value was $5 billion, you also estimate your 2%-tile at $1 million, and your 98%-tile at $50 billion. Even this range does not capture the true value, as your 98th-percentile is little more than halfway to the actual value. This provides another indication of overconfidence. Also, your Q1 and Q3 estimates for the three-parameters imply a means of inferring your 2%-tile and 98%-tile beliefs regarding the total payout value. Since you believe there is only a 25% chance that a given true parameter value is below its Q1 estimate, and there are three parameters, you must believe there is a 25% * 25% * 25% (= 0.25^3 = 0.02, or 2%) chance that each of the three parameter values are below your respective Q1 estimates. The same applies to the other tail, at the 98%-tile. The visual display below provides an intuitive view of the calculations. Each quartile of a given parameter has an equal number of values, represented here by a 4×4 box with 16 cells per quantile. As we combine two parameters, we are left with 25% of the original cells below Q1 and above Q3, or four cells. Combining three parameters reduces cells by 25% again, from four down to one (1/16th of 16; 1/64th of the original 64 cells).

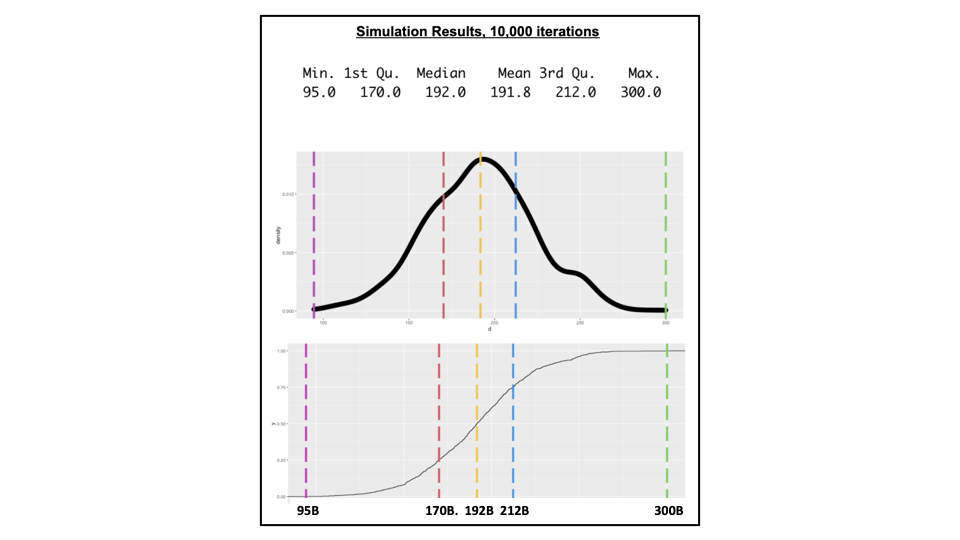

Applying this logic to your estimates, the implied percentiles are shown below. Your Q1, Q2 and Q3 estimates for each of the three parameter questions imply that your best guess estimate of the dollar value of all distributions of U.S. Social Security payments to beneficiaries during May, 2020 is $192 billion — quite the contrast to the direct estimate of $5 billion when initially asked. Further, the implication is that you believe there is about a 2% chance the true value exceeds $292.5 billion, and about a 2% chance it falls below $94.5 billion. Since the actual value is below that lower limit, there is evidence that you exhibit overconfidence in expressing subjective beliefs regarding objective values.

A Standalone APP

We have developed a standalone app to estimate the pdf and cdf of your subjective probability estimates to any problem by applying 10,000 iterations of a computer simulation of the general lognormal distribution, based on the five-number summary you enter.

— Jerry Platt, Ph.D., Emeritus Professor of Finance, San Francisco State U.

Comments 4,072

good content

instagram beğeni satın al, instagram türk beğeni satın al,

instagram ucuz beğeni gibi tüm işlemleri hemen sitemizden alabilir sizde paylaşımlarınızı renklendirebilirsiniz

Sosyal medya dünyasında instagram takipçi satın al işlemleri yapmak artık takipcisatinalin.org ile çok kolay !

hemen tıkla sende takipçi satın al

What’s Happening i am new to this, I stumbled upon this I’ve found It positively helpful and

it has helped me out loads. I am hoping to contribute & help different users like

its helped me. Great job.

Sosyalmedya hesaplarının arasında en hızlı gelişim instagram da gelişiyor..

İster bireysel ister kurumsal olarak instagramı doğru kullandığınızda sizlere çok büyük faydalar sağlanıyor instagram takipçi satın al

hizmeti için takip2018 web sayfasına giriş yapabilirsiniz.

Very good information. Lucky me I found your blog by chance (stumbleupon).

I have saved it for later!

Its not my first time to visit this site, i am visiting

this site dailly and take pleasant facts from here every day.

Have you ever thought about writing an ebook or guest authoring on other websites?

I have a blog centered on the same information you discuss and would really like to have you

share some stories/information. I know my subscribers

would enjoy your work. If you’re even remotely interested, feel free to send me

an email.

If some one desires to be updated with newest technologies therefore he must be

pay a visit this website and be up to date daily.

Birşey almadan önce herzaman araştırırız en güvenilir hangisidir diye.

en güvenilir takipçi satın alma sitesi de instagram da takip2018.com dur hemen en hızlı

takipçi al

I pay a quick visit everyday some blogs and sites to read content, but this website presents quality based articles.

Thanks for some other fantastic post. Where else may just anyone get that kind of info in such

an ideal manner of writing? I’ve a presentation next week, and I’m on the

search for such information.

Howdy! This article could not be written much better!

Reading through this post reminds me of my previous roommate!

He always kept preaching about this. I will send this

information to him. Fairly certain he’s going to have a

very good read. Thank you for sharing!

Amazing things here. I’m very happy to peer your post. Thanks a lot and I’m having a look

forward to contact you. Will you kindly drop me a mail?

İnstagram kullanıcıları daha aktif ve etkin olmasını istiyorsanız takipçi sayınızı belirli bir düzeye ulaştırmalısınız.

Bunun kendi imkanlarınızla kısa sürelerde

hallediyor olmanız neredeyse imkansızdır.

İnstagram takipçi satın al hizmeti ile hesaplarınızda istediğiniz sayılarda takipçi sahibi olabilirsiniz.

Bu alanda hizmet veren ve takipçi satışı yapan platformları kullanabilirsiniz takipcisatinalin.org

Instagram Takipçi Satın Al hizmetleriyle aktif bir

şekilde takipçi hizmeti veriyor

I delight in, lead to I found exactly what I was taking a look for.

You have ended my four day long hunt! God Bless

you man. Have a nice day. Bye

Hey! This post couldn’t be written any better! Reading through this post reminds me of my

good old room mate! He always kept chatting about this. I will forward this write-up to him.

Fairly certain he will have a good read. Thanks for sharing!

You can certainly see your skills within the work you write.

The sector hopes for even more passionate writers like you who are not afraid to mention how they believe.

All the time follow your heart.

It is in reality a nice and useful piece of info. I’m glad that you

shared this helpful info with us. Please keep us up to date like this.

Thank you for sharing.

I’m impressed, I have to admit. Rarely do I encounter a blog that’s both educative and amusing, and without

a doubt, you have hit the nail on the head. The issue is something which too few men and women are speaking intelligently about.

Now i’m very happy that I stumbled across this in my hunt for something concerning this.

Its like you read my thoughts! You appear to grasp so much approximately this, such as you wrote the ebook in it or something.

I believe that you just could do with a few percent to power the message

house a little bit, however other than that, this is excellent blog.

A fantastic read. I will certainly be back.

Saved as a favorite, I like your site!

Hi there I am so happy I found your website, I really found you by accident, while I

was searching on Yahoo for something else, Nonetheless

I am here now and would just like to say many thanks for a tremendous post

and a all round thrilling blog (I also love the

theme/design), I don’t have time to look over it all at the minute but I have saved it

and also added your RSS feeds, so when I have time I

will be back to read a great deal more, Please do keep

up the excellent job.

Hello to every single one, it’s truly a good for me to visit this site,

it consists of priceless Information.

This excellent website certainly has all the information I needed about this subject and didn’t know who to ask.

When I initially left a comment I seem to have clicked the -Notify me when new comments are added- checkbox and from now on whenever

a comment is added I get four emails with the same comment.

There has to be a way you are able to remove me from that service?

Many thanks!

Hello I am so thrilled I found your site, I really found you by mistake, while I was researching on Yahoo for something else, Anyhow I am here now and would just like to say

cheers for a tremendous post and a all round exciting

blog (I also love the theme/design), I don’t have time to look

over it all at the minute but I have saved it and also included your RSS feeds,

so when I have time I will be back to read a great deal more, Please do keep up the fantastic job.

aşam alanlarımızda sık sık rastladığımız hamam böceği problemleri,

kısa vakit içinde araya girmek edilmez ise çok daha değişik boyutlarda sorunlara niçin olabilirler.

antalya böcek ilaçlama Hamam böcekleri dolaştıkları her

ortamdan bünyelerine detaylı bakteri taşımaktadır.

Daha sonra bu bakterileri de girmiş oldukları her alanda yayarak, başka

canlı türlerinin sağlığını rizikoya atabilmektedir.

Bu amaçla hamam böceği ilaçlama faaliyetlerinin önemi gerektiğince büyüktür.

Greetings, There’s no doubt that your web site could be having web

browser compatibility problems. When I take a look at your web site in Safari, it

looks fine however when opening in Internet Explorer,

it’s got some overlapping issues. I just wanted to provide you with a quick heads

up! Apart from that, fantastic blog!

instagram gerçek türk beğeni satın al denilince akla hemen ilk gelen site

olan sitemiz hemen size yılların verdiği

tecrübe ile sizlere hala kesintisiz hizmet

vermekte. Türk ve gerçek beğeni satın alabilmek için tercih sebebi

olan bu siteden hemen faydalanabilirsiniz, Bu sayede profiliniz herkes tarafından sevilecek ve heryerde sizden bahsedecekler.

Türk beğeni almanın faydalarından biri faydası ise gönderileriniz keşfete düşer.

Aynı zamanda türk oto beğeni sağlayıcısıdır.

Oto beğeni siz paylaşım yaptığınız an belirttiğiniz sürede

paylaşımınız ister foto ister video ne olursa olsun otomatik olarak size ulaştırılır.

Shell indirme test sitesi

site de belirtmiş olduğumuz gibi herşeyin sana

özgün olarak logsuz olmalı logsuz shell indir adresi shelldownload.org

Instagram Takipçi Sayısının Önemi

Günümüzde neredeyse en çok kullanımının olduğu

uygulama olan instagram uygulamasında kullanıcılar kendilerini

daha yaygın ve daha yüksek etkileşimler almanın etkisine kaptırmış durumdadır.

Bu nedenle kişiler daha fazla etkileşim alabilmek adına

ve daha yaygın bir kitleye ulaşabilme imkanı elde etmek isterler.

Bu kişilerin takipçi satın al gibi

platformlar aracılığı ile gerçek takipçiye sahip olarak etkileşimleri en kısa zamanda en yüksek seviyelere taşıma imkanı elde ederler.

I was wondering if you ever considered changing the page layout of your website?

Its very well written; I love what youve got to say.

But maybe you could a little more in the way of content so people could connect with it better.

Youve got an awful lot of text for only having 1 or two pictures.

Maybe you could space it out better?

antalya böcek ilaçlama Şirketi olan alc

ilaçlama ile tüm haşarelerden korunmaya hazırmısın?

Böcek ilaçlama lider firması olan titiz ve hızlı personeli sayesinde belirttiğiniz saatte hemen hizmet

vermektedir.

Priv8 shell için Shell Download sitesine giderek hemen shell

d

wso shell indirererk sunucunu hemen test et

wso shell download için shelldownload.org ziyaret edin

Logsuz shell download için hemen siteyi ziyaret et sende shelller ile serverlarını test et

En iyi takipçi satın al sitesini kullanarak popülerliğini arttırma

Takipçi satın al!

It is appropriate time to make some plans for the future and it’s time to be happy.

I have learn this submit and if I could I wish to counsel you few fascinating issues or suggestions.

Perhaps you could write subsequent articles relating to this article.

I wish to learn more issues approximately it!

Takip2018.com ile takipci satin al

Sitemizin yer alan paketler bunlarla sınırlı değil.

Sitemizde görünenlerle sınırlı değildir, dilediğiniz kadar instagram takipci satin al seçeneklerinden dilediğiniz kadar alabilirsiniz.

Ucuz Takipçi Alarak Fenomen Olabilirsin

Instagram da artık basit bir halde fenomen olabilirsiniz.

Takipçilerinizi hızlı ve etken bir şekilde arttırmak istiyor musunuz?

hemen bu siteye giriş yaparak tüm takipçi hizmetlerinden hızlı bir şekilde faydalanabilirsiniz.

Sizlere en kaliteli takipçi sistemlerini sunarak, kısa vakit arasında istediğiniz kadar

takipçi gönderimi yapıyor. Sitede yer alan ucuz takipçi satın al hizmetinden faydalanarak arzu ettiğiniz kadar takipçiye ulaşabilirsiniz.

Bu site sizden aslabir şekilde hesap şifresi istemiyor.

sadece kullanıcı isminiz ehil oluyor. uzun zamandır bu mevzuda hizmet veren bir site olarak, sizlere en kaliteli ve güvenilir takipçi hizmetlerini

sunuyor. Siteye tek tıkla giriş yaparak arzu ettiğiniz kadar takipçiyi hesabınıza gönderebilirsiniz.

Tamamen rahat yöntemlerle dilediğiniz kadar takipçiye ulaşabiliyorsunuz.

Thanks a bunch for sharing this with all folks you really realize what you’re speaking approximately!

Bookmarked. Kindly also talk over with my website =).

We will have a hyperlink alternate contract among

us

Incredible story there. What occurred after? Thanks!

When I initially commented I seem to have clicked on the -Notify me when new comments are added- checkbox and from now on each time a comment is

added I get four emails with the exact same comment.

Is there a means you can remove me from that service?

Appreciate it!

Aktif gerçek İnstagram Takipçi Satın AL işlemini gerçekleştir!

instagramaktiftakipci ile en hızlı takipçi satın al

Instagram aktif takipçi satın alarak siz de fenomen olabilirsiniz, fakat fenomen olmak isterken aynı zaman da bu

işlemleri yapacağınız yerin kalitesi çok önemlidir bunu unutmayınız.

Türk takipçi yazarak yabancı takipçi atılırsa hesabınıza bu sizin hesabınızın gerek

görüntü gerek keşfete düşme gibi olasılıklarınızı tamamen bitirecektir.

Bu yüzden aktif takipçi almanız çok önemli, aynı zamanda tabiki güvenilirlik ön planda olmalıdır.

Biz uzman ekibimiz ile sizlere en iyi hizmeti vermek için sürekli çalışmaktayız.

En iyi takipçi beğeni izlenme gibi sizleri üst seviyeye çıkarmak için elimizden geleni yaptık ve

yapmaya devam edeceğiz. Ucuz Instagram takipçi için bizimle de iletişime geçebilirsiniz.

Instagram bot takipçi içinde geçebilirsiniz fakat bunlara garanti

vermemekteyiz, bot takipçilerin kesinlikle garantisi yoktur bir kaç gün içerisinde hepsi Instagram tarafından silinebilir.

En aktif siteden hemen sende instagram aktif takipçi satın al

Heya i am for the first time here. I found this board and I find It truly useful &

it helped me out much. I hope to give something back and aid others like you aided me.

Instagram takipci sayfanızın satış için yada popülerliğinizi arttırmak için takipci satin al islemini gercekleştirin

Instagram takipçi hizmetlerinden yararlanabilmek amacıyla ilk olarak istenilen hizmetin tercihinin yapılması gerekmektedir.

Sonra ise shopier ekranında sadece kullanıcı adınız ve 3d ödeme yöntemi ile ödeme yapmanız gerekmektedir.

Burada doğru bulguların girildiğinden emin olunması, hizmet yönünden problem yaşamamak

amacıyla önemlidir.

Her yaştaki isteyen herkes Takipçi satın al işlemi takip2018 den yapabilirler.

I’m impressed, I must say. Seldom do I come across a blog that’s both educative and amusing, and

without a doubt, you have hit the nail on the head.

The issue is something which too few folks are speaking intelligently about.

I’m very happy that I came across this in my hunt for something concerning

this.

Thanks for any other informative site. The

place else may just I get that type of info written in such an ideal approach?

I have a project that I’m just now running on, and I’ve been on the glance out for such information.

Şirketi olan alc ilaçlama ile tüm haşarelerden korunmaya hazırmısın?

Böcek ilaçlama lider firması olan titiz ve hızlı personeli

sayesinde

belirttiğiniz saatte hemen hizmet vermektedir antalya böcek ilaçlama

Lider firma bir telefon kadar yakın!

Instagram hesabını büyüterek onbinlerce seni takip eden olsun istiyorsan instagram takipçi al websitesinden hemen faydalan!

Instagram da artık basit bir halde fenomen olabilirsiniz.

Takipçilerinizi hızlı ve etken bir şekilde arttırmak istiyor musunuz?

hemen bu siteye giriş yaparak tüm takipçi hizmetlerinden hızlı bir

şekilde faydalanabilirsiniz. Sizlere en kaliteli takipçi sistemlerini sunarak, kısa vakit arasında istediğiniz kadar takipçi

gönderimi yapıyor. Sitede yer alan İnstagram takipçi Satın Al hizmetinden faydalanarak arzu ettiğiniz kadar takipçiye ulaşabilirsiniz.

I pay a visit day-to-day a few blogs and information sites to read articles, however this

weblog gives feature based articles.

Türk gerçek ve yabancı gerçek gibi 50k 100k 1m gibi Takipçi Satın Al

seçenekleri ile takipçilerini hemen toparla!

Instagram için eşsiz benzersiz hizmetler sunan takip2018 den instagram takipçi al 1000, 2000 gibi bir çok seçenek ile

instagram takipçi satın al

Instagram hesabınızı büyütmek ve yeni müşteriler

yada arkadaşlara

sahip olmak için çok fazla düşünmenize kesinlikle gerek yoktur.

Geri takipler ile uğraşmak yerine hemen takip2018.com a giderek

Takipci Satin Al

işleminizi kolayca halledebilirsiniz

Fenomen ve populer bir kişi olmak için hemen siteyi ziyaret et

Sivilce ve her türlü cilt tonu lekeleri için hc Leke Kremi

ile cilt rengi farklılıklarına son !

Bizler antalya firması olarak çalışmalarımıza yön veren izolasyon uygulamaları

ile siz müşterilerimize en iyi izolasyon uygulamaları yapabilmek adına en kaliteli çatı izolasyon ustaları, ile sizlere hizmet vermekteyiz.

Çatıcı, olarak günümüzde yapmış olduğumuz yalıtım uygulamaları

sayesinde müşteri memnuniyetini kazanmış ve kalitesinden asla ödün vermemiş Babadağ çatı, asla

düzenini bozmadan izolasyon uygulamasına devam etmektedir.

antalya izolasyon

En aktif ve türk gerçek Takipçi Satın Al sitesi olan sitemizden hemen en aktif takipçileri satın al

Instagram’da bir hesabın takipçi sayısı, o hesabın prestiji açısından çok önemlidir.

Bundan dolayı, hesabını büyütmek isteyenler,

öncelikle takipçi satın almaktadır. Fazla takipçi sayısı olan hesaplar,

daha fazla dikkat çeker ve daha fazla kişiye ulaşırlar.

Firma, müşterilerin farklı taleplerine cevap verebilmek

adına farklı takipçi paketleriyle hizmet vermektedir.

kaliteli takipçi satın al

kelimesinde en iyi web sitesi!

.

Hc care leke kremi

HC Pigment-Control’ün cilt lekelerine karşı hızlı ve güçlü etkisi,

Kuzey Kanada Bozkırları’na özgü bir tarla bitkisi olan Rumeks’ten (Tyrostat™), tabiatın yeniden canlandırma mucizesi olan Yeniden Diriliş Bitkisi’ne kadar birçok

doğal ve saf aktif bileşene dayalıdır.

Tüm bu aktif bileşenlerin, lekeler ve cilt yaşlanması üzerindeki etkileri in-vivo testler ve klinik

laboratuvar çalışmalarıyla kanıtlanmıştır.

Tüm cilt tiplerinde, leke problemlerini giderme ve önlemede, cilt tonu eşitsizliğinde, cilt aydınlatmasında, nem

ihtiyacı olan ciltlerde güvenle kullanılabilir.

En iyi leke kremi

Sosyal Medya platformlarının tamamı içn takipçi satın al hizmeti sunmaktayız

https://rebrand.ly/takipci-satin-al-

Üstelik dilediğiniz kadar takipçi yada beğeni alabilirsiniz bu eşsiz hizmetten hemen faydalanmak seninin de hakkın gülo

Instagram’da bir hesabın takipçi sayısı, o hesabın prestiji açısından çok önemlidir.

İnstagram kullanıcılarının sayısı her geçen gün artıyor.

İnstagram da fenomen olmak isteyen kişiler ise bir birleri ile yarışıyor

https://rebrand.ly/instagram-takipci-satin-al-

Takipcisatinalin.org ile hemen instagram takipçi satın al.

Tr Medya sitesi aracılığı ile istediğiniz sayılarda instagram takipçisi satın alabilirsiniz.

Bu satın alma işlemini yaparken hazırlanmış olan takipçi paketlerinden istediğinizi seçebilirsiniz.

Her zaman en uygun fiyatların sunulduğu takipçi paketlerinden her biri her bütçeye uygun olarak hazırlanıyor.

Bütçenize ve ihtiyacınıza en uygun olan paketleri seçebilirsiniz.

https://rebrand.ly/takipci-satin-al

Please let me know if you’re looking for a article author

for your site. You have some really great articles and I believe I would be a good asset.

If you ever want to take some of the load off, I’d love

to write some material for your blog in exchange for

a link back to mine. Please send me an email if interested.

Cheers!

Piece of writing writing is also a fun, if you be acquainted with

then you can write or else it is complex to write.

I’m gone to inform my little brother, that he

should also go to see this web site on regular basis to get updated from hottest

information.

I know this if off topic but I’m looking into starting my

own weblog and was curious what all is needed to get setup?

I’m assuming having a blog like yours would cost a pretty penny?

I’m not very web smart so I’m not 100% positive.

Any tips or advice would be greatly appreciated.

Thank you

Türkiyenin en iyi markası olan hc care artık sizlere leke kremi ile de içten karşılamtakta.

Tamamen doğal ürünlerden üretilen bu en iyi leke kremini kullanmadan cildinize küsmeyin !

https://bit.ly/eniyilekekremi-

Türkiye nin lider sitesi instagramaktiftakipci.com ile Instagram için geçerli türk takipçiler almaya hazırmısın?

Ucuz fiyatlara kalitenin en iyi adresi ile tanışmak sadece bir tık kadar

yakın.. http://bit.ly/turk-takipci-satin-alma

Hemen instagramaktiftakipci den aktif türk takipçiler

alın

Instagram ve diğer soysal medyalar için gerek takipçi gerek beğeni gibi bir çok sizi populeriter gösterecek tüm ürünlere hemen ulaşmak için kısacası takipçi almak için Hemen tıkla ve satın al

https://bit.ly/instagram-takipçi-satın-alma

Do you have any video of that? I’d care to find

out some additional information.

En güvenilir takipçi sitesi ile profiliniz için Takipçi Satın AL işlemi hemen en hızlı şekilde profilinize yüklenir.

Great post. I was checking continuously this blog and I am impressed!

Very useful info specifically the last part 🙂 I care for such info a lot.

I was looking for this certain information for a long time.

Thank you and good luck.

You should be a part of a contest for one of the finest blogs on the web.

I’m going to recommend this website!

Superb site you have here but I was curious about if you

knew of any user discussion forums that cover the same topics talked about in this article?

I’d really like to be a part of online community where I can get feedback from other experienced individuals that share the

same interest. If you have any suggestions, please let me know.

Kudos!

It’s difficult to find well-informed people for this subject, but you seem like you know

what you’re talking about! Thanks

I think everything published was very reasonable. However, think on this, suppose you were to create a awesome headline?

I mean, I don’t wish to tell you how to run your blog,

however what if you added something to maybe get

people’s attention? I mean Quantifying Your Subjective Beliefs | RetirementFinance.Org is a little

boring. You ought to look at Yahoo’s home page and watch how they write post headlines to grab

viewers to open the links. You might add a video or a related picture or two

to grab people interested about what you’ve got

to say. In my opinion, it would make your website a little livelier.

I like it when folks come together and share opinions. Great

blog, stick with it!

Amazing blog! Do you have any hints for aspiring writers?

I’m hoping to start my own blog soon but I’m a

little lost on everything. Would you recommend starting with a free platform like WordPress

or go for a paid option? There are so many options out there that I’m totally overwhelmed ..

Any suggestions? Many thanks!

Hmm it appears like your blog ate my first comment (it was extremely long) so I guess I’ll just sum it up what I wrote and say, I’m thoroughly enjoying your blog.

I too am an aspiring blog blogger but I’m still new to everything.

Do you have any helpful hints for inexperienced blog writers?

I’d definitely appreciate it.

Somebody necessarily help to make significantly articles I would

state. This is the very first time I frequented your web page and so far?

I surprised with the research you made to make this particular

publish incredible. Wonderful activity!

Link exchange is nothing else but it is just placing the other person’s blog link on your page at appropriate place

and other person will also do similar in support of you.

Sweet blog! I found it while surfing around on Yahoo News.

Do you have any tips on how to get listed in Yahoo News?

I’ve been trying for a while but I never seem to get there!

Many thanks

Hi there would you mind sharing which blog platform you’re using?

I’m looking to start my own blog in the near future but

I’m having a hard time deciding between BlogEngine/Wordpress/B2evolution and Drupal.

The reason I ask is because your design seems different then most blogs and I’m looking for something

unique. P.S Apologies for getting off-topic

but I had to ask!

Pretty part of content. I just stumbled upon your blog

and in accession capital to assert that I get in fact loved account your blog

posts. Any way I will be subscribing for your augment or even I achievement you get admission to persistently rapidly.

Thank you for the auspicious writeup. It in truth was once a leisure account it.

Glance advanced to far added agreeable from you! By the way, how could we be in contact?

Wow, awesome blog layout! How lengthy have you been blogging for?

you make running a blog glance easy. The overall look of

your site is great, let alone the content material!

Quality articles or reviews is the crucial to invite the people to visit the web site, that’s what

this web page is providing.

Just wish to say your article is as astounding.

The clearness in your post is simply nice and i can assume you are an expert

on this subject. Fine with your permission let me to grab your RSS feed to keep up to date with forthcoming post.

Thanks a million and please carry on the enjoyable work.

Hello friends, its wonderful piece of writing concerning tutoringand fully defined, keep it up all

the time.

When someone writes an article he/she keeps the plan of a

user in his/her brain that how a user can know it. So that’s why this paragraph is great.

Thanks!

This is really interesting, You’re an overly professional

blogger. I’ve joined your rss feed and look ahead to searching for extra of your wonderful post.

Also, I’ve shared your site in my social networks

Hi there! This post could not be written any better!

Looking at this article reminds me of my previous roommate!

He continually kept talking about this. I am going to forward this post to him.

Fairly certain he’s going to have a very good read. Many thanks for sharing!

Hi there! This is my first visit to your blog!

We are a team of volunteers and starting a new project in a community in the same niche.

Your blog provided us beneficial information to work on. You have done a extraordinary job!

I do not even know how I ended up right here, however I believed this publish was great.

I don’t understand who you might be however certainly you are going to a well-known blogger for those who aren’t already.

Cheers!

Thank you for some other informative web site.

Where else may I am getting that type of info written in such a

perfect manner? I have a undertaking that I’m just now operating on, and I’ve been on the

look out for such info.

Hi! Do you know if they make any plugins to safeguard

against hackers? I’m kinda paranoid about losing everything

I’ve worked hard on. Any recommendations?

Excellent blog you have got here.. It’s difficult to find

high-quality writing like yours these days. I really

appreciate individuals like you! Take care!!

Türkiyenin önde gelen cilt ürünleri firmasından hccare artık

sizlere leke kremi ile de hizmet vermekten gurur duyuyor,

En iyi leke kremini alabilmek artık çok kolay web sitesine giderek hemen leke kremi sahibi

olabilirsini

En iyi leke kremi ; https://cutt.ly/en-iyi-leke-kremi

Hey! Would you mind if I share your blog with my twitter group?

There’s a lot of people that I think would

really appreciate your content. Please let me know. Many thanks

When I originally commented I clicked the “Notify me when new comments are added”

checkbox and now each time a comment is added I get several emails

with the same comment. Is there any way you can remove me from that service?

Cheers!

What i do not realize is in truth how you’re

no longer actually much more well-preferred than you might be now.

You’re so intelligent. You recognize therefore significantly when it

comes to this subject, made me personally imagine it from

a lot of numerous angles. Its like men and women don’t seem to be

fascinated unless it’s one thing to do with Girl gaga! Your individual stuffs outstanding.

All the time deal with it up!

Hi there, of course this article is really fastidious and I have learned lot

of things from it regarding blogging. thanks.

Terrific post however I was wanting to know if you could write a litte more on this topic?

I’d be very grateful if you could elaborate a

little bit further. Thanks!

Türkiye de herkes youtube abone satın almak için takip2018.com u tercih ediyor,

Youtube abone seçenekleri türk ve yabancı paketler bulunmaktadır.

Hemen sizleride sitemize bekliyoruz

Ayrıca paketleri inceleyerek düşmeyen takipçi satın alma seçenekleride bulabilirsiniz,

Hatta ve hatta 8 tl ye bile instagram takipçi satın alabilirsinizz

Youtube Abone Satın aL‘ U Herkes tercih ediyor!

Hey there! I just wish to offer you a huge thumbs up

for the great information you’ve got right here on this post.

I will be returning to your blog for more soon.

Magnificent site. Plenty of useful information here.

I’m sending it to a few friends ans additionally sharing

in delicious. And naturally, thank you in your

sweat!

Instagram takipçi satın alarak profilini büyüt, satışlarını yükselterek en iyi takipçi paketlerine sahip olan siteyi

kesinlikle sana tavsiye diyoruz.

Takipçi satın alma konusunda uzman kadrosu ile sizi bekleyen bu site ile ucuz ve garantili gerçek türk kişilere

ulaşabilirsin. HEmen instagram takipçi satın al

https://rebrand.ly/takipcintr

Today, I went to the beach front with my kids.

I found a sea shell and gave it to my 4 year old daughter and said “You can hear the ocean if you put this to your ear.”

She placed the shell to her ear and screamed. There was a hermit crab inside and it pinched her ear.

She never wants to go back! LoL I know this is totally off topic but I had to tell someone!

payday cash

money advance

auto loans

no credit check payday loans

top payday loans

payday loans direct lender

can you buy viagra in australia

loans online no credit check

brand viagra online

mexican pharmacy

cash loans

SAÇ DÖKÜLMESİNE KARŞI GÜÇLÜ VE ETKİN BAKIM

Saç dökülmesi ile mücadele bazen zorlu bir maratona dönüşebilir.

Bu maratona HC Doping ile bir adım önde başlayın…

Bitiş çizgisine geldiğinizde saçlarınızdaki değişimi ve

ne kadar güçlendiğini hissedeceksiniz…

Üstelik hergün sadece 2 dakikanızı ayırarak.

HC Doping’in procapil, follicusan, bitki özleri ve vitaminler içeren formülü,

saçlarına ihtiyaç duyduğu desteği kazandırmak isteyen her

yaş aralığındaki kadın ve erkek için uygundur.

HC Doping’in formülünde, saçlarınızın ihtiyacı olan doğadaki yararlı bileşenler mevcuttur.

Ayrıca bir başka ürün kullanmanızı gerektirmeyecek

ölçüde zengin içeriği, saçınız için uygun oranlarda formülize edilmiştir.

Birçok saç bakım ürünün aksine HC Doping oldukça kolay bir kullanıma sahiptir.

Saçta kalıntı veya kötü koku bırakmaz. Uyguladıktan sonra durulamaya veya yıkamaya gerek yoktur.

Saç Bakım

installment loan companies

viagra price in india online

personal loan interest rates

loan identifier

cash advance loans online

loans fast cash

tretinoin 0.5 cream buy online

secured loan

loans bad credit

cash in one hour

[url=https://instcashadvance.com/]direct lenders of loans[/url]

payday loan online

how to get quick money

personal loans for people with bad credit

loan apply

sildenafil pharmacy online

no faxing payday loan

2000 loans

viagra super active plus

It is actually a nice and helpful piece of info. I’m satisfied that you shared this helpful

info with us. Please stay us informed like this. Thanks for sharing.

best online loans

bad credit loan

low income payday loans

va home loans

best viagra online australia

loans for poor credit

propecia tablets for sale

sildenafil soft tabs

loans without credit check

online payday cash advance

clomid pills

sildenafil citrate 100mg tab

tretinoin cream 0.05

tadalafil 20 mg buy online

where to buy fildena 100

generic viagra medication

loans guaranteed approval online

buying viagra in australia over the counter

global pharmacy

tadalafil cost in india

HC Vitamin-C Serum, özel olarak geliştirilmiş yüksek stabilite özelliğine

sahip Lipozomal Vitamin-C kompleksi ve en ileri düzeyde konsantre

edilmiş saf Hyaluronik Asit ile formülize edilen yoğun bakım serumudur.

Liposomal C Vitamini Serumu , Saf Hyalüronik Asit, Yeniden Diriliş Bitkisi (Glyceryl

Glucoside), Pentavitin (Saccharide Isomerate) ve Anadenanthera Colubrina Bark

Extract içeren formülü ile ciltte oluşabilecek lekeleri

minimuma indirmeye ve kırışıklıkları önlemeye yardımcı olur.

Çevresel faktörlere karşı etkili korumayı destekler.

Yoğun nemlendirici ve tazeleyici özelliği sayesinde cildin sıkılığını arttırır ve aydınlanmasını destekler.

Ciltteki ton eşitsizliklerine karşı mücadele eder.

Kozmetik piyasasında bulunan C vitamini serumu bir çoğunda Askorbik Asit’in stabil

olmayan %15’lük formu kullanılmaktadır. Bu ürünler stabil olmadıklarından zamanla okside olur, rengi koyulaşır ve doğal olarak da

zamanla etkinliğini kaybeder.

HC Vitamin-C Serum içerisinde stabil formda ve lipozomal kapsül şeklinde %3′ lük Etil Askorbik Asit kullanılmıştır.

Lipozomal taşıyıcı sistemler, hedef noktaya aktif maddeyi taşımak için geliştirilen üst düzey teknolojidir.

Ürün içindeki aktif madde (C VİTAMİNİ) cilt altına indikten sonra çözülür ve daha kısa sürede maksimum etki gösterir.

Bu sayede hem uzun raf ömrü boyunca stabilitesini kaybetmeden etkisini sürdürür,

hem de etkisi diğer formlara göre çok daha başarılıdır.

c vitamini serumu

canadian pharmacy viagra 150 mg

levitra 20mg coupon

stromectol tablets

loan for bad credit

no teletrack payday loans

how to buy genuine viagra online

cash payday loans

cialis australia prices

bad credit catalogues

generic cialis 10

san antonio payday loans

purchase cialis online from canada

personal loans unsecured

cash loans

generic cialis 40mg

tadalafil cheap online

40 mg tadalafil

starter loan

emergency loans

tadalafil generic mexico

hydroxychloroquine sulfate tablet

loans instant approval

small loan no credit

online loans

sildenafil 50mg price australia

secured loan

diflucan 200 mg

cialis 4 sale

stromectol tab price

İnstagram Takipçi Satın Alınabilir Kaliteli Site!

İnstagram hesaplarınızın aktif ve yükselen bir takipçi grubuna haiz olması için son yıllarda takipçi satın alma işlemi yapılıyor.

Bu işlem sayesinde takipçi rakamlarınızın artması olası oluyor.

Hesabınızın tercih edilme olasılığını arttırmak için instagram takipçi satın almak en kolay yol

olduğunu hepimiz biliyoruz.

aktif bir hesap sahibi olmak için bu kolay seçeneklerden yararlanabilirsiniz.

Hesaplarınızla ses getirmek istiyor ve size özel bir hesap özelliği kazandırmak

için instagram takipçi satın almak ve beğeni sayılarına da özen işaret etmek örutubet taşır.

Takipçi satın alma ve gönderme hizmetleri arasında şifresiz takipçi alma işlemi de bulunuyor.

İnstagram takipçi satma sayfaları genellikle otomasyon sistemine dayalı bir halde çalışır.

Tek yapmanız gereken sitemize giderek size uygun paketi seçmek olacaktır…

Başlatmış olduğunuzda takipçileriniz hesaba gelmeye başlar.

bu şekilde takipçileriniz yavaş yavaş profilinizde görünmeye adım atar.

Siz de hizmetimizden memnun kalmış olduğunız için daha da güvenle yapabilirsiniz.

Bu da en hızlı şekilde takipçi satışı gerçekleştiren platform olduğumuzu destekler.

instagram takipçi satın al

cost of sildenafil in india

tadalafil 20mg otc

sildenafil cost india

best viagra coupon

otc viagra canada

generic female viagra online

Everything is very open with a very clear description of the challenges.

It was definitely informative. Your site is very useful.

Thanks for sharing!

canadian pharmacy mall

cialis 75 mg

viagra for sale online

personal loan application

bad credit loans

where to buy cheap viagra in usa

faxless payday loans

Sosyal medya günümüzde oldukça önemli bir yere

sahiptir. Bu neden ile pek çok kişinin bu ağlarda hesabı vardır ve aktif kullanıcılardır.

Hayatları, giydikleri ve yediklerini paylaşıp eğlence amaçlı bu platformda

olan kişilerin yanı sıra bu platformları kazanç olarak

değerlendirenler de fazla olur. Instagram üzerinden pek çok firma

satışlarını artırmayı düşünürken bireysel hesaplar için de fenomen olma arzusu vardır.

Sizde satışlarınızı arttırmak için instagramtakipz.com dan dilediğiniz

kadar instagram Takipçi Satın Al

payday loans phoenix az

viagra online order india

low interest loans

mypharmacy

Takipçi Alarak Fenomen yada İş hayatınızı büyütebilirsiniz

Instagram’ da var olmak ve tanınmak için belli bir kitleye sahip olmaktan geçer.

Bu kitleye sahip olmanın yolu öncelikle doğal şekilde ilerlemek olur.

Kaliteli fotoğraf paylaşımı yanı sıra hesabın güncel tutulması ve hashtag kullanımı doğal şekilde büyümeyi sağlar ayrıca Instagram takipçi satın hizmeti ile de hesap, geniş

kitlelerce tanınmaya başlar.

Takipçi satın alma işlemi kısa olduğu kadar güvenilir bir yöntem olup hesabı, hedef

kitleye ulaştırır. Hesapta paylaşılan gönderiler bu sayede Instagram keşfet’e de

düşer. Bu alanda görülen her hesap, daha fazla takipçi elde etme imkânı bulur.

Takipçi Satın Al

payday installment

buy sildenafil

cialis 2.5 mg price india

viagra 5343

cost of generic sildenafil

order sildenafil tablets

generic viagra 50mg online

prices pharmacy

best mail order pharmacy canada

online loans no credit check instant approval

order viagra

bad credit payday

tadalafil 100mg tablets

300 loan

debt consolidation

order tadalafil online

tadalafil 100

india pharmacy viagra

sildenafil buy over the counter

cialis online india

money lenders california

rx pharmacy

tribal loans online

sildenafil tablets 100mg uk

cialis 100mg pills

generic cialis 20mg

pay day cash advance

australia viagra prescription

Instagram Takipçi Satın Almanızın İşleminin Hesaba Etkisi

Takipçi almak, Instagram üzerinde popülerliği yakalamak isteyen hesapların kullandığı bir yöntemdir.

Son zamanların gözde sosyal medya platformlarından olan Instagram,

her geçen kendini yenileyip güncellemesi ile kullanıcı sayısını milyonlara ulaştırmıştır.

Fotoğraf ve video paylaşma platformu olan zaman içinde firmaların e-ticaret alanına dönüşmüş

ve insanlara ek gelir kapışı olmuştur.

Instagram Takipçi Satın Almanın Profiliniz için Önemi

Popülerlik ya da ek gelir isteyen kişiler için önemli hale gelen uygulamada bu başarıyı yakalamanın yolu takipçi sayısına bağlı olur.

Intagram’ da yüksek takipçi sayısına sahip olmak ile pek çok insanın dikkatini çekmek daha

kolay olur.

Instagram’ da doğal yollar ile takipçi elde etmek diğer sosyal medya uygulamalarına göre daha zor olması

nedeni ile Instagram takipçi satın al işlemine başvurulur.

Bu işlem, hesabın daha öne çıkmasını sağladığı

gibi daha fazla etkileşim almasına da yarar.

Etkileşim alan bir hesap da Instagram keşfet alanına çıkar böylelikle daha çok takipçi hesabı takip etmeye

başlar.

https://rebrand.ly/takipz

10 mg cialis cost

viagra soft pills

can you buy cialis over the counter in australia

cialis .com

plaquenil uk

loan signing

Bedava sirke baldan tatlıdır diyerek sizlere

günlük 200 takipçi kazanabileceğiniz free kazanma şansı ile takipçi hileleri

kazanmanın yolunu tarif ediyoruz

hemen bedavaya takipçi beğeni hilesi yapabilmek için sizleri sitemize

bekliyoruz

https://rebrand.ly/takipcibegenihilesi

generic cialis 20 mg price

viagra generic in mexico

order cheapest sildenafil

order viagra canadian pharmacy

no credit check payday loans online

best loans for bad credit

cheap cialis 100mg

best generic viagra brand

[url=https://sildenafiltadalafilpills.com/]viagra tablet 100mg price[/url]

[url=http://cialisutab.com/]cialis 10mg tablets[/url]

onlinecanadianpharmacy 24

buy generic cialis with paypal

tadalafil 20mg online

top 10 online pharmacy in india

online viagra order india

foreign pharmacy online

lisinopril 20 mg no prescription

cash until payday

stromectol 12mg online

buy viagra online cheap usa

viagra for sale on line

hydroxychloroquine sulfate tab 200 mg

viagra 100 mg generic

cialis online usa

where to buy cialis online in canada

generic viagra over the counter usa

price gabapentin 600 mg

how safe is viagra

top online pharmacy india

cialis 20mg cost canada

tadalafil over the counter

direct payday lenders for bad credit

vardenafil price canada

Instagram’ da var olmak ve tanınmak için belli bir kitleye sahip

olmaktan geçer. Bu kitleye sahip olmanın yolu öncelikle

doğal şekilde ilerlemek olur. Kaliteli fotoğraf paylaşımı yanı sıra hesabın güncel tutulması ve hashtag kullanımı doğal şekilde büyümeyi

sağlar ayrıca Instagram takipçi satın hizmeti

ile de hesap, geniş kitlelerce tanınmaya başlar.

Takipçi satın alma işlemi kısa olduğu kadar güvenilir

bir yöntem olup hesabı, hedef kitleye ulaştırır. Hesapta paylaşılan gönderiler bu sayede Instagram keşfet’e de düşer.

Bu alanda görülen her hesap, daha fazla takipçi

elde etme imkânı bulur.

https://mmo.tc/OVAK

cost of stromectol

cialis without prescription canada

sildenafil online canadian pharmacy

modafinil for sale online

cialis 100mg uk

legal generic viagra

where to buy viagra in mexico

can i buy viagra over the counter in australia

plaquenil osteoarthritis

cheap viagra for sale online

payday loan direct

buy cialis online without a prescription

cost of stromectol

cyalis

pharmacy online tadalafil

cialis one a day

viagra best buy

the best online payday loans

cialis daily cost canada

where can i buy modafinil uk

tadalafil generic mexico

viagra price online

viagra pills online canada

20 mg generic sildenafil

no fee payday loans

loans help

cialis 60mg online

sildenafil 25 mg buy

cialis canada no prescription

valtrex pills where to buy

generic levitra coupon

cialis 5 mg tablets cost

how much is tadalafil cost

legitimate payday loan companies

415 viagra 4

payday loans no credit check

cialis buy in canada

2 sildenafil

brand cialis price

online pharmacy viagra

gabapentin cap 400mg

fluoxetine 37.5

cheap viagra 25

price for sildenafil 100 mg

loans with no credit

100g viagra

sildenafil 100 mg

generic viagra sildenafil

can i buy viagra over the counter in canada

buy cialis canada

valtrex cheapest price

cialis 100 mg

cealis

viagra cream online

canadian pharmacy online prescription tadalafil

canadian pharmacy tadalafil 5mg

where to buy tadalafil 7.5mg

payday loans denver

tadalafil online no prescription

diflucan tablets over the counter

where can you buy viagra uk

discount online viagra

buy modafinil usa

canada discount pharmacy

can you buy cialis over the counter in usa

fast loans no credit check

easy payday loan

buy tadalafil generic

sildenafil canada generic

no prescription cheap viagra

plaquenil 500

viagra online rx

buy provigil uk

cheap cialis generic

overseas pharmacy no prescription

how to get cialis in australia

tadalafil generic uk

generic chewable cialis

direct lender loan

find loan

loan service

cialis canada fast shipping

quick cash loans online

can i buy tadalafil in mexico

how much is sildenafil in canada

where to order viagra online in canada

price viagra generic

modafinil online europe

where to get viagra without prescription

online viagra prescription usa

how much is a cialis prescription

tadalafil generic otc

can you buy real viagra online

cialis 50 mg online

where to get cialis prescription

viagra gel price

medication gabapentin 300 mg capsule

generic cialis 10

price of cialis per pill

ivermectin eye drops

20 mg sildenafil cost

gold pharmacy online

compare cialis

paypal cialis canada

[url=http://brandivermectin.com/]ivermectin 6mg dosage[/url]

[url=https://cialisohot.com/]average price of cialis[/url] [url=https://zbcialis.com/]price generic cialis[/url] [url=https://valcialis.com/]generic cialis pills[/url] [url=https://cialiselilly.com/]36 hour cialis[/url] [url=https://edkamagra.com/]kamagra oral jelly next day delivery uk[/url] [url=https://viagrafour.com/]viagra generic cost[/url] [url=https://viagraunf.com/]viagra 50 mg tablet price[/url] [url=https://cialisdist.com/]generic tadalafil mexico[/url]

payday loan vancouver

generic sildenafil 20 mg

sildenafil soft tablets

australia cialis

furosemide drug brand name

modafinil price

mail order cialis

sildenafil rx

motilium medication

modafinil online mexico

best tadalafil

viagra online no script

generic cialis tadalafil 20mg

generic plaquenil coupon

where can i buy metformin over the counter uk

viagra pharmacy cost

viagra 50 mg

sky pharmacy

australia modafinil

tadalafil 5mg coupon

sildenafil online purchase

viagra original

buy viagra sale

cialis cost per pill

stromectol tablets

viagra tablets online in india

cialis generic levitra viagra

cialis generic online india

generic cialis tablets

loans lenders

п»їcialis

buy viagra online no prescription

modafinil 200 mg price india

pharmacy mall

cialis 2.5 mg tablet

where to get cialis in canada

payday loans utah

prozac 90 mg

monthly installment

can you buy motilium over the counter

ventolin cap

ivermectin

legitimate online pharmacy usa

cialis prescription cost uk

levitra price in singapore

sildenafil 100mg buy online us

buy viagra 100mg

order cialis by phone

price viagra in india

buying from canadian pharmacies

can you buy sildenafil over the counter

otc female viagra pill

discount viagra for sale

sildenafil price 50 mg

cialis price south africa

current loan rates

ciallis

generic plaquenil price

generic viagra canada price

can i buy viagra online in usa

online cialis professional

loans online instant approval

cialis gel online

metformin 10 mg

buy cialis daily use online

buy lasix water pill

For latest information you have to pay a visit web and on web I

found this site as a finest site for most up-to-date updates.

kamagra oral jelly in delhi

where can i buy fluoxetine online

Aw, this was an incredibly nice post. Taking the time and

actual effort to create a really good article… but what can I say… I put things off a lot and don’t seem to get anything done.

sildenafil generic usa

metformin 500 mg pill

viagra 1000mg price

legit online payday loans

where to get viagra

cialis online canada pharmacy

If you would like to grow your experience just keep visiting this site

and be updated with the latest information posted here.

payday loans no credit check

over the counter cialis

levitra billig

female viagra price

tadalafil 2.5 mg online india

ivermectin 3mg

cialis 5 mg tablet

where can you buy cialis over the counter

cheapest price for tadalafil

cialis levitra

tadalafil uk prescription

canadianpharmacyworld com

viagra for sale online australia

viagra otc canada

indian cialis

save on pharmacy

pharmacy rx world canada

kamagra oral jelly 5mg usa

cheap cialis canada online

viagra cheap online

rx pharmacy no prescription

loan options

allopurinol 300 mg cost

tadalafil price

where to get cialis prescription

buy viagra online in australia

plaquenil osteoarthritis

canadian pharmacies not requiring prescription

buy viagra online nz

online pharmacy cialis

short term loan lenders

It’s an amazing piece of writing in favor of all the

online people; they will get benefit from it I am sure.

I think this is a real great article post.Thanks Again. Really Cool. https://follower-band.com/buy-iranian-followers/ ssalpha

ivermectin eye drops

where can i buy cialis tablets

viagra pills order online

buy liquid ivermectin

viagra online purchase

generic cialis online best price

purchase viagra online in usa

payday loans instant approval

super viagra

Its like you learn my mind! You appear to grasp a lot

approximately this, such as you wrote the book in it or something.

I believe that you can do with some % to pressure the message

home a little bit, but other than that, this

is fantastic blog. A great read. I’ll certainly be back.

bad credit installment loan

cialis no prescription canada

discount cialis pills

viagra online discount

buy viagra canada fast shipping

payday cash

valsartan hydrochlorothiazide

online pharmacy 365 pills

gabapentin generic brand

buy cialis online no prescription usa

where to buy viagra online australia

best loans

[url=https://lisinoprilpills.com/]lisinopril generic price[/url] [url=https://hydrochlorothiazideonline.com/]buying hydrochlorothiazide[/url] [url=https://cialisxrx.com/]where can i get cialis pills[/url]

tadalafil 20mg pills

cost daily cialis

best price viagra 50 mg

cheap levitra pills uk

buy tadalafil paypal

cialis for daily use for sale

cialis tablets online

60 mg generic cialis

levitra 500mg

female viagra pill for sale

best debt consolidation loans

buy sildenafil 100mg online in usa

[url=https://gnrcialis.com/]buy generic cialis cheap[/url]

[url=https://kamagraedtab.com/]super kamagra oral jelly[/url] [url=https://xtviagra.com/]can you buy viagra over the counter australia[/url] [url=https://dscialis.com/]cost for generic cialis[/url] [url=https://bactrimds.com/]bactrim 500 mg[/url] [url=https://cialisgenericpills.com/]canadian pharmacy online cialis[/url]

cheap generic viagra online canada

best buy cialis online

30 day loan

Thanx for aetq3

viagra buy online

real viagra no prescription

gabapentin price

viagra online price comparison

online payday lenders

online pharmacies that use paypal

ivermectin india

where can i buy sildenafil over the counter

loan service

low price cialis

buy cialis europe

buy brand name viagra online

order antabuse over the counter

online pharmacy price checker

personal loan for bad credit

viagra tablet cost

buy generic cialis online usa

online cash advance no credit check

30 mg sildenafil buy online

[url=http://wmdrugstore.com/]bitcoin pharmacy online[/url] [url=http://hydrochlorothiazideonline.com/]hctz hydrochlorothiazide[/url] [url=http://maletadalafil.com/]5mg cialis online canada[/url] [url=http://cialisxrx.com/]paypal cialis[/url] [url=http://lasixmed.com/]lasix 3170[/url] [url=http://cialisldi.com/]cialis brand name buy online[/url]

[url=http://arpviagra.com/]viagra 6[/url]

viagra 150 mg price

viagra india cheap

order levitra

viagra professional canada

sildenafil citrate generic viagra

buy cialis australia

chewing cialis

how to viagra tablet

generic viagra from canada online

real cialis for sale

prices of cialis daily use

online pharmacy prescription

how to get viagra pills

sildenafil 100mg price

buy genuine cialis

get payday loan

online pharmacy australia

prednisone without prescription.net

buy viagra cheap online

canada cialis no prescription

generic viagra cipla

payday loans online instant approval

viagra 150mg

no income verification loans

cialis lowest price

tadalafil for sale uk

cialis online with paypal

where to buy generic cialis safely

viagra online south africa

buy accutane

order viagra australia

loans without checking account

how to buy accutane

After I originally commented I appear to have clicked on the -Notify me

when new comments are added- checkbox and from now on each time a comment is

added I recieve 4 emails with the exact same comment.

Is there a way you are able to remove me from that service?

Thanks!

kamagra oral jelly in bangalore

cheapest pharmacy

5000 personal loan

brand cialis online pharmacy

cash advance today

antabuse-the no drinking drug

how to buy viagra in mexico

can i buy cialis over the counter

where to buy cialis uk

prices for viagra prescription

presnidone without a prescription

buy cialis 20mg australia

bactrim ds tablets online

non prescription viagra

prednisone 5 mg tablets

sildenafil 60mg

viegra

viagra for women 2013

sildenafil online canada

cialis daily 5mg online

cost of cialis 5 mg in canada

purchase real cialis online

cheapest price for cialis 5mg

Your style is really unique compared to other people I’ve read stuff from.

Thanks for posting when you have the opportunity, Guess I will just bookmark this

blog.

how can i get a loan with bad credit

advair diskus generic

[url=https://ivermectinstrm.com/]buy stromectol online[/url] [url=https://genericviagranow.com/]sildenafil 25[/url] [url=https://vardenafilsale.com/]no prescription vardenafil[/url] [url=https://axviagra.com/]otc viagra[/url] [url=https://xtcialis.com/]best price for cialis 10mg[/url]

online cialis prescription

buy viagra online south africa

a person who supports and admires a particular person or set of ideas.

payday direct

cheap xenical pills

rx cialis online

buy brand viagra

bad credit loans not payday loans

buy viagra online without rx

Hi there, I found your website via Google whilst looking for a comparable matter, your website got here up, it appears to be

like great. I have bookmarked it in my google bookmarks.

Hello there, just was aware of your blog thru Google, and located that

it’s really informative. I am gonna watch out for brussels.

I’ll be grateful if you happen to proceed this in future.

Many folks shall be benefited from your writing. Cheers!

title loan

brand cialis 5 mg

خرید فالوور

viagra tablets for sale uk

us pharmacy viagra online

viagra sublingual

tadalafil dosage 40 mg

tadalafil rx

generic cialis 20mg

can you buy cialis otc in canada

canadian pharmacy cialis paypal

candida diflucan

viagra 25mg for sale

cheap viagra 25mg

what is debt consolidation

stromectol nz

modafinil 1000mg

payday loans lenders only

cash online

tadalafil tablets 20 mg india

payday loans online no credit

generic cialis daily use

cialis daily use 5 mg

viagra tablets online australia

can you buy cialis online in canada

otc cialis canada

price of generic seroquel

tadalafil online purchase

can i order viagra

generic cialis 60 mg india

where can i buy generic viagra online

sildenafil pills uk

generic cialis 2018 canada

seroquel tablets 200mg

where can i order viagra

cialis

viagra 150 mg pills

modafinil 100mg cost

payday loans with bad credit

can i purchase viagra

cialis singapore pharmacy

viagra-50mg

best price on cialis

viagra prescription nz

ivermectin virus

viagra 100mg buy online

[url=https://askcialis.com/]cialis brand name[/url] [url=https://vardenafilsale.com/]vardenafil online[/url] [url=https://diflucantab.com/]diflucan 150 mg medication[/url] [url=https://sildenafilext.com/]sildenafil best price uk[/url] [url=https://drtadalafil.com/]otc cialis usa[/url] [url=https://cialisvx.com/]cheapest cialis online[/url] [url=https://tadalafilxs.com/]where to buy real cialis online[/url] [url=https://tadacippill.com/]tadacip 20 mg price[/url]

cash today

viagra buy uk online

buy brand viagra canada

ivermectin cost canada

canadian pharmacy tadacip

online rx viagra

loan help

seroquel generic price

strattera 25 mg pills

viagra capsule online

buy brand cialis

cialis best price australia

ivermectin topical

buy tadalafil 20

sildenafil uk paypal

online pharmacy ed

canadian viagra no prescription

canadian discount pharmacy

buy cialis europe

cost of ivermectin

best place to purchase cialis

cialis 20mg cost canada

online med pharmacy

pharmacy viagra generic

viagra for sale fast shipping

15mg cialis

viagra 25

cialis buy no prescription

viagra paypal canada

advair mexico pharmacy

low cost viagra

where to get sildenafil

cheapest viagra online

viagra sildenafil citrate

female viagra medication

sildenafil medicine

buy cialis online australia paypal

brand cialis canadian pharmacy

brand cialis online

tadalafil tablets 2.5 mg

discount cialis 20mg

cialis daily online

debt consolidation advice

daily generic cialis

cialis daily pill

over the counter viagra 2017

can i buy cialis over the counter in australia

loans for women

generic viagra 50

tadalafil price online

viagra pills uk

sildenafil 20 mg online

sildenafil tablets 150mg

where can you buy viagra cheap

on line viagra

payday advance loans

online money

ciallis

cialis 50 mg online

order modafinil online canada

average price of cialis 20mg

viagra 100 mg for sale

purchase viagra canada

buy viagra pills online india

cialis 20mg tablets prices

best canadian pharmacy to order from

cheap cialis professional

buy generic sildenafil

viagra cost in mexico

cialis 5mg daily price

sildenafil rx

sildenafil citrate 100mg tab

3 viagra pills

cialis 1000 mg

ivermectin 20 mg

cialis for daily use canadian pharmacy

combivent respimat

viagra online with prescription

XEvil – the best captcha solver tool with unlimited number of solutions, without thread number limits and highest precision!

XEvil 5.0 support more than 12.000 types of image-captcha, included ReCaptcha, Google captcha, Yandex captcha, Microsoft captcha, Steam captcha, SolveMedia, ReCaptcha-2 and (YES!!!) ReCaptcha-3 too.

1.) Flexibly: you can adjust logic for unstandard captchas

2.) Easy: just start XEvil, press 1 button – and it’s will automatically accept captchas from your application or script

3.) Fast: 0,01 seconds for simple captchas, about 20..40 seconds for ReCaptcha-2, and about 5…8 seconds for ReCaptcha-3

You can use XEvil with any SEO/SMM software, any parser of password-checker, any analytics application, or any custom script:

XEvil support most of well-known anti-captcha services API: 2Captcha, RuCaptcha, AntiGate.com (Anti-Captcha.com), DeathByCaptcha, etc.

Interested? Just search in Google “XEvil” for more info

You read this – then it works! 😉

Regards, LolitaHoupt6414

buy prednisone online nz

sildenafil citrate generic viagra

2 viagra pills

instant personal loans

where can you buy viagra in australia

where to get a loan with bad credit

where to get generic viagra online

cheap viagra from canada

generic cialis drugs

viagra pharmacy over the counter

prescription for cialis

brand cialis singapore

modafinil fast shipping

stromectol tablets

buy sildenafil without a prescription

generic cialis no rx

online pharmacy meds

levitra 10mg canada

buy cialis over the counter usa

doxycycline 200mg price

buy kamagra tablets

online quick loans

cialis brand 20mg

kamagra mexico

cialis 5mg in india

Only good sex games for free https://www.myadultonlinegames.com/category/premium-adult-games in best quality

best price for cialis

generic viagra in usa

loans with low interest

modafinil generic

kamagra buy australia

albuterol canada cheap rx

My relatives always say that I am wasting my time here at net, but I know I am getting familiarity all the time by reading thes nice posts.

Здравствуйте дамы и господа

Where is admin?

I’ts important.

Regards.

купить плиткорез зубр

stromectol tablets 3 mg

affordable pharmacy

canada cialis

buy tadalafil 20mg online

Привет господа

Where is moderator??

I’ts important.

Thank.

плиткорез patriot

ivermectin 1 topical cream

provigil 300 mg

Duorup – erectile dysfunction symptoms Riufbl

Custom university creative writing advice .

Proceed to Order!!! http://forum.googlecrowdsource.com/member.php?action=profile&uid=65498

UYhjhgTDkJHVy

buy generic provigil online

cialis drugstore

first american loans

cheap cialis soft

can i order furosemide without a prescription

ivermectin

sildenafil online buy india

cialis 20mg price in india online

sildenafil rx drugstore online

ivermectin lotion

buy lasix over the counter

brand viagra online

where to buy cheap cialis pills online

What do you think about this material? https://emag220.ru/

I think it is best!!!

https://geni.us/qX4pKE natural leather knapsack for women

generic prednisone cost

ivermectin over the counter

Medication information leaflet. Generic Name.

can i get cheap erythromycin in USA

Best what you want to know about drug. Read here.

payday cash

buy albuterol no prescription

which cialis is best medicament tadalafil cialis generyczny najtaniej

modafinil tablets for sale

20 mg cialis daily

Новости:

Лидерами экспресс-кредитования в последние годы были три крупных банка: «Русский стандарт», Хоум Кредит энд Финанс Банк, «Ренессанс Кредит»….

Искали срочно получить займ на карту до 2000? Тебе на сайт и попробуй получить stbcard.ru и получи микрозайм до 3000 рублей 100% процентов без проверки КИ без отказа в городе Уфа.

Срочно нужны наличные?

Hаличные сразу

Проверок кредитной историии нет. 97% одобрений.

Новости:

Страна расплачивается за ипотечный бум: свыше трех тысяч россиян, взваливших на себя ипотеку, потеряли жилье по решению суда. Антирекорд поставили в Алтае: здесь «на выход» людей попросили оптом. Закон разрешает выселять в «никуда» — даже с детьми….

order viagra canadian pharmacy

buy cheap viagra online from india

Hi! I’m Alice from Russia. I am looking for a sponsor. I want to find a grown man. Come to my profile: http://datingforkings.club/ I am 18 years old. I `m A virgin.

generic cialis without a prescription

amoxil 250 mg

where can i buy sildenafil tablets

stromectol brand

viagra coupon online

Hello,

Download Music Scene Releases: https://0daymusic.org

Server’s capacity 186 TB Music

Support for FTP, FTPS, SFTP, HTTP, HTTPS.

Best regards, Jimmy

prednisone price australia

canadian pharmacy viagra pills

Hi there are using WordPress for your site platform? I’m new to the blog world but

I’m trying to get started and set up my own. Do you require any html coding expertise to make your own blog?

Any help would be greatly appreciated!

sildenafil 50mg without prescription

Здравствуйте друзья

Where is administration?

It is important.

Regards.

плиткорез зубр 33191 40

Hello. And Bye.

7585482473)_*_&^%$%^&*(

Cover letter job advert .

Proceed to Order!!! http://b.u.yf.oot.bolk.a@demosite.center/dotclear/index.php?post/2015/06/26/Welcome-to-Dotclear%21&error=DIFFERENT_DOMAIN&back

UYhjhgTDkJHVy

cialis australia over the counter

sildenafil prescription prices

tadalafil 10 mg online

pharmacy shop

В Pinterest с 2012 г. Реклама в нем дает Заказчикам из Etsy, Shopify, amazon заработки от 7000 до 100 000 usd в месяц. http://1541.ru Ручная работа, Цена 300-1000 usd за месяц

loli*ta gi*rl fu*ck c*p pt*hc

https://xor.tw/4pgec

Regards, I enjoy it! how to write a good english essay writing a thesis statement thesis or thesis

low price cialis

cheapest cialis 20mg

viagra gel caps

How to write self reflection essay .

Order NOW!!! https://www79.zippyshare.com/v/ZJkRNYtj/file.html

UYhjhgTDkJHVy

cialis for sale over the counter

خرید فالوور اینستاگرام خرید فالوور اینستاگرام خرید فالوور اینستاگرام خرید فالوور اینستاگرام

tadalafil 20mg india

sildenafil price comparison uk

خرید فالوور ارزان خرید فالور ارزان خرید فالوور ارزان خرید فالوور ارزان خرید فالوور ارزان خرید فالوور ارزان

otc cialis pills

cheap amoxicillin

how to get a viagra prescription online

pharmacy websites