The year 2020 will forever be linked to a pandemic, a known global risk that most years manage to avoid. Such hazards sometimes lead to cascading risks traceable back to its root cause. Already, the virus has led to major disruptions of economies, massive unemployment, and reduced levels of international trade (particularly regarding medical supplies). What other risk exposures lurk as a result, and over what proximate time period?

The Spectrum of Risks

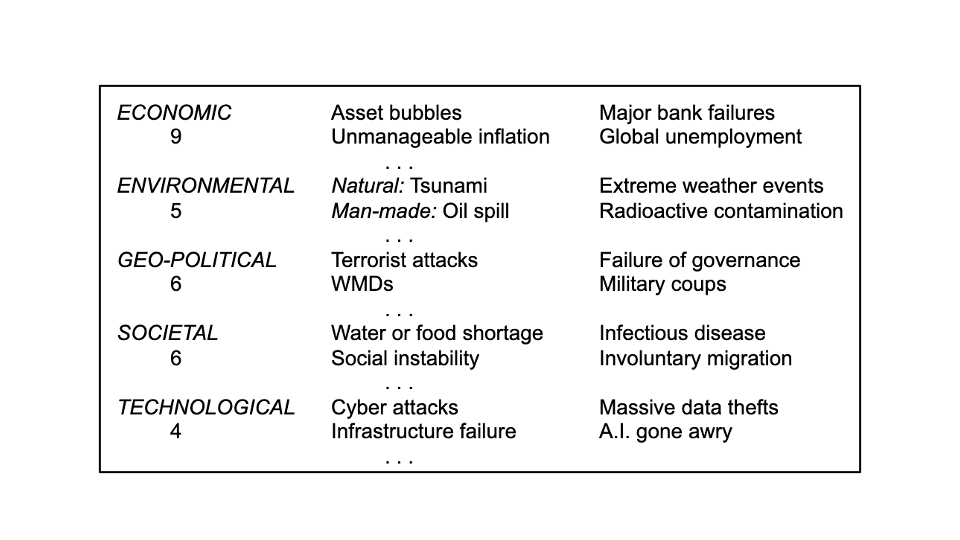

During September and October, 2019, the World Economic Forum (WEF) surveyed 1,047 of its stakeholders regarding global risks during the 2020s. First, the WEF identified 30 specific global risks, across five categories:

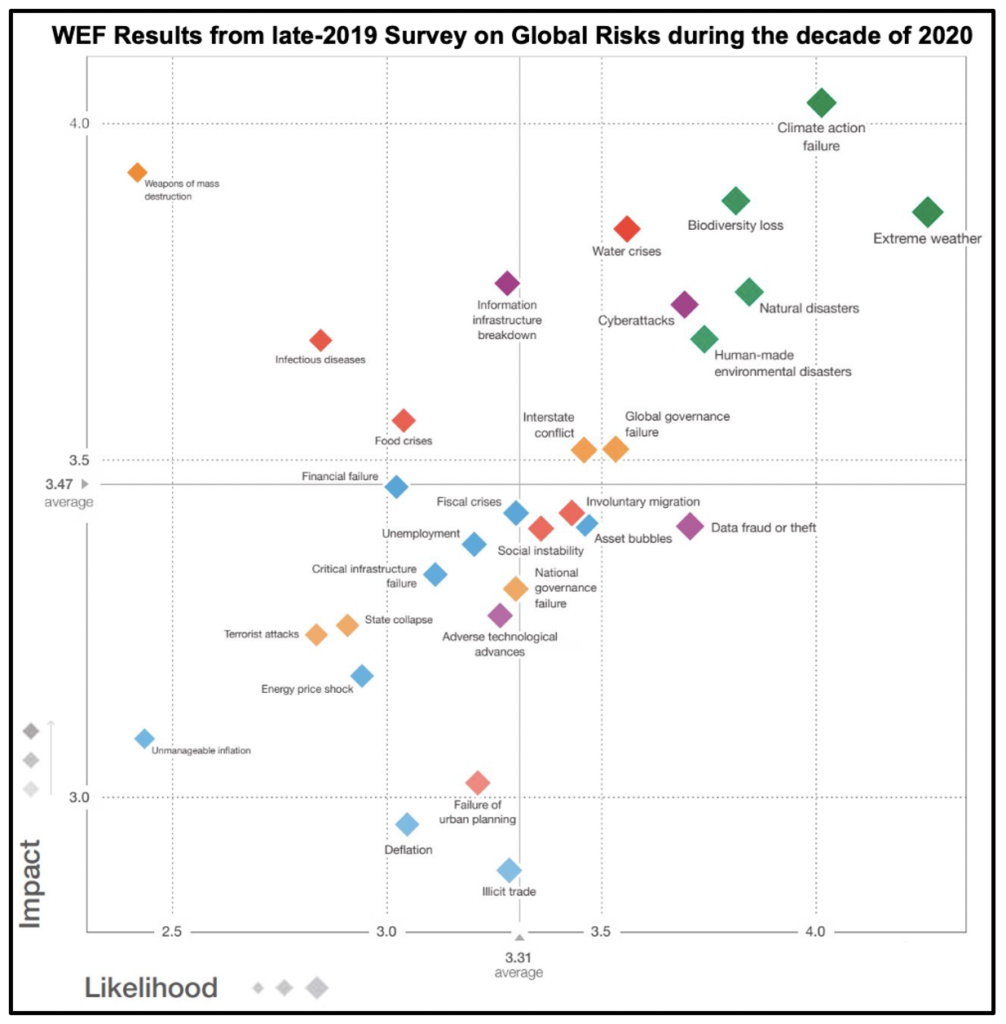

Respondents were asked to score each of the 30 risks over the next decade on a scale from 1 (“very unlikely”) to 5 (“very likely), separately in

terms of likelihood and impact. Average bivariate scores are plotted below.

The perceived global risk from infectious disease was deemed 8th-most impactful if it materialized, but 3rd-least likely in terms of perceived likelihood.

Next, respondents were asked the following question: “On a global level, do you think that in 2020 the risks presented by the following issues will increase or decrease compared to 2019?” Respondents were given the option to add perceived risks not already on the WEA list. Results were reported for 40 different risks, with the percentage responding in the affirmative ranging from 79% to 23% — but infectious disease did not make the list. This, despite global outbreaks of SARS, Swine Flu, ebola and MERS during the first two decades of the 21st century. Hindsight is easy.

Actions to Mitigate Risks

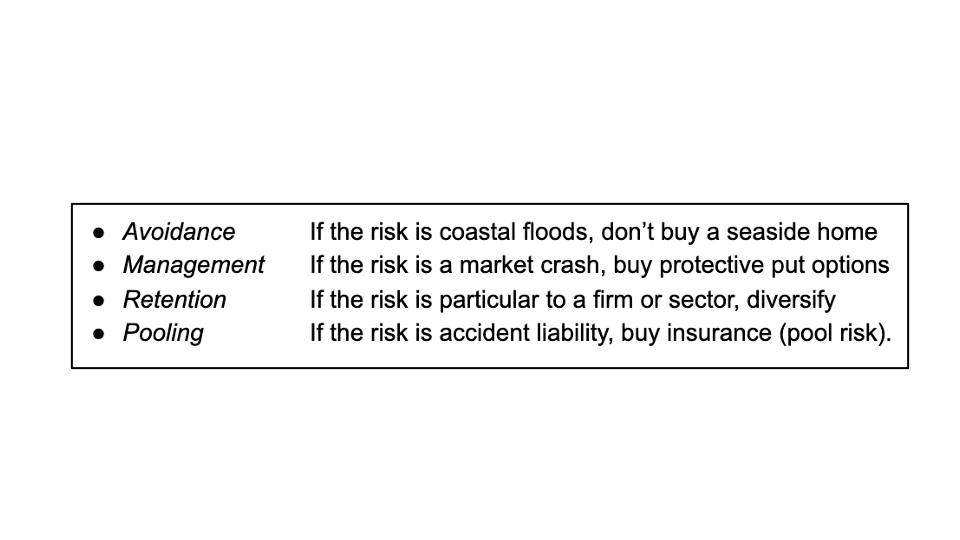

Risk management techniques abound. Many global organizations, such as the United Nations (U.N.) , the World Trade Organization (WHO), and the World Health Organization (WHO) exist primarily to identify and prevent or mitigate specific global risks. National, state and local governments do the same on a more limited scale, usually by targeting more localized risks. An international corporation is likely to have a risk management unit focused on anticipating and addressing business risk exposures, whether physical or financial. What risk mitigation strategies are available to deal with global risks at the individual level? There are four categories of tools:

There is no assurance that an appropriate strategy will be available to match any given risk exposure, and available does not assure recognizable.

Speculation Along the Spectrum

Even the dozens of global risks identified above represent but a fraction of the potential hazards we face, and they are the less consequential ones. There also are existential risks, which The Economist magazine recently defined as those that threaten “the destruction of humanity’s long-term potential”. Examples include the likes of asteroid impacts or volcanic super-eruptions. Immeasurably small odds, with immeasurably immense impact. As Gordon Woo notes: “One of the most insidious aspects of natural disasters is the protracted timescale … over which they occur. Collective memory … tends to fade into amnesia.” The list has only grown with the advancement of bio-weapons. Billions of humans are alive today, but perhaps trillions are yet to come — if only we can hold on to what we have.

The coronavirus has been devastating, and the worst may be yet to come, but it shows no signs of rising to an existential risk. Nonetheless, it has triggered other global risks and is likely to trigger more. Which? When?

Following are some candidates.

2020 Infectious Disease

Half a year after first learning of the novel coronavirus, the U.S. continues with disjointed and conflicting messaging. It remains uncertain if or when a vaccine will be available, and the virus is highly contagious and often lethal. A rational person, living alone with no work or family obligations, has an easy fix: If the risk is outside, stay inside. For everyone else, the choice is more nuanced, relying on some form of quasi-avoidance, such as social distancing.

2023 CLO-driven Banking Crisis

The “Great Recession” has become a distant memory to some, and its lessons perhaps not fully absorbed. Risky investments were the trigger that led to a global economic crisis. Sub-prime loans by banks were known to be risky investments. Collateralized Debt Obligations (CDOs) were created to mitigate these risks, relying on the financial concept of diversification. Lenders would slice their mortgages into tranches of risk classifications, bundle individual loans by tranch, and sell them into a shadow banking community of CDOs that were not subject to regulatory oversight. Bottom-tranches attracted institutional investors because they paid higher rates than Treasury bills but were considered nearly as safe, because housing markets were thought local and the pooling of similar-risk loans was thought to benefit from diversification. But increased interest rates and more sub-prime lending resulted in a cascading of defaults that crossed geographic boundaries and devoured the lower CDO tranches to threaten even a AAA-rated tranch. These “riskless investments” were a myth.

In the past decade we have witnessed a remarkable increase in corporate debt, fueled by relatively low interest rates, lax lending standards and leveraged buyouts. Enter Collateralized Loan Obligations (CLOs). They mimic CDOs, as shown on the left display. Will they soon mimic the right?

2026 Double-digit Inflation

During 2020 governments around the world have chosen to distribute massive amounts of funds to businesses and individuals to soften the economic impact of the pandemic. Many retail stores remain shuttered, and some of those will never reopen. The slump in demand has led to a curtailment of supply as production has been reduced. Presidential wishes notwithstanding, this situation seems unlikely to change much unless and until there is an effective vaccine, which may or may not matetialize. The reality of the deadly seriousness of this threat is settling in, as locales that reopened early are closing again and deaths continue to mount. Schools are making aggressive plans to reopen, often without consulting teachers who may well be unwilling to return to classrooms with their asymptomatic students. A day will come, however, when a “new normal” emerges that facilitates satisfying pent-up consumer demand. Unless supply is prepared to meet that demand, inflation will result. Coupled with massive government debt obligations, inflation easily could reach double-digits. The U.S. has not seen such levels of inflation in more than a generation, so expect a shock.

2029 An Anti-globalization Trigger

The Trade Openess Index is the sum of world imports and exports divided by world GDP. It rose to about 30% during the Industrial Revolution of the late 19th-century, fell to 10% during the period that spanned two “World Wars”, a pandemic and Depression-era move toward nationalism, and rose to 60% just prior to the “Great Recession” of 2008, fueled by post-WWII cooperation, the emergence of China, the decline of the Soviet Union, and technological advances in transportation and communication. The Index has declined during the past decade, as nationalist sentiments have materialized and led to Brexit, the U.S. withdrawal from trade deals,and trade tensions with China. During the first half of 2020, ninety countries have imposed restrictions on exporting medical supplies, a that sentiment is likely to spread to other sectors. By the end of the decade, global trade could return to pre-WWII levels and the Index could drop below 30 — or a couple years of such restrictions could help nations rediscover the many advantages of international cooperation and exchange. A new normal?

2032 Reconstruction of U.S. Social Security

By most measures, Social Security is the most successful social program ever created and run by the U.S. government. It indeed provides security as Americans contemplate life after work, but it comes at considerable cost. About $90 billion is distributed to recipients each month.and the cost is set to rise significantly due to a combination of longer life expectancy, a surge in “Baby Boomer” retirements, and further shrinkage of the tax-paying workforce as fertility and immigration rates drop and machines replace workers. While demand will rise, supply is set to shrink. About one-quarter of benefits are funded by a Trust Fund that is forecasted to be depleted in about a dercade, and the remaining three-quarters are funded by payroll taxes (which President Trump has proposed eliminating) and taxes on Social Security distributions. There are plausible and effective means of addressing the problem. Democrats tend to favor eliminating the cap on payroll taxes (currently on all income beyond $138,000, which would raise about $1.5 trillion annually), while Republicans tend to prefer raising the full retirement age (perhaps to age 70), likely with a rider to opt-out and convert promised future payments to a 401(k)-style account that transfers primary responsibility for a secure retirement from the government to the individual.

The Interconnectivity of Risks

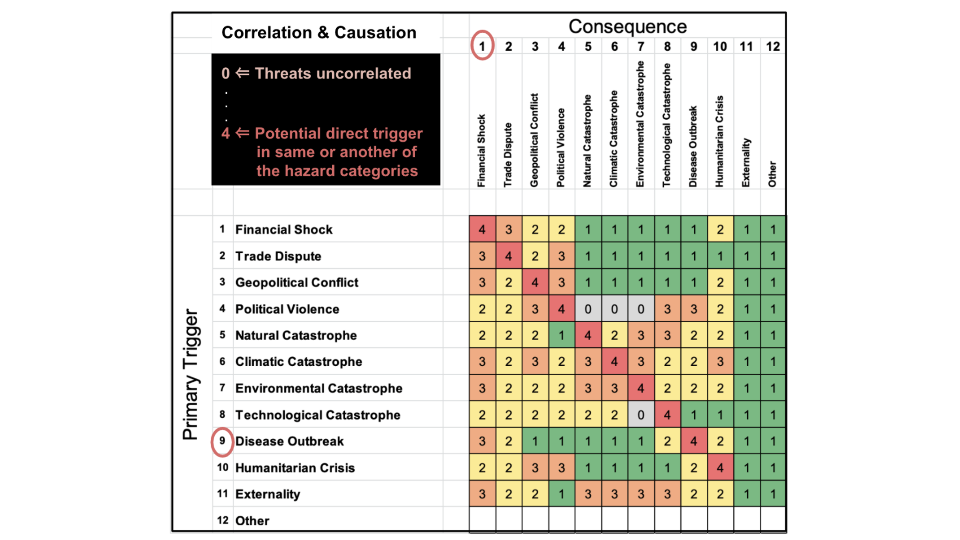

Discussion so far has considered risks in isolation, as if they are independent events. Experience suggests that many are correlated, and science suggests some bear causal relationships. While statistical associations can assist risk predictions, they also multiply the impacts.

The Cambridge Risk Framework offers a taxonomy of risks and states: “The worst catastrophies are combinations of events, where a primary catastrophe causes secondary effects by triggering another ‘follow-on’ catastrophe. The escalation of consequences can be worse than if they had happened separately.”

For example, on March 11, 2011 the “Great East Japan Earthquake” struck the coastline of Honshu, Japan with a magnitude of 9.1. That earthquake triggered a massive tsunami, with waves as high as the equivalent of a 12-story building, that flooded 200 acres of coastal land. That coastline also is the location of the Fukushima nuclear power plant. The earthquake cut off external power to the reactors, while the tsunami diabled backup generators. Limited power led to overheated fuel in the reactor cores, hydrogen explosions in three reactor buildings, and radiation releases that contaminated surrounding areas and resulted in the evacuation of about 500,000 residents. According to World Vision: “The direct economic loss from the earthquake, tsunami, and nuclear disaster is estimated at $360 billion … and caused overwhelming damage and humanitarian needs that required an international response.” So, one hazard triggered several other risk exposures in a cascading manner, including a significant uptick in cancer diagnoses throughout much of the region. I lived about 100 miles away at the time, with no known health issues, but twenty months later was diagnosed with Stage IV cancer (now in remission). Was that causation or correlation?

Your Conjectures Welcome

I’ve offered suggestions regarding how the current coronavirus pandemic might trigger compounding risks spread over the next dozen years. None of us know how the future actually will unfold, which for better and worse is one of the beauties of life, but you’re encouraged to share your thoughts

References

Briefings, “The world should think better about catastrophic and existential risks”, The Economist, June 25, 2020 edition. https://www.economist.com/briefing/2020/06/25/the-world-should-think-better-about-catastrophic-and-existential-risks (Downloaded July 1, 2020).

Coburn, A.W.;, Bowman, G.; Ruffle, S.J.; Foulser-Piggott, R.; Ralph, D.; Tuveson, M.; 2014, “A Taxonomy of Threats for Complex Risk Management” , Cambridge Risk Framework series; Centre for Risk Studies, University of Cambridge. https://www.jbs.cam.ac.uk/fileadmin/user_upload/research/centres/risk/downloads/crs-cambridge-taxonomy-threats-complex-risk-management.pdf

Woo, G., “Downward Counterfactual Search for Extreme Events”, Frontiers in Earth Science, 7:340, Dec. 2019. https://www.researchgate.net/publication/338046148_Downward_Counterfactual_Search_for_Extreme_Events (Downloaded July 3, 2020).

World Economic Forum, “The Global Risks Report 2020”, January 15, 2020. https://www.weforum.org/reports/the-global-risks-report-2020

World Vision, “2011 Japan earthquake and tsunami: Facts, FAQs, and how to help“, https://www.worldvision.org/disaster-relief-news-stories/2011-japan-earthquake-and-tsunami-facts (Accessed July 3, 2020).

— Jerry Platt, Ph.D., Emeritus Professor of Finance, San Francisco State U.

Comments 1,492

Your method of describing everything in this piece of writing is in fact good, every one

be able to without difficulty understand it,

Thanks a lot.

I’ll right away clutch your rss feed as I can’t find

your email subscription hyperlink or e-newsletter service.

Do you have any? Please allow me recognise so that I may just subscribe.

Thanks.

I am truly grateful to the owner of this web page who

has shared this great post at at this time.

Yepyeni bir sossyal medya aracı olan ve insanlarla

sohbet edebileceğiniz bir sosyal medya uygulaması. sadece daha önce kullandığınız uygulamalardan birazcık farklı.

Bu tatbik sohbet edebileceğiniz bir uygulamayken, ancak ses verileriyle yazışma

kurmanızı destekliyor. resim vb. benzer biçimde veriler yerine, sohbet odalarında

ses ile kontakt kurabiliyorsunuz. Artık clubhose takipçi

takip2018 de https://www.takip2018.com/ dan hemen clubhose

takipçi alabilirsiniz.

fast loans no credit check

sildenafil citrate over the counter

payday money

how to get cialis coupon

payday loan instant cash

bad credit online payday loans

installment loan calculator

sildenafil tablets online in india

0.1 tretinoin cream

loan instant decision

online payday loans no fax

Nice bro thank you.

paydayloans

cialis gel uk

Nice bro thank you.

where can i get a payday loan

loan direct

cialis generic cost

Nice bro thank you.

express loans

Nice bro thank you.

loan brokers

payday loans no faxing

where to buy cialis in singapore

online payday loan lenders

guaranteed loans

20 mg lisinopril tablets

instant payday loan

bad credit no money down

Nice bro thank you.

personal loans low interest

med pharmacy

online cash loan

loans for no credit

money fast

cheapest place to buy viagra

payday loans online no credit

where to buy generic cialis safely

Nice bro thank you.

Nice bro thank you.

us online viagra

buy cialis soft tabs online

instant decision payday loans

lending tree loan

tadalafil capsule

porno izle

checking account advance

payday

best debt relief companies

personal loan for bad credit

hard money loans

fast loans

personal loans bad credit

low apr loans

viagra cream

fastest payday loan

best cash advance loans

generic viagra 50

online cialis canada

Nice bro thank you.

loan needed

loan payments

online cialis professional

tadalafil soft tablets

The article is really excellent. Every time I read it, I get information again.

personal loans online approval

cost of cialis in canada

Nice bro thank you.

quineprox 75

Nice bro thank you.

100mg viagra cost

500 cash loan

direct consolidation loan

loans locations

pharmacy

online cash advances

viagra 50 mg price in usa

Nice bro thank you.

where can you buy cialis online

unsecured personal loans bad credit

modafinil prescription uk

stromectol 3 mg tablets price

sildenafil tablets 150mg

viagra pharmacy

pay day loans online

loans com

candida diflucan

cheap valtrex 1000 mg

buy cialis cheap

[url=https://kikiloans.com/]online personal loans instant approval[/url]

[url=http://sildenafilsex.com/]sildenafil 20 mg coupon[/url]

Nice bro thank you.

[url=https://cialisdist.com/]best price tadalafil[/url] [url=https://viagrafour.com/]cheap brand viagra 100mg[/url] [url=https://viagraedpill.com/]cheap viagra paypal[/url] [url=https://ivermectinquick.com/]ivermectin 3mg tablets[/url]

[url=http://crepills.com/]doxycycline tablet price in india[/url]

[url=https://lynxloans.com/]pay day loans[/url]

Nice bro thank you.

personal loan for bad credit

northwest pharmacy canada

buy sildenafil without prescription

1 hour payday loans no credit check

short term loans

where can i buy cialis in australia

i need a payday loan

generic viagra on sale

albuterol canada coupon

online installment loans

buy sildenafil uk

india viagra

overseas online pharmacy

personal loans for bad credit

payday cash advance

can i buy cialis without a prescription

cialis 5 mg tablets cost

reputable payday loans

direct payday lenders bad credit

wells fargo loans

Danke schöner Blog. Wenn es um Urlaub geht, vergessen wir nicht, dass er in erster Linie am Flughafen beginnt. Wenn Sie einen qualitativ hochwertigen Flughafentransfer suchen, dann sind Sie bei uns richtig. Verschwenden Sie keine Zeit, buchen Sie den bequemsten Flughafentransfer auf unserer Website. https://www.tourwix.de/tr

personal loan no credit check

Nice bro thank you.

payday cash loans

long term personal loans

Nice bro thank you.

home loans

order generic viagra uk

bank loan application

cheap generic viagra uk

personal loans with low interest rates

pfizer viagra price

overnight payday loans

online cash

over the counter deltasone medication

cash fast loan

express loans

loans online same day

loans in nc

tadalafil brand

ivermectin 5ml

loan rate calculator

approved loans

cialis 200mg

payday lender

ivermectin 3mg dose

borrow money

cheap online generic cialis

consolidation loan companies

500 payday loan

faxless cash advance

bactrim 480

where to buy generic viagra in canada

payday loans in maryland

5000 personal loan

Takipçi satın al konusunda türkiye’nin lider sosyal medya ajansını denediniz mi? Sizde instagram takipçi satın al hizmetini ucuz bir şekilde kullanmak için hemen takipçi satın alabilirsiniz. Türk, gerçek, aktif, güvenilir ve en ucuz instagram takipçi satın alma hizmeti ile yükselişe geç. İnstagram takipçi satın al ve takipçini rakiplerine oranla arttır.

viagra over the counter europe

İnstagram takipçi satın almak için, yıllardır en kurumsal hizmet veren takipcisepette ile güvenilir takipçi satın al.

İnstagram hesabına takipçi satın almak için, ucuz ve güvenilir takipçi sitemizi incele.

texas payday loan

fluoxetine tablets online

viagra india 100mg

lendingtree personal loans

İnstagram takipçi satın al son zamanlarda binlerce kişi tarafından araştırılmaktadır. İnstagram takipçi satın al hizmetinden faydalanmak için alacağınız sitenin güvenilir olması gerekmektedir. Güvenilir instagram takipçi satın almak için bizi tercih etmenizde fayda vardır. İnstagram takipçi satın al hizmeti için en güvenilir site ile karşınızdayız!

Hadi sende takipcisepette ile güvenilir instagram takipçi satın alarak, takipçini arttır.

Türkiye’nin en güvenilir ve en güncel şifresiz takipçi satın alma sitesinden takipçi satın al.

İnstagram hesabına ucuz takipçi satın al ve güvenilir takipçi satın alarak takipçini arttır.

İnstagram takipçi satın al son zamanlarda binlerce kişi tarafından araştırılmaktadır. İnstagram takipçi satın al hizmetinden faydalanmak için alacağınız sitenin güvenilir olması gerekmektedir. Güvenilir instagram takipçi satın almak için bizi tercih etmenizde fayda vardır. İnstagram takipçi satın al hizmeti için en güvenilir site ile karşınızdayız!

pay day online

bad credit same day loans

online loan applications

Türk, gerçek, aktif ve en güvenilir instagram takipçi satın al.

İnstagram’da takipçi satın almak bu kadar kolay olmamıştı. En kolay ve en hızlı instagram takipçi satın al paketleri ile sende buluş. İnstagram takipçi satın alma paketlerini hemen kullan ve hesabını yükselt! İnstagram takipçi satın al için en güvenilir site için linke tıklayınız. İnstagram takipçi satın alma ucuz bir şekilde gerçekleşir ve sizi popüler hale getirir.

İnstagram takipçi satın alma konusunda türkiye’nin lider sosyal medya ajansını denediniz mi? Sizde instagram takipçi satın al hizmetini ucuz bir şekilde kullanmak için hemen takipçi satın alabilirsiniz. Türk, gerçek, aktif, güvenilir ve en ucuz instagram takipçi satın alma hizmeti ile yükselişe geç. İnstagram takipçi satın al ve takipçini rakiplerine oranla arttır.

no employment verification payday loan

İnstagram takipçi satın alma konusunda türkiye’nin lider sosyal medya ajansını denediniz mi? Sizde instagram takipçi satın al hizmetini ucuz bir şekilde kullanmak için hemen takipçi satın alabilirsiniz. Türk, gerçek, aktif, güvenilir ve en ucuz instagram takipçi satın alma hizmeti ile yükselişe geç. İnstagram takipçi satın al ve takipçini rakiplerine oranla arttır.

İnstagram hesabına takipçi satın al, instagram güvenilir takipçi sitesi ile yükselişe geç.

direct payday loan

İnstagram hesabınızı canlandırmak için, türk takipçi satın alma sitemizi ziyaret edebilirsiniz. En güvüvenilir ve en hızlı şekilde siparişleriniz tamamlanmaktadır. Faturalı hizmet ile resmi bir şekilde takipçi satın alabilirsiniz. İnstagram 100, 500 veya 1000 takipçi paketlerinden hesabın için seçim yap ve takipçi satın al.

installment sale

cialis one a day

İnstagram türk ve aktif güvenilir takipci, ucuz takipçi takipcisepette sitesinde. Sende tıkla ve instagram takipçi satın al.

cash advance payday loans online

İnstagram takipçi satın almak için, yıllardır en kurumsal hizmet veren takipcisepette ile güvenilir takipçi satın al.

generic viagra best online pharmacy

cheap cialis generic online

instagram da takipçi satın alma twitter’da takipçi satın alma instagram’da takipçi satın almak takipçi satın al bot takipçi satın al bedava takipçi satın al bayan takipçi satın alma bot instagram takipçi satın al.

İnstagram hesabına gerçek, türk ve güvenilir takipçi satın al.

2019 twitter takipçi satın al 2019 takipçi satın al 3 tl 30k takipçi satın al 300 takipçi satın al 3000 takipçi satın al 3 bin takipçi satın al 3 tl takipçi satın al instagram takipçi satın al 4 tl.

İnstagram Takipçi satın al hizmeti ile takipçi sayını arttırmaya başla! Türkiye’nin en güvenilir instagram takipçi satın alma sitesi ile takipçi sayınızı arttırmak çok kolay. Güvenilir ve ucuz instagram takipçi satın alma paketleri sunan sitemiz ile güvenilir bir şekilde hesabını yükselişe geçir! İnstagram güvenilir takipçi satın almak için sitemizi ziyaret edin.

how to get a personal loan with bad credit

İnstagram takipçi satın al ve hesabını popülerliğe ulaştırmak için, ucuz takipçi sitemizden güvenilir takipçi satın al.

where can i buy generic cialis

buy viagra new york

Türk, gerçek, şifresiz ve ucuz instagram takipçi satın al. Türk hesaplardan oluşan takipçi paketlerini hesabına gönder.

İnstagram’da yükselmek ve takipçi satın alarak takipçi arttırmak mı istiyorsunuz? Doğru seçim instagram takipçi satın almak olacak. O halde zaman kaybetme sende ucuz ve güvenilir instagram takipçi satın al.

İnstagram takipçi satın almak için, takipavm’yi kullanabilirsin. Güvenilir hizmet ile sende instagram takipçi satın al, ucuz takipçi satın alarak yükselişe geç!

fast money loan

unsecured loans no credit check

Türkiye’nin en güvenilir ve en güncel şifresiz takipçi satın alma sitesinden takipçi satın al.

payday lender

İnstagram türk takipçi satın almak ve hesabını popülerliğe ulaştırmak için, ucuz takipçi sitemizden güvenilir takipçi satın al.

pharmacy website india

best price cialis 20mg australia

cialis 5mg price comparison

vardenafil generic

bad credit loans direct

no credit loans

buy atarax online

cialis 2.5 mg tablet

stromectol usa

female viagra canada

bad credit loan

generic cialis 60 mg india

tadalafil 6mg

loans online legit

buy viagra uk pharmacy

Merhabalar,

Kaliteli içerik için size ayrıca teşekkür ediyoruz. Bize Tourwix ailesi olarak, turizm sahasında, öncelik olarak kaliteli hiztmet vermekdeyiz. Söz konusu aile ile tatil olunca, o zaman ilk düşümemiz gerken havalimanı transferi olacaktır, Cünki tatil havalimanından başlar. O zaman siz de havalimanı transferinizi şimdiden sipariş verin. Size en iyi Havalimanı transfer hizmet,vermeyi sözünü veriyoruz.

Rezervasyon için https://www.tourwix.de/tr yapa bilirsiniz.

canadian pharmacy for viagra

apply for a loan

payday loans instant approval

Merhabalar,

Kaliteli içerik için size ayrıca teşekkür ediyoruz. Bize Tourwix ailesi olarak, turizm sahasında, öncelik olarak kaliteli hiztmet vermekdeyiz. Söz konusu aile ile tatil olunca, o zaman ilk düşümemiz gerken havalimanı transferi olacaktır, Cünki tatil havalimanından başlar. O zaman siz de havalimanı transferinizi şimdiden sipariş verin. Size en iyi Havalimanı transfer hizmet,vermeyi sözünü veriyoruz.

Rezervasyon için https://www.tourwix.de/tr/ yapa bilirsiniz.

a payday loan

furosemide 40mg price

buy tadalafil online uk

loan balance

Vyzrrd – erectile dysfunction pills over the counter Kekgtt

get a personal loan

5mg tadalafil price

cialis average price

generic cialis otc

Nice bro thank you.

Nice bro thank you.

order cialis daily

generic priligy 90mg – priligy usa cialis generic viagra

ivermectin humans stromectol ivermectin for humans – ivermectin iv

ivermectin lotion stromectol ivermectin for humans – ivermectin drug

ed pills gnc – erectile dysfunction treatment best treatment for erectile dysfunction

deltasone cost – price of prednisone 50 mg prednisone 20 mg over the counter

sildenafil 100mg order

The other day, while I was at work, my sister stole my iPad and tested to see if it can survive a

twenty five foot drop, just so she can be a youtube sensation. My apple ipad is now destroyed and she has 83 views.

I know this is completely off topic but I had to share it with someone!

Thanks for another magnificent post. Where else may anybody get that type of info in such

an ideal way of writing? I’ve a presentation next week, and I’m at the look for such information.

I couldn’t refrain from commenting. Very well

written!

Howdy, i read your blog occasionally and i own a similar one and i was just curious if you get a lot of spam feedback?

If so how do you prevent it, any plugin or anything you can advise?

I get so much lately it’s driving me mad so any assistance is very much appreciated.

With havin so much content do you ever run into any problems of plagorism or

copyright infringement? My site has a lot of exclusive

content I’ve either created myself or outsourced but it looks like a lot of it is

popping it up all over the internet without my agreement.

Do you know any methods to help stop content

from being ripped off? I’d certainly appreciate it.

natural ed remedies: ed pills for sale – levitra without a doctor prescription

order provigil online – provigil 200 mg generic provigil

natural cures for ed: ed treatment pills – ed vacuum pumps

accutane online india – accutane cost without insurance accutane uk

buy provigil online india

antibiotics without a doctor’s prescription – buy amoxicilina noscript amoxicilina 500 mg from mexico

buy viagra from canada

order vardenafil online pharmacy – where to buy vardenafil how to use vardenafil

where to buy cialis for daily use

stromectol pill price – ivermectin buy online ivermectin pills for humans

cialis 30

5mg cialis canadian pharmacy – can you buy cialis over the counter canada best price cialis canadian pharmacy

generic female viagra 100mg

best place to buy viagra online viagra price – where can i buy viagra over the counter

ivermectin over counter – stromectol 6 mg tablet ivermectin dose for covid

viagra 10 mg

online prescriptions for viagra

generic levitra from india

sildenafil tablets 120 mg

viagra cost per pill generic viagra – how much is viagra

accutane pill 30 mg – buy accutane 5 mg accutane 20 mg price in india

Hello, I enjoy reading all of your article post. I like to write a little comment to support you.

Way cool! Some very valid points! I appreciate you writing this

article and the rest of the website is also really good.

lyrica pills price – canada drugs coupon code www canadian pharmacy

can i buy cialis in toronto buy cialis 36 hour online – generic cialis daily pricing

buy generic viagra with paypal

viagra for sale cheap

tadalafil canada 20mg

how to get lasix without a prescription

amoxil 500mg – amoxil 500 amoxicillin sales worldwide

canadian pharmacy no scripts

tadalafil best online pharmacy

viagra pill for women

how much is viagra generic

generic stromectol

cialis online canada cheap

canadianpharmacy com

tadalafil 20mg daily

where can i get antabuse

motilium canada pharmacy

cheap generic viagra pills

order viagra online canada mastercard – sildenafil generic mexico female viagra drugstore

antabuse online canada

25 mg generic viagra

viagra canadian pharmacy prices

tadalafil 20 mg price comparison

tadalafil generic from canada

how much is the viagra pill

viagra usa

best price generic tadalafil

can you buy sildenafil over the counter

motilium price

ivermectin cream 5%

purchase cialis in usa

cross border pharmacy canada – buy cialis paypal buy generic cialis online safely

plaquenil 200

ivermectin 1%

buy brand name cialis

price of ivermectin liquid

cialis brand online australia

buy clomid 100mg online

can i buy generic viagra

buy accutane without prescription

ivermectin lotion 0.5 – buy ivermectin tablets ivermectin cream cost

20mg tadalafil canada

buy cialis online cheap

doxycycline 75 mg

viagra 200

men viagra

sildenafil 5 mg price

buy ivermectin pills

stromectol south africa

buy ivermectin for humans uk

ivermectin 2ml

ivermectin 18mg

where to buy ivermectin cream

stromectol for sale

buy stromectol pills

cost of ivermectin

ivermectin 18mg

ivermectin 1 cream

stromectol 3 mg

stromectol covid

ivermectin price comparison

ivermectin generic

cost for ivermectin 3mg

buy ivermectin stromectol

ivermectin 2%

ivermectin cost canada

buy prednisone with paypal canada – prednisone canada pharmacy prednisone over the counter canada

ivermectin 0.5 lotion

ivermectin humans

generic ivermectin cream

cost of stromectol medication

buy oral ivermectin

stromectol 15 mg

price of ivermectin tablets

ivermectin rx

stromectol order

buy oral ivermectin

how to buy stromectol

ivermectin 5

stromectol buy uk

where can i buy oral ivermectin

stromectol 6 mg tablet

ivermectin

stromectol tablets 3 mg

ivermectin

where to buy ivermectin pills

ivermectin 1 cream

ivermectin for sale

ivermectin price uk

purchase ivermectin

ivermectin 4 tablets price

ivermectin tablets

ivermectin price

stromectol tab price

stromectol where to buy

ivermectin 0.5 lotion

stromectol ivermectin buy

stromectol 3 mg price

ivermectin price comparison

ivermectin over the counter uk

stromectol online

generic ivermectin

ivermectin oral

ivermectin rx

ivermectin cream uk

cheap stromectol

ivermectin tablets order

ivermectin 0.5

stromectol 3 mg tablet

stromectol tab

stromectol tablets buy online

ivermectin 0.08%

cost of ivermectin cream

price of ivermectin tablets

ivermectin lotion

ivermectin 4 tablets price

ivermectin 3mg

stromectol price uk

ivermectin price comparison

stromectol nz

ivermectin 5 mg price

stromectol 3 mg tablet

ivermectin buy online

ivermectin topical

stromectol how much it cost

order provigil online – provigil a narcotic modafinil generic

stromectol 3mg tablets

ivermectin buy australia

ivermectin 0.08

stromectol liquid

ivermectin tablets

stromectol for sale

how much does ivermectin cost

ivermectin 24 mg

ivermectin cream canada cost

generic stromectol

stromectol 12mg

ivermectin buy australia

ivermectin humans

ivermectin 3

stromectol ivermectin

stromectol uk

stromectol liquid

ivermectin tablets

ivermectin tablets order

ivermectin 20 mg

stromectol pill

stromectol tab price

ivermectin india

stromectol tablets

ivermectin over the counter uk

stromectol medication

oral ivermectin cost

ivermectin 0.1 uk

stromectol australia

stromectol tab 3mg

stromectol australia

stromectol 3 mg tablets price

ivermectin 0.1

stromectol australia

ivermectin buy canada

ivermectin 4000

where to buy stromectol online

stromectol covid

ivermectin 3

where to buy stromectol online

ivermectin 0.08%

ivermectin 1 cream 45gm

stromectol tablets buy online

stromectol nz

stromectol over the counter

ivermectin generic cream

stromectol ivermectin buy

ivermectin 0.5

stromectol cost

ivermectin syrup

ivermectin 8000

ivermectin 6mg

ivermectin 0.5

cost of ivermectin 1% cream

where to buy stromectol online

ivermectin usa price

price of ivermectin liquid

ivermectin 0.08 oral solution

ivermectin lice oral

how much does ivermectin cost

ivermectin otc

oral ivermectin cost

ivermectin uk coronavirus

stromectol tablets

ivermectin malaria

ivermectin brand

ivermectin 5 mg

how to buy stromectol

cost of ivermectin cream

stromectol tablets buy online

stromectol for sale

ivermectin 5ml

stromectol ivermectin 3 mg

ivermectin 3mg tablets

ivermectin 8000

stromectol 6 mg tablet

stromectol tablets buy online

stromectol for sale

ivermectin 8000 mcg

stromectol australia

stromectol price in india

ivermectin 4 mg

buy azithromycin online – buy azithromycin 500mg azithromycin tablets

ivermectin 0.08

how much does ivermectin cost

ivermectin over the counter

stromectol south africa

ivermectin 3 mg

stromectol without prescription

stromectol 15 mg

cheap stromectol

ivermectin malaria

buy ivermectin pills

ivermectin 3mg tablets

stromectol uk

stromectol medication

ivermectin price comparison

stromectol over the counter

ivermectin 3mg tablets price

ivermectin 3

stromectol ivermectin buy

oral ivermectin cost

ivermectin 3 mg

ivermectin 3mg

ivermectin

ivermectin pills canada

ivermectin india

stromectol pills

ivermectin 6mg

ivermectin 0.5

buy ivermectin cream for humans

stromectol australia

price of ivermectin

ivermectin 3mg tablets

buy stromectol pills

buy oral ivermectin

cost of ivermectin

stromectol order

ivermectin 5 mg

ivermectin uk

stromectol tab 3mg

stromectol over the counter

where can i buy oral ivermectin

stromectol 6 mg dosage

stromectol drug

lasix drug – buy lasix without a doctor’s prescription furosemide tablets 40 mg for sale

buy ivermectin canada

ivermectin rx

where to buy ivermectin pills

where can i buy stromectol

stromectol for sale

ivermectin virus

stromectol brand

ivermectin cream cost

stromectol without prescription

ivermectin goodrx

ivermectin 2ml

where to buy stromectol

ivermectin 1 cream 45gm

price of ivermectin

ivermectin pills canada

ivermectin lotion

[url=https://ivermectinbestbuy.com/]stromectol online pharmacy[/url]

ivermectin brand

ivermectin for sale

ivermectin 9 mg tablet

where to buy ivermectin

ivermectin 0.5% lotion

ivermectin cream cost

ivermectin nz

ivermectin cream 1%

stromectol south africa

ivermectin coronavirus

stromectol brand

ivermectin rx

stromectol where to buy

ivermectin 2

purchase stromectol

ivermectin pills

buy ivermectin stromectol

ivermectin 90 mg

ivermectin cream 1

ivermectin oral

where to buy ivermectin pills

where to buy stromectol online

ivermectin 12

stromectol price us

ivermectin cream 1

stromectol ivermectin

stromectol generic

ivermectin 12

stromectol australia

stromectol 3 mg tablet

ivermectin 1 cream

oral ivermectin cost

how much is ivermectin

cost of ivermectin lotion

ivermectin 3mg tablets

stromectol tablets buy online

ivermectin cream

ivermectin where to buy for humans

ivermectin cream

stromectol medication

stromectol 3mg tablets

stromectol tablet 3 mg

cost for ivermectin 3mg

ivermectin purchase

stromectol 0.1

ivermectin lice

where to buy ivermectin

ivermectin 3 mg

where to buy ivermectin

ivermectin 6mg

ivermectin 50 mg

stromectol otc

ivermectin lotion for scabies

price of ivermectin liquid

ivermectin 3mg tablets

stromectol tablets

ivermectin rx

price of ivermectin

ivermectin 6 mg tablets

buy stromectol online

stromectol australia

order stromectol online

ivermectin 6mg

buy stromectol online uk

generic viagra 100mg india

cialis 5mg pharmacy

sildenafil from india

viagra cheap fast delivery

sildenafil tablets 100mg uk

cheap sildenafil 100

best pharmacy prices for cymbalta

ivermectin cost canada

where to buy finasteride

sildenafil 100mg cheap

sildenafil 25 mg mexico

buy sildenafil india online

where can i buy clomid – clomid purchase purchase clomid

cheap tadalafil 60 mg

tadalafil generic coupon

viagra usa 100mg

where can i buy viagra in usa

real cialis canada

cialis daily use price

paypal cialis

cheap zoloft

Hi there, this weekend is good in support of me,

because this time i am reading this wonderful informative paragraph

here at my house.

stromectol usa

generic sildenafil from india

cialis generic price

tadalafil india paypal

provigil generic over the counter

where can i buy over the counter sildenafil

I’m not sure exactly why but this blog is loading incredibly slow

for me. Is anyone else having this problem or is it a issue on my end?

I’ll check back later and see if the problem still exists.

international online pharmacy

purchase viagra without prescription

prednisone 20 mg without prescription

reputable indian online pharmacy

celexa price canada

best cialis brand in india

tadalafil tablet 10mg price in india

buy oral ivermectin

sildenafil online price

buy prednisone online canada

online pharmacy zoloft

tadalafil 10mg australia

purchase viagra india

cialis tadalafil

cialis canada buy online

cymbalta generic cost

60 mg generic cialis

buy tadalafil from india

generic sildenafil 100mg price

sildenafil 50 mg canada

stromectol coronavirus

5mg tadalafil online

cheap online pharmacy

generic sildenafil prescription

tadalafil 10mg australia

best celexa generic

buy oral ivermectin

disulfiram buy

sildenafil prescription cost

viagra otc united states

how to order cialis without a prescription

I was pretty pleased to uncover this great site. I wanted to

thank you for your time for this particularly wonderful read!!

I definitely savored every bit of it and I have you bookmarked to see new things on your site.

female viagra in australia

tadalafil tablets buy

finpecia online pharmacy

20mg sildenafil

tadalafil online paypal

sildenafil 20 mg pill

canada rx pharmacy

generic tadalafil online 20mg buy

tadalafil india generic

I don’t even know the way I ended up right here, but I believed this

publish used to be great. I don’t recognize who you’re however definitely you are going to a famous blogger when you are not already.

Cheers!

zoloft otc

celexa 40mg tablet

viagra compare prices

cialis without prescription canada

viag

wellbutrin online australia

celexa price canada

best viagra brand in canada

viagra 25 mg tablet price

safe generic viagra

sildenafil buy online india

buy zoloft 20 mg

viagra from canada prices

prednisone 1 mg for sale

sildenafil canada

tadalafil generic us

tadalafil 5mg tablets india

finasteride 1mg discount coupon

online cialis from india

canadian pharmacy cialis no prescription

ivermectin lice

ivermectin lotion price

tadalafil 5mg online canada

wellbutrin otc

tadalafil 5mg tablets price

ivermectin cost

best price for cymbalta 60mg

canada pharmacy world

generic cialis 2019

15mg cialis

ivermectin over the counter

ivermectin buy online

cialis 5

Instagram Takipçi Satın Almanızın İşleminin Hesaba Etkisi

Takipçi almak, Instagram üzerinde popülerliği yakalamak isteyen hesapların kullandığı bir yöntemdir.

Son zamanların gözde sosyal medya platformlarından olan Instagram, her geçen kendini

yenileyip güncellemesi ile kullanıcı sayısını milyonlara ulaştırmıştır.

Fotoğraf ve video paylaşma platformu olan zaman içinde firmaların e-ticaret

alanına dönüşmüş ve insanlara ek

gelir kapışı olmuştur.

Instagram Takipçi Satın Almanın Profiliniz için Önemi

Popülerlik ya da ek gelir isteyen kişiler için önemli hale gelen uygulamada bu başarıyı yakalamanın yolu takipçi

sayısına bağlı olur. Intagram’ da yüksek takipçi sayısına

sahip olmak

ile pek çok insanın dikkatini çekmek daha kolay olur.

Instagram’ da doğal yollar ile takipçi elde etmek diğer sosyal medya

uygulamalarına göre daha zor olması nedeni ile

Instagram takipçi satın al işlemine başvurulur.

Bu işlem,

hesabın daha öne çıkmasını sağladığı

gibi daha fazla etkileşim almasına da yarar.

Etkileşim alan bir hesap da Instagram keşfet alanına çıkar

böylelikle daha çok takipçi hesabı takip etmeye başlar.

https://rebrand.ly/takipz

viagra substitute over the counter

canadian pharmacy viagra online

Hızla Yükselen Bir Fenomen Olmak İçin İnstagram Takipçi Satın Al

Türkiye’nin en çok tanınan fenomenlerinin aylık ne kadar kazandığını biliyor

musunuz? Peki, İnstagram takipçi satın al hizmeti sayesinde yüksek kazançlara ulaşmanın mümkün olduğunu?

Eğer siz de bir sosyal medya fenomeni olmak istiyorsanız,

doğru stratejiyi uyguladığınızdan emin olmalısınız.

İşte, adım adım fenomen olmak için yapmanız gerekenler.

https://u.to/h_NHGw İnstagram Takipçi Satın Al

chewable ed

Kalıcı İnstagram Takipçi Satın Al : Kazanmaya Başla

Takipçilerinizin kalıcı olmasını istiyorsanız, öncelikle İnstagram takipçi satın al sayfamızda yer alan gerçek takipçi paketlerimizden birini tercih etmelisiniz.

Türk takipçilerin yer aldığı birbirinden ekonomik paketlerimiz ile siz de hızla büyüyen bir

profile sahip olabilirsiniz.

Düzenli İçerik Yüklediğinizden Emin Olun

Bir sosyal medya platformunda fenomen olmak istiyorsanız,

düzenli ve kaliteli içerik üretmelisiniz. Hedef kitlenizin yaş ve profiline uygun içerikler üretmek ve bunu düzenli şekilde yapmak sizin organik olarak yeni takipçiler kazanmanızı

sağlar.

Satın aldığınız takipçilerin de profilinizi ömür boyu takip etmesini istiyorsanız gönderilerinizin takipçilerinize uygun olduğundan emin olmalısınız.

Takipçi Satın Al sende kazan

cost of generic sildenafil

buy tadalafil online india

finpecia 1mg

cialis australia pharmacy

It’s going to be end of mine day, but before end I am reading this impressive paragraph to increase my know-how.

stromectol otc

sildenafil 80 mg

south africa cialis

sildenafil 150 mg

modafinil how to get

reliable canadian pharmacy

stromectol

order viagra from mexico – viagra prescription nz cheap viagra online

Good answers in return of this query with solid arguments and telling everything concerning that.

viagra 123 pills 7000 mg

antabuse cost

generic cialis pills

how can i get generic viagra

where do you get viagra

where to buy cialis without a prescription

sildenafil 100mg tablets for sale

stromectol 3 mg

sildenafil over the counter australia

canadian online pharmacy no prescription

stromectol covid 19

order prednisone

best price for viagra in uk

sildenafil in usa

sildenafil 100mg online canada

canadian pharmacy 1 internet online drugstore

cheap viagra

super active viagra pfizer viagra 100mg online glixxen – buycheap viagra online

augmentin xr 1000 mg

sterapred ds

india viagra generic

generic viagra buy

viagra otc uk

buy ivermectin for humans australia

prescription viagra for sale

how much is cymbalta

I like the helpful information you provide in your articles.

I’ll bookmark your weblog and check again here frequently.

I am quite sure I will learn lots of new stuff

right here! Best of luck for the next!

augmentin canada

where can you buy cialis in canada

indian pharmacies safe

stromectol 0.1

40mg cialis

reliable online pharmacy

sildenafil pills online

generic sildenafil from canada

sildenafil 25 mg

I know this site gives quality based articles or reviews and other

information, is there any other web site which gives such stuff in quality?

canadian pharmacy ed medications

stromectol 3 mg price

canadian price for cialis

buy viagra online europe

stromectol price in india

generic sildenafil 20 mg cost

5mg tadalafil price

female viagra uk pharmacy

price cialis 20 mg

[url=http://ivermectintablets.com/]ivermectin otc[/url]

online pharmacy australia free delivery

desyrel 150 mg

ivermectin 400 mg

cealis from canada

cheap sildenafil citrate tablets

price of tadalafil 20mg

buy tadalafil tablets 20mg

sildenafil soft tabs 100mg

trazodone uk

ivermectin uk coronavirus

150 mg viagra

sildenafil over the counter usa

buy viagra over the counter

cost of tadalafil in mexico

tadalafil price in canada

wellbutrin online australia

buy kamagra oral jelly online uk

generic tadalafil canadian

tadalafil 2.5 mg daily

cheap rx sildenafil

buy sildenafil generic

hydroxychloroquine 300 mg tablet

cialis order online usa

purchase sildenafil 20 mg

online viagra australia

tadalafil cost pharmacy

cialis no rx – legitimate online pharmacy cialis price generic

cheaper viagra

Отряд самоубийц боевик

provigil prescription uk

ivermectin for humans

ivermectin otc

ivermectin canada

5mg cialis best price

how much is cialis generic

generic viagra for sale in usa

sildenafil tablets uk

canada azithromycin over the counter

order tadalafil online

tadalafil 5mg prescription

motilium over the counter usa

viagra price comparison

stromectol for sale

Фильм Дом Гуччи смотреть онлайн

tadalafil generic cialis

average cost of viagra

cheap generic sildenafil

motilium 10 mg

cheapest pharmacy prescription drugs

buy viagra nyc

stromectol for sale

cialis 10 mg daily

female viagra gel

buy cialis in canada

tadalafil in india online

buy tadalafil paypal

viagra uk where to buy

ivermectin 3mg price

viagra where to buy

stromectol 3mg online – ivermectin 1 cream ivermectin us

Remarkable! Its genuinely awesome piece of writing,

I have got much clear idea concerning from this paragraph.

motilium 30 mg

tadalafil brand name

generic cialis 2019

tadalafil 30

ivermectin where to buy

viagra online buy usa

kamagra 100mg online india

generic stromectol

buy lexapro online usa

Nice bro thank you.

Главный герой смотреть

cialis 5mg best price australia

Instagram da takipci satin alabilmek icin en dogru adres olan takipcisatinaltr ile takipci alarak instagram da fenomen olabilirsin

https://www.takipcisatinal-tr.com/

cheap viagra pills from india

albuterol aerosol

lowest price generic viagra

atarax 25mg online

cheap cialis 10mg

ivermectin iv

stromectol covid

sildenafil otc

cialis 5mg best price india

https://bit.ly/films-ne-dshi-2 фильм онлайн

tadalafil 40 mg india

zithromax without a script

stromectol cost

generic viagra 100mg

Дивитися онлайн Форсаж 9

Загін самогубців 2

albendazole drug cost

buy cialis online australia paypal

price of stromectol

antabuse-the no drinking drug

where to buy ivermectin cream

generic tadalafil mexico

generic name for ivermectin

stromectol

can you safely buy viagra online

gambling casino – winslotgms casino slot games

albendazole otc

stromectol for sale

can i buy nolvadex otc

viagra generic drug

how to get female viagra

tadalafil 5 mg tablet

tadalafil 20 mg medication

tadalafil 20 mg no rx for sale

can you buy viagra in europe

sildenafil usa

tadalafil india brand

buy sildenafil viagra

antabuse uk buy

ivermectin 6mg

how much is a cialis prescription

real cialis online canada

https://bit.ly/3yBOvDZ смотреть онлайн любимые фильмы и сериалы

cialis 5mg online canada

discount canadian pharmacy cialis

https://bit.ly/3Aj0jeW Смотреть фильмы онлайн ютуб

generic viagra uk pharmacy

buy real viagra online

viagra original

best viagra tablets in india online

20 mg tadalafil best price

buy generic cialis online with paypal

ivermectin medication

stromectol price usa

sildenafil tablets 100mg

stromectol 6 mg dosage

order kamagra online

ivermectin oral 0 8

stromectol price us

where to get albendazole

stromectol buy

cialis medicine in india

atarax for anxiety

zithromax for sale us zithromax 250 mg australia – zithromax online usa

tadalafil generic usa

brand name cialis online

tadalafil online pharmacy

viagra cost mexico

sexual dysfunction – medications for ed erectile dysfunction medication

buy cialis online canadian pharmacy

rx tadalafil

sildenafil 20 mg sale

stromectol sales

canada pharmacy cialis

price for cialis daily use

generic tadalafil 20mg

25 mg tadalafil

where to buy cheap cialis online

azithromycin from mexico

tadalafil australia buy

prednisone price in india

свати 4 сезон дивитися безкоштовно

buy sildenafil from india

online pharmacy generic cialis

generic tadalafil 20mg for sale

cost of prescription cialis

tadalafil 10mg cost

plaquenil 10 mg

rx pharmacy viagra

ivermectin 3mg tablets price

plaquenil cost australia

can you order viagra online in canada

ivermectin coronavirus

rezka

brand cialis

гра престолів смотреть

best tadalafil in india

where to buy tadalafil in usa

canadian pharmacy online prescription tadalafil

buy plaquenil in india

cheapest sildenafil 100 mg uk

best price for sildenafil 100 mg

ivermectin lotion

generic prednisone without prescription – prednisone drops after cataract surgery prednisone 5mg pills

cost of tadalafil 20 mg

generic cialis over the counter

buy cialis tablets australia

sildenafil 100mg gel

ivermectin 6mg dosage

generic tadalafil 60 mg

how to order viagra online safely

buy generic cialis online us pharmacy

tadalafil dosage 40 mg

tadalafil online prescription

to all the boys i loved before 123movies

tadalafil 100mg india

atarax 25mg for sleep

sildenafil 20 mg sale

plaquenil 200mg tablets

viagra online pharmacy usa

cialis online canada pharmacy

ivermectin 0.2mg

ivermectin uk

viagra usa pharmacy

ivermectin buy online

discount viagra

order viagra online canada

amoxicillin buy online canada amoxil for sale – buy amoxicillin online uk

viagra no prescription online

ivermectin 1% cream generic

buy tadalafil in usa

sildenafil 120

cialis daily cost

purchase sildenafil citrate

ivermectin 500mg

25mg viagra

how much is viagra in usa

ivermectin 6mg generic stromectol – stromectol 3 mg

sildenafil in mexico

lowest price tadalafil tablets 20 mg

generic cialis canada

stromectol 0.5 mg

hydroxychloroquine 40 mg

ivermectin brand

is albenza over the counter

ivermectin cost australia

generic viagra online pharmacy – cheap viagra online united states sildenafil online singapore

buy tadalafil in australia

daily cialis 5mg

disulfiram generic

online order prednisone 10mg no prescription

buy brand name cialis online

australia viagra over the counter

buy lexapro online australia

tadalafil online nz

tadalafil generic mexico

can you order cialis online

viagra 200mg pills

stromectol order online

I constantly spent my half an hour to read this blog’s posts daily along with a mug of coffee.

cialis tablets 5mg price

cialis 40 mg pills

cheapest propecia in canada

buy generic cialis canadian pharmacy

buy paroxetine online

buy cheap sildenafil uk

Hi! Do you know if they make any plugins to protect

against hackers? I’m kinda paranoid about losing everything I’ve worked

hard on. Any suggestions?

tadalafil canada price

Good day! Do you know if they make any plugins

to safeguard against hackers? I’m kinda paranoid about losing everything I’ve worked hard on. Any recommendations?

price of cialis daily

sildenafil 60mg

Hey there! I could have sworn I’ve been to this blog before but after reading

through some of the post I realized it’s new to me.

Nonetheless, I’m definitely glad I found it and I’ll be bookmarking and checking back

frequently!

buy zoloft online europe

viagra 300mg

where to buy viagra over the counter usa

cialis 20mg india price

motilium for sale

quineprox 750

chewing up viagra

canadian pharmacy online prescription tadalafil

modafinil online pharmacy canada

ivermectin uk coronavirus

zoloft 200 mg

5mg tadalafil generic

bupropion 225 mg

order modafinil online uk

online viagra canada

cheap cialis professional – Cialis low price 5mg cialis canadian pharmacy

purchase trazodone online

23629 desyrel

ivermectin over the counter

lexapro brand coupon

stromectol cost

best propecia prices

buy clomid discount

tadalafil 40 mg

buy real viagra canada

sildenafil 50 mg tablet price in india

buy kamagra 100mg

how to get real viagra online

tadalafil 10 mg tablet

order tadalafil

buy viagra online nz

buy accutane online

best price tadalafil 20 mg

femail viagra

online pharmacy cheap cialis

wellbutrin 75 mg tablets

ildenafil citrate

buy baclofen online usa

generic cialis professional

viagra pills for sale nz

cialis generic usa

cymbalta online pharmacy

soft tabs cialis

sildenafil buy online usa

generic viagra soft gel capsule

sildenafil 100mg online

viagra uk

how to get real viagra online

buy generic antabuse online

brand viagra online canada

stromectol pills

cialis 2.5 daily

cialis over the counter canada

provigil buy usa

woman viagra

sildenafil 50 mg tablet price in india

accutane drug

cheap viagra online australia

ivermectin coronavirus – ivermectin generic name cost of stromectol medication

cheap generic viagra usa

can i buy real cialis online

plaquenil tablets 200mg

quineprox 40

buy generic cialis online from india

tadalafil 10 mg online india

cheap viagra online india pharmacy

Nice bro thank you.

ivermectin drug

cost of viagra in india

stromectol 3mg cost

online medication cialis

buy cialis online

cheapest online pharmacy india

lowest price for sildenafil 20 mg

paroxetine 10mg tabs

no prescription cheap cialis

modafinil daily

tetracycline to buy

фильм

I like the valuable info you provide in your articles.

I will bookmark your blog and check again here frequently.

I’m quite sure I will learn a lot of new stuff right here! Good luck for the next!

sildenafil 100 capsule

where can i buy viagra without a prescription

generic propecia from india

generic viagra in the usa

buying cialis online

cialis australia cost

where to get cialis prescription

propecia pharmacy cost

where to buy sildenafil canada

trazodone hydrochloride 100 mg

best tadalafil brand

generic tadalafil without prescription

Global Gerçek İnstagram Takipçi Satın Al

Hem gerçek hem de kalıcı sosyal medya takipçisine ulaşmak oldukça zordur.

Bu sayı 10 bin olduğunda çok daha zordur.

Takip2018 uzman ekip üyeleri tarafından sağlanan gerçek ve kalıcı takipçiler ile sosyal medya hesabınız kısa sürede Keşfet

sayfasında yerini alabilir.

Siz de İnstagram takipçi satın al kategorisinde yer alan 10 bin yurt

içi ve yurt dışı takipçinin yer aldığı paketimizi

tercih edebilirsiniz.

Diğer tüm paketleri görebilmek adına instagram takipçi satın al linkimiz ; instagram takipçi satın al

modafinil uk pharmacy

90 cymbalta

online prescription viagra

no prescription cialis

viagra online order in india

Hilesiz İnstagram Takipçi Satın Al

Takipçi kitlenizi arttırarak marka ya da kişisel blog hesabınızın değerini arttırmak istiyorsanız

seçim konusunda oldukça titiz davranmalısınız.

Birçok site üzerinden yapılan takipçi satın alma işlemi sonrasında, hızlı bir şekilde takipçi kaybı

yaşanabilmektedir.

InstagramtakipZ şeffaf bir çalışma prensibine sahip olup, bu

doğrultuda hilesiz ve kalıcı İnstagram takipçi satın al işlemini benimsemektedir.

Sizde köklü firmamızın tecrübeli çalışanlarından destek alarak,

sosyal medyada hak ettiğiniz noktaya ulaşabilirsiniz.

İnstagram takipçi satın al işlemi sırasında hızlı geri dönüş alabilmek firma ve

bireysel hesapların kısa sürede büyük takipçi kitlesine ulaşabilmesi için önemlidir.

InstagramtakipZ bu noktada bekleme sürenizi minimuma indirgemek amacıyla canlı destek hattı oluşturmuştur

hadi sende takipçi satın al : instagram takipçi satın al

cheap female viagra pills

buy sildenafil pills

ivermectin human

can you buy tadalafil over the counter

buy brand viagra 100mg

generic cialis for sale online

смотреть фильмы

order sildenafil 100mg

sildenafil australia

erection pills – new ed drugs ed meds

reputable indian online pharmacy

ivermectin lotion 0.5

viagra tablets pharmacy

cialis online canada pharmacy

sildenafil buy from canada

sildenafil medicine in india

hydroxychloroquine virus

generic viagra us

cialis 10 mg price

ivermectin lice

ivermectin buy

ivermectin tablets

buy prednisone mexico

generic accutane rx cost

viagra capsule price in india

sildenafil 100 online

sildenafil 20 mg

propecia online india

sildenafil coupon 50 mg

zoloft for sale

tadalafil 20mg coupon

average price of cialis 20mg

https://bit.ly/3y43XaQ

super cialis

viagra best price usa

non prescription cialis

viagra price in malaysia

cialis purchase online

average cost of 20mg cialis

viagra pills generic brand

india cialis

generic tadalafil australia

buy accutane nz

best price for sildenafil 100 mg

cialis 10mg price

buy trazodone online uk

tadalafil pills price

stromectol coronavirus

where can i purchase modafinil

tadalafil tablets prices

viagra 8000mg

cheap sildenafil 20 mg

buy cialis 40 mg

best online pharmacy tadalafil

where to purchase sildenafil

cialis cheapest price canada

tadalafil 5mg tablets online

sildenafil from india

tadalafil generic cialis

buy disulfiram without prescription

tadalafil generic pills

kamagra uk paypal

kamagra oral jelly

cheapest pharmacy price for viagra

nolvadex 20mg price in india

sildenafil pharmacy prices

sildenafil for sale india

viagra pill 100mg

discount pharmacy viagra

sildenafil pills for sale

stromectol ivermectin buy

tadalafil tablets 20 mg buy

viagra pills discount

canadian prescription pharmacy

sildenafil online for sale

sildenafil 20 mg price

buy effexor xr 150mg

where to buy real cialis online

cost of ventolin in usa – cheap albuterol ventolin cost canada

ivermectin 0.08

cialis tablets purchase

citalopram hydrobromide 10 mg

20 mg sildenafil 30 tablets cost

buy accutane online canada pharmacy

azithromycin 1000

ivermectin coronavirus

over the counter cialis canada

tadalafil 10mg price in india

which online pharmacy is reliable

tadalafil cost pharmacy

real viagra online uk

buy citalopram online india

stromectol tablets

buy ivermectin stromectol

tadalafil medication cost

terramycin 500mg price

buy celexa online cheap

cialis 20 mg tablet cost

order generic lexapro online

online pharmacy uk

online pharmacy viagra cheap

sildenafil generic no prescription

best generic sildenafil

stromectol price us

where can i buy viagra pills over the counter

buy tadalafil paypal

online viagra store

viagra prescription canada

viagra price comparison uk

canadapharmacy24h

viagra pill price in india

where to order cialis

sildenafil gel india

how to get viagra us

cialis order online usa

lisinopril cost uk

paroxetine 12.5 mg

tadalafil softgel capsule 20mg

tadalafil mexico price

cialis prescription cost uk

buy viagra online generic

viagra canada drugstore

retin a mexico cost

order modafinil us

generic cialis 5mg

stromectol ivermectin 3 mg

buy ventolin over the counter australia

how can i get viagra prescription

online pharmacy generic viagra

sildenafil tablets 100mg australia

cheap tadalafil no prescription

buy cytotec online fast delivery uk – how to get cytotec without prescription cytotec drug

cialis canada pharmacy online

sildenafil 100mg price

sildenafil 100mg price australia

sildenafil 50 mg mexico

tadalafil canadian pharmacy

where to buy sildenafil in south africa

how much is a 100mg viagra

ivermectin cost uk

tadalafil mexico price

generic sildenafil from india

trazodone usa

bupropion buy online india

ivermectin usa price

generic kamagra australia

kamagra jelly bangkok

how to buy cialis cheap

5mg tadalafil online

plaquenil for fibromyalgia

cialis lowest price

canadian pharmacy without prescription

631311 doxycycline – doxycycline cheapest uk doxycycline without a prescription

Nice bro thank you.

Nice bro thank you.

medicine neurontin 300 mg – neurontin for sale levothyroxine 1.25 mg

https://takipavm.com/abone-hile/

viagra other benefits

viagra canadian – canadian drugstore viagra

You said it adequately.!

homemade porno

video porno anal http://www.occl.ca/

https://bit.ly/movies-ogon-film-ogon-2021

https://bit.ly/spider-man-3-no-way-home

tadalafil 2.5 mg india – how can i get cialis over the counter

Nice bro thank you.

Nice bro thank you.

levitra generic – buy vardenafil in usa online levitra

Nice bro thank you.

Nice bro thank you.

Nice bro thank you.

Nice bro thank you.

Nice bro thank you.

ivermectin 10 ml ivermectin – stromectol xr

ivermectin buy nz – ivermectin 12mg ivermectin 0.08 oral solution

Nice bro thank you.

prednisone 100 mg daily – buy prednisone without prescription paypal medication prednisone

Nice bro thank you.

buy zithromax online with mastercard buy zithromax online – buy zithromax online fast shipping

Nice bro thank you.

accutane pills price in india – isotretinoin 30mg accutane canada 40mg

сайт

сайты

buy ivermectin uk

Nice bro thank you.

amoxicillin 250 mg – where to buy amoxicilin 500 mg amoxicillin without a doctors prescription

http://buysildenshop.com/ – Viagra

oh ??

where to buy propecia buy propecia – propecia uk

ivermectin 1 topical cream

https://buypropeciaon.com/ – propecia online pharmacy

buy lasix online buy furosemide tablets mag Viorm

Yes! Finally something about özel cenaze hizmetleri.

It’s very trouble-free to find out any matter on web as compared to textbooks, as I found this post at this site.

Cytotec En Gynecologie

ile takip�i kazandim tesekk�r ederim??

viagra cialis efectos secundarios

lasix pill furosemide cost cvs mag Viorm

I guessed some, I think this app is really true ??

buy propecia 5mg

furosemide 20 mg price cheap lasix mag Viorm

Vendita Cialis Da 5 Mg

Nice bro thank you.

cheap lasix lasix price at walmart mag Viorm

http://buytadalafshop.com/ – Cialis

Nice bro thank you.

Кэндимен

really gives thank you??

12024

Cialis

buy oral ivermectin

tadalafil 2.5 mg price

generic tadalafil no prescription

sildenafil 20 mg brand name

where can i get genuine viagra

Hesabima Takipçi yagiyordu 🙂

advair

buspar no prescription

can you buy zoloft over the counter

how much is plavix in canada

cheap levitra 10 mg

vip medications buy lasix without prescription

zovirax cream pharmacy

desyrel 100 mg price

ivermectin 0.2mg

tadacip 20 tablet

where to buy keflex online

propranolol brand name canada

no prescription wellbutrin online

metformin 1000 mg tablet price in india

bactrim 800 mg 160 mg

biaxin 125

levofloxacin

dapoxetine without prescription

erectafil 10

neurontin 100mg cost

synthroid 25 mcg tablet

zoloft 25 mg tablet

buy advair diskus

budesonide for sale

hydrochlorothiazide 25 mg tab price

can you buy acyclovir over the counter

6.25 mg hydrochlorothiazide

albendazole mexico

amoxil without a prescription

where can i buy propecia

zofran in mexico

synthroid 88 lowest cost

how to get nolvadex in australia

stromectol price usa

cialis brand 20mg

600mg allopurinol

acyclovir price in india

clonidine hcl 1 mg

viagra soft tablets

online viagra canadian pharmacy online

rx trazodone over the counter

sildenafil online united states

buy accutane online pharmacy

strattera for sale

abilify drug

levaquin antibiotics

how to get propranolol

strattera medication

misoprostol canada pharmacy

tretinoin gel prescription cost

augmentin 850 mg

amoxil best price

how to order cialis

fluoxetine capsules 10 mg

cost of antabuse uk

atarax drug

atarax uk pharmacy

kamagra uk online pharmacy

diflucan 150 mg over the counter

order prozac

zestoretic 20 12.5 mg

how to get real nolvadex

real viagra online canadian pharmacy

synthroid 0.175

atarax 10mg otc

lexapro 2019

cheap female viagra

prozac 10 mg capsule

viagra 50 mg cost

fildena 100 canada

tizanidine 2mg cost

motilium 10mg

amoxicillin 99

advair 230 mcg

keflex price in india

bactrim ds without prescription

over the counter toradol

canadian pharmacy coupon

canadian pharmacy ampicillin

trental 40 mg

lyrica tablets 300mg

where can i buy elavil online

can i buy erythromycin over the counter uk

retino 0.25

elavil 50 mg price

cost of viagra generic

buy furosemide tablets online uk

budesonide pill

viagra professional online

lyrica 100 mg

fluoxetine 40mg

cephalexin 500 mg tablets

erectafil canada

You stated this wonderfully! homeworks help please write my essay

825 mg augmentin

600 mg zithromax

where can i buy clomid online uk

us pharmacy

lyrica 25mg price

piroxicam 20 mg

celebrex pharmacy

best pharmacy

ordering antabuse

buy clomid 50mg uk

buy cheap clomid online uk

clomid online pharmacy uk

prazosin 5 mg price

tizanidine 10mg tablets

inderal 20 mg tab

paroxetine tabs

3mg prazosin

generic of augmentin

amoxicillin uk pharmacy

medicine amitriptyline 25mg

accutane over the counter uk

paroxetine cr 25 mg

how much is valtrex cost

inderal 10 tablet

zofran price

atenolol prescription online

20 mg propranolol cost

indocin pill

buy paxil uk

zofran 8mg price in india

cialis india pharmacy

synthroid 62 5 mg

purchase generic valtrex online

zestoretic 20 25mg

baclofen buy uk

cheap valtrex for sale

can you buy diflucan over the counter

valtrex acyclovir

vermox price canada

750 mg metformin

online phenergan

inderal sale

medrol buy online

cafergot tablets

augmentin brand name india

where to buy propranolol

suhagra 100 mg

prazosin 1mg

hydroxychloroquine sulfate generic

phenergan 25mg tablets

pharmacy discount card

phenergan cream australia

amoxicillin medicine

cost of cymbalta 60 mg

cleocin 300 coupon

order tamoxifen

cheap medrol

erythromycin pills over the counter

cialis from singapore

levofloxacin

purchase propecia no prescription

cheapest tadalafil online uk

biaxin prescription

zyban tablets uk

erectafil 40

albendazole brand name

albendazole buy online